Concept explainers

Problem 3-62A Cash-Basis and Accrual-Basis Income

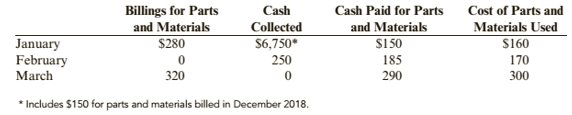

George Hathaway, an electrician, entered into an agreement with a real estate management company to perform all maintenance of basic electrical systems and air-conditioning equipment in the apartment buildings under the company’s management. The agreement, which is subject to annual renewal, provides for the payment of a fixed fee of S6,600 on January 1 of each year plus amounts for parts and materials billed separately at the end of each month. Amounts billed at the end of I month are collected in the next month. During the first 3 months of 2019, George makes the following additional billings and cash collections:

Required:

1. Calculate the amount of cash-basis income reported for each of the first 3 months.

2. Calculate the amount of accrual-basis income reported for each of the first 3 months.

3. CONCEPTUAL CONNECTION Why do decision-makers prefer accrual-basis accounting?

Trending nowThis is a popular solution!

Chapter 3 Solutions

Cornerstones of Financial Accounting

- Calculate the sample size based on the specifications in Buhi's contract. Make sure it is within budget, reasonable to obtain, and that you use appropriate inputs relative to market research best practices. Use the calculator to adjust the sample size statement. Use the agreed-upon sample size in Buhi's contract: 996. In your secondary research, find the target population size (an estimate of those in the United States looking to purchase luggage in the category in the next two years). You will use this target population size for each sample size estimate. Adjust the provided sample size calculator inputs to find the rest of the figures that get you to the agreed-upon sample size. The caveats from Buhi are that you must: Use the market research standard for your confidence level. Use a confidence interval that is better than the market research standard for your confidence interval.arrow_forwardThe partnership of Keenan and Kludlow paid the following wages during this year: Line Item Description Amount M. Keenan (partner) $108,000 S. Kludlow (partner) 96,000 N. Perry (supervisor) 54,700 T. Lee (factory worker) 35,100 R. Rolf (factory worker) 27,200 D. Broch (factory worker) 6,300 S. Ruiz (bookkeeper) 26,000 C. Rudolph (maintenance) 5,200 In addition, the partnership owed $250 to Rudolph for work he performed during December. However, payment for this work will not be made until January of the following year. The state unemployment tax rate for the company is 2.95% on the first $9,000 of each employee's earnings. Compute the following: ound your answers to the nearest cent. a. Net FUTA tax for the partnership for this year b. SUTA tax for this yeararrow_forwardGiven answer financial accounting questionarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning