Sales of tablet computers at Ted Glickman’s electronics store in Washington, D.C., over the past 10 weeks are shown in the table below:

a)

b) Compute the MAD.

c) Compute the tracking signal.

a)

To determine: To forecast the demand for 10 weeks using exponential smoothing.

Introduction: A sequence of data points in successive order is known as time series. Time series forecasting is the prediction based on past events, which are at a uniform time interval. Exponential smoothing is one of the time series methods which use a smoothing constant to emphasis past data.

Answer to Problem 59P

Using exponential smoothing, the forecast for week 10 is done.

Explanation of Solution

Given information:

| Week | Demand |

| 1 | 20 |

| 2 | 21 |

| 3 | 28 |

| 4 | 37 |

| 5 | 25 |

| 6 | 29 |

| 7 | 36 |

| 8 | 22 |

| 9 | 25 |

| 10 | 28 |

Formula to calculate the forecasted demand:

Where,

Calculation to forecast demand using exponential smoothing:

| Week | Demand | Ft |

| 1 | 20 | 20 |

| 2 | 21 | 20 |

| 3 | 28 | 20.50 |

| 4 | 37 | 24.25 |

| 5 | 25 | 30.63 |

| 6 | 29 | 27.81 |

| 7 | 36 | 28.41 |

| 8 | 22 | 32.20 |

| 9 | 25 | 27.10 |

| 10 | 28 | 26.05 |

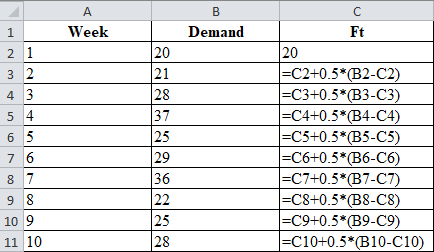

Excel worksheet:

Calculation of the forecast for week 2:

To calculate the forecast for week 2, substitute the value of forecast of week 1, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 2 is 20.

Calculation of the forecast for week 3:

To calculate the forecast for week 3, substitute the value of forecast of week 1, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 3 is 20.50.

Calculation of the forecast for week 4:

To calculate the forecast for week 4, substitute the value of forecast of week 3, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 4 is 24.25.

Calculation of the forecast for week 5:

To calculate the forecast for week 5, substitute the value of forecast of week 4, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 5 is 30.63.

Calculation of the forecast for week 6:

To calculate the forecast for week 6, substitute the value of forecast of week 5, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 6 is 27.81.

Calculation of the forecast for week 7:

To calculate the forecast for week 7, substitute the value of forecast of week 6, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 7 is 28.41.

Calculation of the forecast for week 8:

To calculate the forecast for week 8, substitute the value of forecast of week 7, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 8 is 32.20.

Calculation of the forecast for week 9:

To calculate the forecast for week 9, substitute the value of forecast of year 8, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 9 is 27.10.

Calculation of the forecast for week 10:

To calculate the forecast for week 10, substitute the value of forecast of year 9, smoothing constant and difference between actual and forecasted demand in the above formula. The result of forecast for week 10 is 26.05.

Thus, using exponential smoothing, the forecast for week 10 is done.

b)

To determine: To compute MAD.

Answer to Problem 59P

MAD is 4.99.

Explanation of Solution

Given information:

| Week | Demand |

| 1 | 20 |

| 2 | 21 |

| 3 | 28 |

| 4 | 37 |

| 5 | 25 |

| 6 | 29 |

| 7 | 36 |

| 8 | 22 |

| 9 | 25 |

| 10 | 28 |

Formula to calculate MAD:

Calculation of MAD:

| Week | Demand | Ft | Absolute error |

| 1 | 20 | 20 | 0 |

| 2 | 21 | 20 | 1 |

| 3 | 28 | 20.50 | 7.50 |

| 4 | 37 | 24.25 | 12.75 |

| 5 | 25 | 30.63 | 5.63 |

| 6 | 29 | 27.81 | 1.19 |

| 7 | 36 | 28.41 | 7.59 |

| 8 | 22 | 32.20 | 10.20 |

| 9 | 25 | 27.10 | 2.10 |

| 10 | 28 | 26.05 | 1.95 |

| Total | 49.91 | ||

| MAD | 4.99 | ||

Table 1

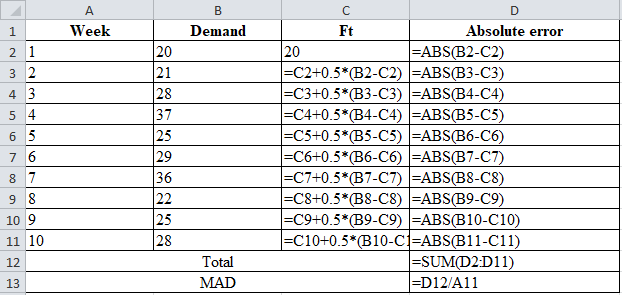

Excel worksheet:

Calculation of the absolute error for week 2:

The absolute error for week 1 is the modulus of the difference between 21 and 20, which corresponds to 1. Therefore, the absolute error for week 2 is 1.

Calculation of the absolute error for week 3:

The absolute error for week 3 is the modulus of the difference between 28 and 20.50, which corresponds to 7.50. Therefore, the absolute error for week 3 is 7.50.

Calculation of the absolute error for week 4:

The absolute error for week 4 is the modulus of the difference between 37 and 24.25, which corresponds to 12.75. Therefore, the absolute error for week 4 is 12.75.

Calculation of the absolute error for week 5:

The absolute error for week 5 is the modulus of the difference between 25 and 30.63, which corresponds to 5.63. Therefore, the absolute error for week 5 is 5.63.

Calculation of the absolute error for week 6:

The absolute error for week 6 is the modulus of the difference between 29 and 27.81, which corresponds to 1.19. Therefore, the absolute error for week 6 is 1.19.

Calculation of the absolute error for week 7:

The absolute error for week 7 is the modulus of the difference between 36 and 28.41, which corresponds to 7.59. Therefore, the absolute error for week 7 is 7.59.

Calculation of the absolute error for week 8:

The absolute error for week 8 is the modulus of the difference between 22 and 32.20, which corresponds to 10.20. Therefore, the absolute error for week 8 is 10.20.

Calculation of the absolute error for week 9:

The absolute error for week 9 is the modulus of the difference between 25 and 27.10, which corresponds to 2.10. Therefore, the absolute error for week 9 is 2.10.

Calculation of the absolute error for week 10:

The absolute error for week 10 is the modulus of the difference between 28 and 26.05, which corresponds to 2.10. Therefore, the absolute error for week 10 is 2.10.

Calculation of the Mean Absolute Deviation:

The substitution of the summation value of absolute error for 10 weeks, divided by the number of weeks, which is 10 yields a MAD of 4.99.

The computed MAD is 4.99.

c)

To determine: To compute the tracking signal.

Answer to Problem 59P

The tracking signal is 2.82.

Explanation of Solution

Given information:

| Week | Demand |

| 1 | 20 |

| 2 | 21 |

| 3 | 28 |

| 4 | 37 |

| 5 | 25 |

| 6 | 29 |

| 7 | 36 |

| 8 | 22 |

| 9 | 25 |

| 10 | 28 |

Formula to calculate tracking signal:

Calculation of tracking signal:

Table 1 shows the calculation of MAD

| Week | Demand | Ft | Absolute error | Error | Cumulative error |

| 1 | 20 | 20 | 0 | 0 | 0 |

| 2 | 21 | 20 | 1 | 1 | 1 |

| 3 | 28 | 20.50 | 7.50 | 7.5 | 8.50 |

| 4 | 37 | 24.25 | 12.75 | 12.75 | 21.25 |

| 5 | 25 | 30.63 | 5.63 | -5.63 | 15.63 |

| 6 | 29 | 27.81 | 1.19 | 1.19 | 16.81 |

| 7 | 36 | 28.41 | 7.59 | 7.59 | 24.41 |

| 8 | 22 | 32.20 | 10.20 | -10.20 | 14.20 |

| 9 | 25 | 27.10 | 2.10 | -2.10 | 12.10 |

| 10 | 28 | 26.05 | 1.95 | 1.95 | 14.05 |

| Total | 49.91 | ||||

| MAD | 4.99 | Tracking signal | 2.82 |

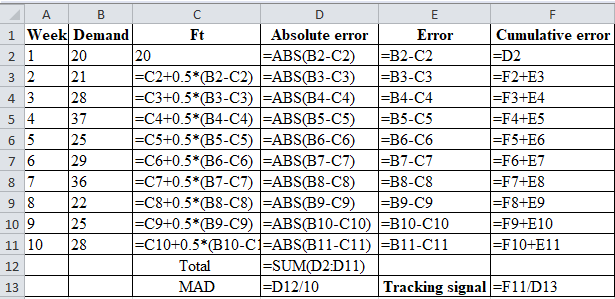

Excel worksheet:

Calculation of tracking signal:

The ratio of cumulative error and MAD is known as the tracking signal. The tracking signal of 2.82 is obtained by dividing 14.05 by 4.99.

Hence, the computed tracking signal is 2.82.

Want to see more full solutions like this?

Chapter 4 Solutions

Pearson eText Principles of Operations Management: Sustainability and Supply Chain Management -- Instant Access (Pearson+)

- Under what conditions might a firm use multiple forecasting methods?arrow_forwardThe Baker Company wants to develop a budget to predict how overhead costs vary with activity levels. Management is trying to decide whether direct labor hours (DLH) or units produced is the better measure of activity for the firm. Monthly data for the preceding 24 months appear in the file P13_40.xlsx. Use regression analysis to determine which measure, DLH or Units (or both), should be used for the budget. How would the regression equation be used to obtain the budget for the firms overhead costs?arrow_forwardThe file P13_42.xlsx contains monthly data on consumer revolving credit (in millions of dollars) through credit unions. a. Use these data to forecast consumer revolving credit through credit unions for the next 12 months. Do it in two ways. First, fit an exponential trend to the series. Second, use Holts method with optimized smoothing constants. b. Which of these two methods appears to provide the best forecasts? Answer by comparing their MAPE values.arrow_forward

- The owner of a restaurant in Bloomington, Indiana, has recorded sales data for the past 19 years. He has also recorded data on potentially relevant variables. The data are listed in the file P13_17.xlsx. a. Estimate a simple regression equation involving annual sales (the dependent variable) and the size of the population residing within 10 miles of the restaurant (the explanatory variable). Interpret R-square for this regression. b. Add another explanatory variableannual advertising expendituresto the regression equation in part a. Estimate and interpret this expanded equation. How does the R-square value for this multiple regression equation compare to that of the simple regression equation estimated in part a? Explain any difference between the two R-square values. How can you use the adjusted R-squares for a comparison of the two equations? c. Add one more explanatory variable to the multiple regression equation estimated in part b. In particular, estimate and interpret the coefficients of a multiple regression equation that includes the previous years advertising expenditure. How does the inclusion of this third explanatory variable affect the R-square, compared to the corresponding values for the equation of part b? Explain any changes in this value. What does the adjusted R-square for the new equation tell you?arrow_forwardScenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling contract submitted by four suppliers. She was evaluating the quotes based on price, target quality levels, and delivery lead time promises. As she was working, her manager, Dave Cox, entered her office. He asked how everything was progressing and if she needed any help. She mentioned she was reviewing quotations from suppliers for a tooling contract. Dave asked who the interested suppliers were and if she had made a decision. Sharon indicated that one supplier, Apex, appeared to fit exactly the requirements Visionex had specified in the proposal. Dave told her to keep up the good work. Later that day Dave again visited Sharons office. He stated that he had done some research on the suppliers and felt that another supplier, Micron, appeared to have the best track record with Visionex. He pointed out that Sharons first choice was a new supplier to Visionex and there was some risk involved with that choice. Dave indicated that it would please him greatly if she selected Micron for the contract. The next day Sharon was having lunch with another buyer, Mark Smith. She mentioned the conversation with Dave and said she honestly felt that Apex was the best choice. When Mark asked Sharon who Dave preferred, she answered, Micron. At that point Mark rolled his eyes and shook his head. Sharon asked what the body language was all about. Mark replied, Look, I know youre new but you should know this. I heard last week that Daves brother-in-law is a new part owner of Micron. I was wondering how soon it would be before he started steering business to that company. He is not the straightest character. Sharon was shocked. After a few moments, she announced that her original choice was still the best selection. At that point Mark reminded Sharon that she was replacing a terminated buyer who did not go along with one of Daves previous preferred suppliers. What does the Institute of Supply Management code of ethics say about financial conflicts of interest?arrow_forwardScenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling contract submitted by four suppliers. She was evaluating the quotes based on price, target quality levels, and delivery lead time promises. As she was working, her manager, Dave Cox, entered her office. He asked how everything was progressing and if she needed any help. She mentioned she was reviewing quotations from suppliers for a tooling contract. Dave asked who the interested suppliers were and if she had made a decision. Sharon indicated that one supplier, Apex, appeared to fit exactly the requirements Visionex had specified in the proposal. Dave told her to keep up the good work. Later that day Dave again visited Sharons office. He stated that he had done some research on the suppliers and felt that another supplier, Micron, appeared to have the best track record with Visionex. He pointed out that Sharons first choice was a new supplier to Visionex and there was some risk involved with that choice. Dave indicated that it would please him greatly if she selected Micron for the contract. The next day Sharon was having lunch with another buyer, Mark Smith. She mentioned the conversation with Dave and said she honestly felt that Apex was the best choice. When Mark asked Sharon who Dave preferred, she answered, Micron. At that point Mark rolled his eyes and shook his head. Sharon asked what the body language was all about. Mark replied, Look, I know youre new but you should know this. I heard last week that Daves brother-in-law is a new part owner of Micron. I was wondering how soon it would be before he started steering business to that company. He is not the straightest character. Sharon was shocked. After a few moments, she announced that her original choice was still the best selection. At that point Mark reminded Sharon that she was replacing a terminated buyer who did not go along with one of Daves previous preferred suppliers. Ethical decisions that affect a buyers ethical perspective usually involve the organizational environment, cultural environment, personal environment, and industry environment. Analyze this scenario using these four variables.arrow_forward

- Scenario 4 Sharon Gillespie, a new buyer at Visionex, Inc., was reviewing quotations for a tooling contract submitted by four suppliers. She was evaluating the quotes based on price, target quality levels, and delivery lead time promises. As she was working, her manager, Dave Cox, entered her office. He asked how everything was progressing and if she needed any help. She mentioned she was reviewing quotations from suppliers for a tooling contract. Dave asked who the interested suppliers were and if she had made a decision. Sharon indicated that one supplier, Apex, appeared to fit exactly the requirements Visionex had specified in the proposal. Dave told her to keep up the good work. Later that day Dave again visited Sharons office. He stated that he had done some research on the suppliers and felt that another supplier, Micron, appeared to have the best track record with Visionex. He pointed out that Sharons first choice was a new supplier to Visionex and there was some risk involved with that choice. Dave indicated that it would please him greatly if she selected Micron for the contract. The next day Sharon was having lunch with another buyer, Mark Smith. She mentioned the conversation with Dave and said she honestly felt that Apex was the best choice. When Mark asked Sharon who Dave preferred, she answered, Micron. At that point Mark rolled his eyes and shook his head. Sharon asked what the body language was all about. Mark replied, Look, I know youre new but you should know this. I heard last week that Daves brother-in-law is a new part owner of Micron. I was wondering how soon it would be before he started steering business to that company. He is not the straightest character. Sharon was shocked. After a few moments, she announced that her original choice was still the best selection. At that point Mark reminded Sharon that she was replacing a terminated buyer who did not go along with one of Daves previous preferred suppliers. What should Sharon do in this situation?arrow_forwardThe file P13_22.xlsx contains total monthly U.S. retail sales data. While holding out the final six months of observations for validation purposes, use the method of moving averages with a carefully chosen span to forecast U.S. retail sales in the next year. Comment on the performance of your model. What makes this time series more challenging to forecast?arrow_forward14 Community General Hospital finds itself treating many bicycle accident victims. Data from the last seven 24-hour periods is shown below: Day Bicycle Victims 1 8 2 14 3 8 4 14 5 18 6 15 With an alpha value of 0.31 and a starting forecast in day 3 equal to the 21 , what is the exponentially smoothed forecast for day 4? (Round to two decimal places) 15 What is the exponentially smoothed forecast for day 5? (Round to two decimal places) 16arrow_forward

- Passenger miles flown on Northeast Airlines, a commuter firm serving the Boston hub, are shown for the past 12 weeks: Week 1 2 4 6. 7 8 10 11 12 Actual Passenger Miles (in thousands) 17 21 19 23 19 17 21 19 23 21 13 24 a) Assuming an initial forecast for week 1 of 17,000 miles, use exponential smoothing to compute miles for weeks 2 through 12. Use a = 0.25 (round your responses to two decimal places). Week 1 2 3 4 6. 7 8. 10 11 12 Forecasted Passenger Miles (in thousands) 17.00 17.00 18.00 18.25 19.44 19.33 18.75 19.31 19.23 20.17 b) The MAD for this model = thousand (round your response to two decimal places). c) Compute the Cumulative Forecast Errors, cumulative MAD in thousands, and tracking signals (round your responses to two decimal places). Cumulative Cumulative Tracking Signal Forecast Tracking Signal Forecast Week Errors MAD Week Errors MAD 1 0.00 0.00 9.23 2.11 4.37 2 4.00 2.00 2.00 8. 8.92 1.89 4.73 3 5.00 1.67 3.00 9. 12.69 2.09 6.06 9.75 2.44 4.00 10 13.52 1.97 6.87 9.31…arrow_forward- Sales of tablet computers at Ted Glickman's electronics store in Washington, D.C., over the past 10 weeks are shown in the table below: 6 10 Week 1 Demand 20 2 3 23 27 4 5 37 26 7 8 9 30 35 22 24 29 a) The forecast for weeks 2 through 10 using exponential smoothing with a = 0.55 and a week 1 initial forecast of 20.0 are (round your responses to two decimal places): Week 1 Demand 20 Forecast 20.0 2 3 23 27 4 37 5 26 6 30 7 35 8 22 9 24 10 29arrow_forwardThe past two years sales at ACSR Inc. were 3 million and 5 million. Their forecast team used a two-period moving average to forecast its sales this year. But the actual sales for this year were 5 million. Now, the forecast team wants to forecast its sales for next year by using exponential smoothing with alpha equals 0.6. What is the forecast using exponential smoothing with alpha = .6? 2. If we decide to use an alpha of .2 instead of .6, will we be ‘weighting the error from the previous period higher or the Forecast from the previous period higher? Explain briefly or show using math! (In this question I am asking if we change the alpha to a lower alpha, what will be the effect – what will we be ‘weighing’ as more important?)arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning