Concept explainers

The monthly sales for Yazici Batteries, Inc., were as follows:

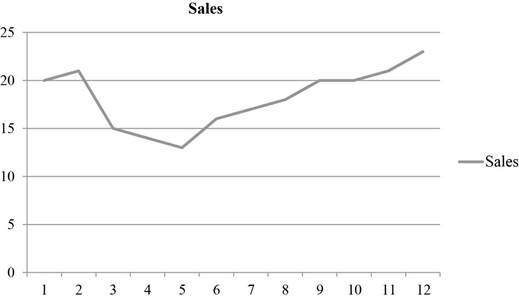

a) Plot the monthly sales data.

b)

i) Naive method.

ii) A 3-month moving average.

iii) A 6-month weighted average using .1, .1, .1, .2, .2, and .3, with the heaviest weights applied to the most recent months.

iv) Exponential smoothing using an α = .3 and a September forecast of 18.

v) A trend projection.

c) With the data given, which method would allow you to forecast next March’s sales?

a)

To determine: Plot and represent the monthly sales data in graphical form.

Introduction: Forecasting is used to predict future changes or demand patterns. It involves different approaches and varies with different time periods. A sequence of data points in successive order is known as a time series. Time series forecasting is the prediction based on past events which are at a uniform time interval.

Answer to Problem 6P

The monthly sales data is plotted and represented.

Explanation of Solution

Given information:

| Month | Sales |

| January | 20 |

| February | 21 |

| March | 15 |

| April | 14 |

| May | 13 |

| June | 16 |

| July | 17 |

| August | 18 |

| September | 20 |

| October | 20 |

| November | 21 |

| December | 23 |

Table 1

Graph:

The data to plot the sales is obtained from Table 1. Graph is plotted with the sales for January to December.

Thus, the sales data points are plotted and the graphical representation of sales data is presented.

b) i)

To determine: Forecast January sales using Naïve method.

Answer to Problem 6P

The forecast for January using Naïve method is 23

Explanation of Solution

Given information:

| Month | Sales |

| January | 20 |

| February | 21 |

| March | 15 |

| April | 14 |

| May | 13 |

| June | 16 |

| July | 17 |

| August | 18 |

| September | 20 |

| October | 20 |

| November | 21 |

| December | 23 |

Naïve Approach: This method assumes that the demand for a particular period will be the same as the demand in the most recent period.

| Month | Sales |

| January | 20 |

| February | 21 |

| March | 15 |

| April | 14 |

| May | 13 |

| June | 16 |

| July | 17 |

| August | 18 |

| September | 20 |

| October | 20 |

| November | 21 |

| December | 23 |

| January | 23 |

According to the naïve approach, the demand for January will be the same as the demand in the most recent past month. That is, the demand will be the same as that of December. Therefore, the demand for January will be same as the demand of December; 23.

Hence, the forecast for January using naïve approach is 23

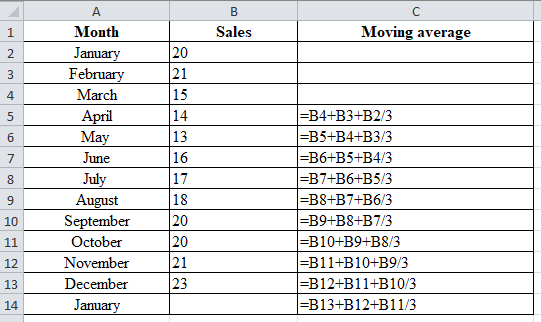

ii)

To determine: Forecast January sales using 3-month moving average.

Answer to Problem 6P

The forecast for January using 3-month moving average is 50.67

Explanation of Solution

Given information:

| Month | Sales |

| January | 20 |

| February | 21 |

| March | 15 |

| April | 14 |

| May | 13 |

| June | 16 |

| July | 17 |

| August | 18 |

| September | 20 |

| October | 20 |

| November | 21 |

| December | 23 |

Formula to calculate the demand forecast:

| Month | Sales | Moving Average |

| January | 20 | |

| February | 21 | |

| March | 15 | |

| April | 14 | 42.67 |

| May | 13 | 36.00 |

| June | 16 | 32.00 |

| July | 17 | 33.67 |

| August | 18 | 37.33 |

| September | 20 | 40.33 |

| October | 20 | 43.67 |

| November | 21 | 46.00 |

| December | 23 | 47.67 |

| January | 50.67 |

Excel worksheet:

Calculation of the demand forecast for January sales:

Substitute the summation of the values 20, 21, and 23and divide it by the nth period; n=3

The January forecast is 50.67

Hence, the forecast of January sales using 3-month moving average is 50.67

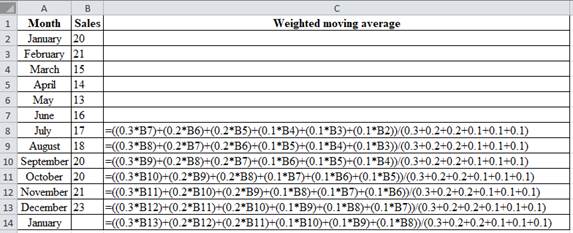

iii)

To determine: Forecast January sales using 6-month weighted moving average.

Answer to Problem 6P

The forecast for January using 6-month moving average is 20.60

Explanation of Solution

Given information:

| Month | Sales |

| January | 20 |

| February | 21 |

| March | 15 |

| April | 14 |

| May | 13 |

| June | 16 |

| July | 17 |

| August | 18 |

| September | 20 |

| October | 20 |

| November | 21 |

| December | 23 |

Formula to calculate the demand forecast:

| Month | Sales | Weighted moving average |

| January | 20 | |

| February | 21 | |

| March | 15 | |

| April | 14 | |

| May | 13 | |

| June | 16 | |

| July | 17 | 15.80 |

| August | 18 | 15.90 |

| September | 20 | 16.20 |

| October | 20 | 17.30 |

| November | 21 | 18.20 |

| December | 23 | 19.40 |

| January | 20.60 |

Excel worksheet:

Calculation for the demand forecast of January sales:

To calculate the forecast for January, multiply the weights with the sales of recent year, i.e. multiply weight 0.3 with 23, 0.2 with 21, 0.2 with 20, 0.1 with 20, 0.1 with 18 and 0.1 with 17.

Divide the summation of the multiplied values with the summation of the weights i.e. (0.3+0.2+0.2+0.1+0.1+0.1). The corresponding result is 20.60which is the forecasted value for January. Therefore January forecast is 20.60.

Hence, the forecast of January sales using 6-month weighted moving average is 20.60

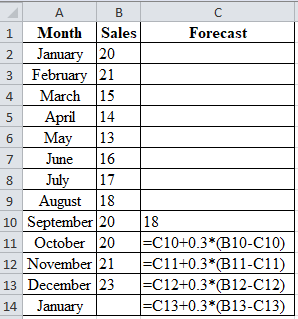

iv)

To determine: Forecast January sales using exponential smoothing method.

Answer to Problem 6P

The forecast for January using exponential smoothing method is 20.6298

Explanation of Solution

Given information:

| Month | Sales |

| January | 20 |

| February | 21 |

| March | 15 |

| April | 14 |

| May | 13 |

| June | 16 |

| July | 17 |

| August | 18 |

| September | 20 |

| October | 20 |

| November | 21 |

| December | 23 |

Formula to calculate the demand forecast

Where

| Sl. No. | Month | Sales | Forecast |

| 1 | January | 20 | |

| 2 | February | 21 | |

| 3 | March | 15 | |

| 4 | April | 14 | |

| 5 | May | 13 | |

| 6 | June | 16 | |

| 7 | July | 17 | |

| 8 | August | 18 | |

| 9 | September | 20 | 18 |

| 10 | October | 20 | 18.6 |

| 11 | November | 21 | 19.02 |

| 12 | December | 23 | 19.614 |

| 13 | January | 20.6298 |

Excel worksheet:

Calculation of the forecast for October:

To calculate forecast for October, substitute the value of forecast of September, smoothing constant and difference of actual and forecasted demand of September. The result of forecast for October is 18.6.

Calculation of the forecast for November:

To calculate forecast for November, substitute the value of forecast of October, smoothing constant and difference of actual and forecasted demand of October. The result of forecast for November is 19.02.

Calculation of the forecast for December:

To calculate forecast for December, substitute the value of forecast of November, smoothing constant and difference of actual and forecasted demand of November. Therefore, the forecast for December is 19.614.

Calculation of the forecast for January:

To calculate forecast for January, substitute the value of forecast of December, smoothing constant and difference of actual and forecasted demand of December. Therefore, the forecast for January is 20.6298.

Hence, the forecast of January sales using exponential smoothing method is 20.6298

v)

To determine: Forecast January sales using trend projection.

Answer to Problem 6P

The forecast for January using trend projection is 20.754

Explanation of Solution

Given information:

| Month | Sales |

| January | 20 |

| February | 21 |

| March | 15 |

| April | 14 |

| May | 13 |

| June | 16 |

| July | 17 |

| August | 18 |

| September | 20 |

| October | 20 |

| November | 21 |

| December | 23 |

Formula to calculate the demand forecast

Where,

Where

| Month (x) | Sales (y) | xy | x2 |

| 1 | 20 | 20 | 1 |

| 2 | 21 | 42 | 4 |

| 3 | 15 | 45 | 9 |

| 4 | 14 | 56 | 16 |

| 5 | 13 | 65 | 25 |

| 6 | 16 | 96 | 36 |

| 7 | 17 | 119 | 49 |

| 8 | 18 | 144 | 64 |

| 9 | 20 | 180 | 81 |

| 10 | 20 | 200 | 100 |

| 11 | 21 | 231 | 121 |

| 12 | 23 | 276 | 144 |

| ∑=78 | ∑=218 | ∑=1474 | ∑=650 |

Substituting the values in the above formula

Calculation of average of x values

Average of x values is obtained by dividing the summation of x values i.e. (1+2+…+12) with the number of period n i.e.12. The value of

Calculation of average of y values

Average of y values is obtained by dividing the summation of sales with the number of period n i.e.12. The value of

Calculation of slope of regression line ‘b’:

Summation of product of sales (y) with x values is ∑xy = 1474, product of number of months (n), average of x values and average of y values is obtained i.e.

Summation of square of x values i.e. 650 is subtracted from the product of number of months i.e. 12 with average of x values i.e. 6.5. The resultant value is 143. The slope of regression line is obtained by dividing 57 with 143. The value of ‘b’ is 0.398.

Calculation of y axis intercept ‘a’:

The y axis intercept is obtained by the difference between average of y values and values obtained by the product of slope of regression line with average of x values. The resultant value of ‘a’ is 15.579.

Calculation of forecast of January:

The January forecast is obtained by summation of the product of slope of regression line and forecasted month, January i.e. 13 with the y-axis intercept. The forecasted value obtained is 20.754.

Hence, the forecast for January sales using trend projection is 20.754

c)

To determine: The best technique among time series methods to forecast March sales.

Explanation of Solution

The calculated results from the data revels that the trend projection (refer to equation (4)) is the best suitable technique to forecast March sales as it is useful in evaluating trends in the data.

Want to see more full solutions like this?

Chapter 4 Solutions

Pearson eText Principles of Operations Management: Sustainability and Supply Chain Management -- Instant Access (Pearson+)

- The oasis outpost of Abu Ilan, in the heart of the Negev desert, has a population of 20 Bedouin tribesmen and 20 Farima tribesmen. El Kamin, a nearby oasis, has a population of 32 Bedouins and 8 Farima. A lost Israeli soldier, accidentally separated from his army unit, is wandering through the desert and arrives at the edge of one of the oases. The soldier has no idea which oasis he has found, but the first person he spots at a distance is a Bedouin. 1. What is the probability that he wandered into Abu Ilan? 2. What is the probability that he is in El Kamin?arrow_forward2-22 The lost Israeli soldier mentioned in Problem 2-21 decides to rest for a few minutes before entering the desert oasis he has just found. Closing his eyes, he dozes off for 15 minutes, wakes, and walks toward the center of the oasis. The first person he spots this time he again recognizes as a Bedouin. What is the posterior probability that he is in El Kamin?*Note* 2-21 The oasis outpost of Abu Ilan, in the heart of the Negev desert, has a population of 20 Bedouin tribesmen and 20 Farima tribesmen. El Kamin, a nearby oasis, has a population of 32 Bedouins and 8 Farima. A lost Israeli soldier, accidentally separated from his army unit, is wandering through the desert and arrives at the edge of one of the oases. The soldier has no idea which oasis he has found, but the first person he spots at a distance is a Bedouin. What is the probability that he has wandered into Abu Ilan? What is the probability that he is in El Kamin?arrow_forwardHello, please make an excel of this. Show all the cells thanks. some replied with a paper answer thank you I just cant understand the way the did it. Can someone show me all screenshots o fthis problem solved and in excel? i need to solver too for the constraints. I seen multiple times across other platforms that one of the chairs optimal solutions is 0 but they both have to be higher than 1 The Heinrich Company manufactures two types of plastic hangerracks (Foldaways and Straightaways) especially suited for mountingnear clothes dryers. Because permanent press clothing must be hungon hangers immediately after removal from the dryer, these items havebeen especially popular. However, there is some concern that thePreppie movement (popularized by its own handbook) will extinguishpolyester clothing; Heinrich is terribly interested in doing the best withthe resources it has while its products are still in demand. The firsttype of hanger rack, the Foldaway, requires 10 ounces of…arrow_forward

- Review the Profit Ratio by Product chart again. What information is uncovered when the data is less aggregated than the data in Profit Ratio by Category chart?arrow_forwardWhat is the correlation between Measure A and Measure B in this example?arrow_forward1) View the video ON Unveils ‘Lightspray’ Technology (4.55 mins, Ctrl+Click in the link), and The Secret of Lightspray (8.27 mins, Ctrl+Click in the link), answer the following questions: https://www.youtube.com/watch?v=wjmeaC-wlZs a) What is new about the design of ON’s shoes? b) How will ON’s new manufacturing technique affect location planning for footwear firms? c) How does ON focus on it sustainability strategy? Note: As a rough guideline, please try to keep the written submission to one or two paragraphs for each of the questions. 2) Unimed Hospital currently processes patient admissions through three admitting clerks who are set up to work in series, with respective reliabilities of 0.96, 0.95, and 0.90 (see figure below). a) Find the reliability of the current admission process. Due to rising patient complaints, the hospital administrator, Chimeg Ganbaatar, has decided to improve the reliability of the admission process by providing backup clerks for two of the…arrow_forward

- + < Question 21 of 39 What is the correct common name for the compound shown here? 2-methoxyprop ane | 3-1-2- n-tert- iso sec- eth prop meth methoxy propoxy ethoxy yl acid ether ester ane Reset ☑ Submitarrow_forward(25 Marks) Discuss how you would "reset the store estate" to remain competitive and relevant in the market?arrow_forwardHello, please make an excel of this. Show all the cells thanks The Heinrich Company manufactures two types of plastic hangerracks (Foldaways and Straightaways) especially suited for mountingnear clothes dryers. Because permanent press clothing must be hungon hangers immediately after removal from the dryer, these items havebeen especially popular. However, there is some concern that thePreppie movement (popularized by its own handbook) will extinguishpolyester clothing; Heinrich is terribly interested in doing the best withthe resources it has while its products are still in demand. The firsttype of hanger rack, the Foldaway, requires 10 ounces of plasticmaterial and 0.3 hours of labor. Plastic costs Heinrich 10 cents anounce; labor costs Heinrich $20 per hour. The second type of hangerrack, the Straightaway, requires 15 ounces of plastic and 0.175 hoursof labor. The prices of these resources are the same as those for theFoldaway. Under current market conditions, Heinrich can sell…arrow_forward

- FORMATIVE ASSESSMENT 1 Read the article below and answer ALL the questions Pick n Pay reveals strategy to restore its business 27 May 2024 [100 MARKS] Following a disappointing full year performance for FY24, Pick n Pay CEO Sean Summers has unveiled the new board- approved six-point strategy to restore the Group's core Pick n Pay supermarket business to profitability. PHASED APPROACH IMPLEMENTATION Leverage strength of partnerships Leadership and people 2 Reset the store estate 3 Improve offer to drive sales 4 Optimise operating model Leverage strength of partnerships Recapitalisation Pick n Pay Prod FY26 FY27 Before Tax break-even FY25 Halve Group H2 FY24 H1 FY25 H2 FY25 H1 FY26 H2 FY26 HI FY27 H2 FY27 KEY IMPACT AND/OR TARGETED OUTCOMES Appointing the right people, in the optimal roles, to Directly and indirectly impact revenue growth drivers and 1 drive sales and realise margin improvement 5 enhances gross and operating margins 2 Expected notable associated savings/loss avoidance…arrow_forwardWith an enormous amount of data stored in databases and data warehouses, it is increasinglyimportant to develop powerful tools for analysis of such data and mining interestingknowledge from it. Data mining is a process of inferring knowledge from such huge data. Themain problem related to the retrieval of information from the World Wide Web is theenormous number of unstructured documents and resources, i.e., the difficulty of locating andtracking appropriate sources. Your company is considering investing in a Human Resource Information System (HRIS).Briefly explain the strategies for justifying HRIS investments.arrow_forwardYour company is considering investing in a Human Resource Information System (HRIS).Briefly explain the strategies for justifying HRIS investments.arrow_forward

- MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,  Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning