Concept explainers

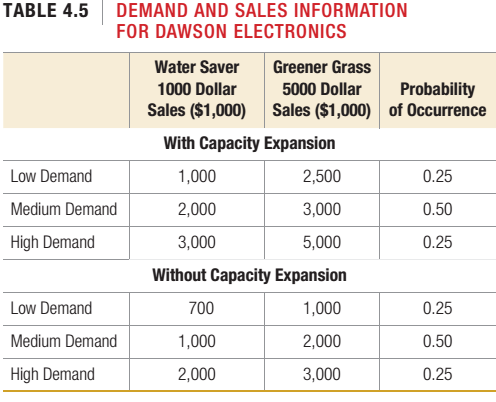

Dawson Electronics is a manufacturer of high-tech control modules for lawn sprinkler systems. Denise, the CEO, is trying to decide if the company should develop one of the two potential new products, the Water Saver 1000 or the Greener Grass 5000. With each product, Dawson can capture a bigger market share if it chooses to expand capacity by buying additional machines. Given different demand scenarios, their probabilities of occurrence, and capacity expansion versus no change in capacity, the potential sales of each product are summarized in Table 4.5.

- What is the expected payoff for Water Saver 1000 and the Greener Grass 5000, with and without capacity expansion?

- Which product should Denise choose to produce, and with which capacity expansion option?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Operations Management: Processes and Supply Chains, Student Value Edition Plus MyLab Operations Management with Pearson eText -- Access Card Package (12th Edition)

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Fundamentals of Financial Accounting

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Advanced Financial Accounting

- How is Little’s Law currently used in today’s supply chains? Provide an example of where it is used.arrow_forwardHow would you Briefly state your views on music for a Christian school interview?arrow_forward3) Rane Brake Linings manufactures brake pads in a process focused facility; the fixed costs are nine thousand dollars per year, the variable cost is fifty dollars per brake pad, each brake pad sells for two hundred dollars. a) Calculate the breakeven point (in units) for this operation. b) Calculate the breakeven point (in $) for this operation. c) Calculate the profit/loss on a demand of two hundred brake pads per year. Note: You could work out the problem by hand or use excel; in chapter 5, section 5.11 of the Stevenson text, evaluating alternatives (cost volume analysis) is covered with examples; chapter 5 Stevenson lecture power point slides 34 to 44 (chapter 5 lecture: 29.49 mins to 38.87 mins) cover cost volume analysis with examples.arrow_forward

- 1. For the purpose of process analysis, which of the following measures would beconsidered an appropriate flow unit for analyzing the operation of a coffee shop?Instructions: You may select more than one answer. a. Square footage of the store b. Number of employees working each week c. Number of hours the store is open each week d. Number of customers served each weekarrow_forwardLO2-1 1. From the perspective of process analysis, which of the following could be appropriate flow units for a hardware store? a. Number of workers b. Number of cash registers c. Number of customers d. Number of suppliers page 37 2. Over the course of a month, which of the following is most likely to describe an appropriate flow unit for a process analysis of a hospital? a. The number of physicians b. The number of beds c. The square footage of the building d. The number of patients LO2-2 3. At a cruise ship terminal, each day on average 1000 passengers embark on ships. On average, passengers spend 5 days on their cruise before returning to this terminal. If the flow unit is a passenger, then what are the flow rate and flow time of this process? 4. It is election day and 1800 voters vote in their precinct’s library during the 10 hours the polls are open. On average, there are 15 voters in the library and they spend on average 5 minutes in the library to complete their voting. What is…arrow_forwardWhat do you feel is the most effective way to communicate with families? Describe how you have used this/these technique(s).arrow_forward

- PP.52 A manufacturer of solid state drives (SSDs) has projected the next six months of demand to be as shown the table below: Supply/Demand Info Beginning Jan Feb Mar Apr May Jun Forecast (demand) 53,800 53,400 51,000 63,800 49,200 59,000 Regular production Overtime production Subcontract production Ending inventory 4,000 Hired employees Fired employees Total employees 190 Cost variables are as follows: Cost Variables Labor cost/hour $16 Overtime cost/unit $39 Subcontracting cost/unit $35 Holding cost/unit/month $14 Hiring cost/employee $3,100 Firing cost/employee $5,500 Here is some additional relevant (capacity) information: Capacity Information Total labor hours/SSD 4 Regular production units/employee/month 200…arrow_forwardDiscuss how a human resource professional can better gain the confidence of senior management and, thereby, become a key participant/player in the organization’s future.arrow_forwardPP.63 Jupiter, a large candy company, is having great success with its "Swan" family of candy bars. Due to a number of factors they like to plan their production at least six months into the future. The table below contains their demand projections (in tons) for April through September: Supply/Demand Info Beginning Apr May Jun Jul Aug Sep Predicted Sales 45,500 45,100 51,900 52,800 47,900 47,200 Regular production Overtime production Subcontract production Ending inventory 14,400 Hired employees Fired employees Total employees 423 Cost variables are as follows: Cost Variables Labor cost/hour $13 Overtime cost/ton $30 Subcontracting cost/ton $28 Holding cost/ton/month $14 Hiring cost/employee $3,700 Firing cost/employee $5,800 Here is some additional…arrow_forward

- What are the responsibilities and duties of a consultant for a local company who is considering expanding its operations to international markets? How can a local Agriculture and Food Processing company successfully enter international markets?arrow_forwardWhat is an example of how someone would explain how their past personal and professional experience makes you a quality candidate for a teaching position at an Elementary School as a K-6 Teacher?arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage LearningMarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing