Concept explainers

Problem 3-70B Comprehensive Problem: Reviewing the Accounting Cycle

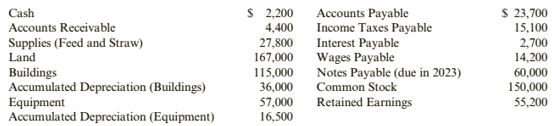

Wilburton Riding Stables provides stables, care for animals, and grounds for riding and showing horses. The account balances at the beginning of 2019 were:

During 2019, the following transactions occurred:

- Wilburton provided animal care services, all on credit, for $210,300. Wilburton rented stables to customers for $20,500 cash. Wilburton rented its grounds to individual riders, groups, and show organizations for $41,800 cash.

- There remains $15,600 of

accounts receivable to be collected at December 31, 2019. - Feed in the amount of $62,900 was purchased on credit and debited to the supplies

- Straw was purchased for $7,400 cash and debited to the supplies account.

- Wages payable at the beginning of 2019 were paid early in 2019. Wages were earned and paid during 2019 in the amount of $12,000.

- The income taxes payable at the beginning of 2019 were paid early in 2019.

- Payments of $73,000 were made to creditors for supplies previously purchased on credit.

- One year’s interest at 9% was paid on the note payable on July 1, 2019.

- During 2019, Jon Wilburton, a principal stockholder, purchased a horse for his Wife, Jennifer, to ride. The horse cost $7,000, and Wilburton used his personal credit to purchase it. The horse is stabled at the Wilburton home rather than at the riding stables.

- Property taxes were paid on the land and buildings in the amount of S17,000.

- Dividends were declared and paid in the amount Of

The following data are available for

• Supplies (feed and straw) in the amount of $30,400 remained at year end.

• Annual

• Annual depreciation on the equipment is

• Wages of $4,000 were unrecorded and unpaid at year end.

• Interest for 6 months at 9% per year on the note is unpaid and unrecorded at year end.

• Income taxes of $16,500 were unpaid and unrecorded at year end.

Required:

- Post the 2019 beginning balances to T-accounts. Prepare

journal entries for Transactions a through j andpost the journal entries to T-accounts, adding any new T-accounts you need. - Prepare the adjustments and post the adjustments to the T-accounts, adding any new T-accounts you need.

- Prepare an income statement.

- Prepare a

retained earnings statement. - Prepare a classified

balance sheet - Prepare closing entries.

- CONCEPTUAL CONNECTION Did you include Transaction g among Tarkington’s 2019 journal entries? Why or why not?

1.

To record:Journal entries and prepare T accounts to post those entries.

Introduction: Journal entries provide a record of the financial activities undertaken within an organization. Journal entries helps in preparation of financial statements of a company.

Explanation of Solution

Journalizing:

Journalizing is the process of recording the transactions of an organization in a chronological order. Based on these journal entries recorded, the accounts are posted to the relevant ledger accounts.

Accounting rules for journal entries:

- To increase balance of the account: Debit assets, expenses, losses and credit all liabilities, capital, revenue and gains.

- To decrease balance of the account: Credit assets, expenses, losses and debit all liabilities, capital, revenue and gains.

Recording service revenue:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Cash | 686,838 | |||

| Accounts receivables | 2,256,700 | |||

| Service revenue | 2,943,538 | |||

| (to recordservice revenue) |

Table (1)

- Since cash is an asset, asset is increased. Hence, cashaccount is debited.

- Since accounts receivables is anasset, asset is increased. Hence, accounts receivablesaccount is debited.

- Since service revenue is an income, income is increased. Hence, service revenue account is credited.

Recording receipt from accounts receivables:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Cash | 286,172 | |||

| Accounts receivable | 286,172 | |||

| (to record receipt of accounts receivables) |

Table (2)

- Since cash is an asset, asset is increased. Hence, cashaccount is debited.

- Since accounts receivables is anasset and it decreased. Hence, accounts receivablesaccount is credited.

Recording prepaid advertising:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Prepaid advertising | 138,100 | |||

| Cash | 138,100 | |||

| (to record unearned income) |

Table (3)

- Since prepaid advertising is an asset, asset is increased. Hence, prepaid advertisingaccount is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording purchase of supplies:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Supplies | 27,200 | |||

| Accounts payable | 27,200 | |||

| (to record purchase of supplies) |

Table (4)

- Since supplies is an asset, asset is increased. Hence, suppliesaccount is debited.

- Since accounts payable is aliability, liability is increased. Hence, accounts payable account is credited.

Recording repayment of accounts payable:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Accounts payable

| 12,000 | |||

| Cash | 12,000 | |||

| (to record repayment of accounts payable) |

Table (5)

- Since accounts payable is aliability, liability is decreased. Hence, accounts payableaccount is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording cash paid for wages:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Wages payable | 30,200 | |||

| Wages expense | 666,142 | |||

| Cash | 696,342 | |||

| (to record payment of wages) |

Table (6)

- Since wages payable is aliability, liability is decreased. Hence, wages payableaccount is debited.

- Since wages expense is an expense, expense is increased. Hence, wages expenseaccount is credited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording withdrawal of cash for personal purposes:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Drawings | 42,000 | |||

| Cash | 42,000 | |||

| (to record drawing) |

Table (7)

- Since drawing is capital, capital is decreased. Hence, drawingaccount is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording interest expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Interest expense | 30,000 | |||

| Cash | 30,000 | |||

| (to record interest expense) |

Table (8)

- Since interest expense is an expense, expense is decreased. Hence, interest expenseaccount is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording property taxes:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Property taxes | 170,000 | |||

| Cash | 170,000 | |||

| (to record property taxes) |

Table (9)

- Since property taxes is an expense, expense is increased. Hence, property taxes account is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Recording dividend payment:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Dividend | 25,000 | |||

| Cash | 25,000 | |||

| (to record dividend payment) |

Table (10)

- Since dividend is an expense, expense is increased. Hence, dividend account is debited.

- Since cash is an asset, asset is decreased. Hence, cashaccount is credited.

Working Notes:

Computation of interest payable:

Preparation of cash account in general ledger:

| Cash | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 92,100 | 92,100 | |||

| Service revenue | 686,838 | 778,938 | |||

| Accounts receivable | 286,172 | 1,065,110 | |||

| Prepaid advertisement | 138,100 | 927,010 | |||

| Accounts payable | 12,000 | 915,010 | |||

| Wages payable | 30,200 | 884,810 | |||

| Wages expenses | 666,142 | 218,668 | |||

| Drawings | 42,000 | 176,668 | |||

| Interest expense | 30,000 | 146,668 | |||

| Property tax | 1,70,000 | (23332) | |||

| Dividend | 25,000 | (48,332) | |||

Table (11)

Preparation of accounts receivable account in general ledger:

| Accounts receivable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 361,500 | 361,500 | |||

| Service revenue | 2,256,700 | 2,618,200 | |||

| Cash | 286,172 | 2,332,028 | |||

Table (12)

Preparation of supplies account in general ledger:

| Supplies | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 24,600 | 24,600 | |||

| Accounts payable | 27,200 | 51,800 | |||

Table (13)

Preparation of prepaid advertising account in general ledger:

| Prepaid advertising | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 2,000 | 2,000 | |||

| Cash | 138,100 | 140,100 | |||

Table (14)

Preparation of building account in general ledger:

| Building | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 2,190,000 | 2,190,000 | |||

Table (15)

Preparation of accumulated depreciation account in general ledger:

| Accumulated depreciation-Building | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 280,000 | ||||

Table (16)

Preparation of equipment account in general ledger:

| Equipment | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 795,000 | 795,000 | |||

Table (17)

Preparation of accumulated depreciation account in general ledger:

| Accumulated depreciation-Equipment | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 580,000 | ||||

Table (18)

Preparation of land account in general ledger:

| Land | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 304,975 | 304.975 | |||

Table (19)

Preparation of accounts payable account in general ledger:

| Accounts payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 17,600 | 17,600 | |||

| Supplies | 27,200 | 44,800 | |||

| Cash | 12,000 | 32,800 | |||

Table (20)

Preparation of wages payable account in general ledger:

| Wages payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 30,200 | ||||

| Cash | 30,200 | 0 | |||

Table (21)

Preparation of notes payable account in general ledger:

| Notes payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 1,000,000 | ||||

Table (22)

Preparation of common stock account in general ledger:

| Common stock | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 1,400,000 | ||||

Table (23)

Preparation of retained earnings account in general ledger:

| Retained earnings | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 462,375 | ||||

Table (24)

Preparation of service revenue account in general ledger:

| Service revenue | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Accounts receivable | 2,256,700 | ||||

| Cash | 686,838 | ||||

Table (25)

Preparation of wages expense account in general ledger:

| Wages expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 666,142 | 666,142 | |||

Table (26)

Preparation of drawing account in general ledger:

| Drawing | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 42,000 | 42,000 | |||

Table (27)

Preparation of interest expense account in general ledger:

| Interest expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 30,000 | 30,000 | |||

Table (28)

Preparation of property tax account in general ledger:

| Property tax expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 170,000 | 170,000 | |||

Table (29)

Preparation of dividend account in general ledger:

| Dividend expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 25,000 | 25,000 | |||

Table (30)

2.

To record:Adjusting entries. Also, post the adjustment entries in the respective T accounts.

Introduction: Adjusting entries are made at the end of reporting period at the time of preparation of financial statements. Adjusting entries are recorded to reflect the correct picture of financial position of the organization in the financial statements.

Explanation of Solution

Recording adjustment of supplies:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Supplies Expense

| 38,115 | |||

| Supplies | 38,115 | |||

| (to record adjustment of supplies) |

Table (31)

- Since supplies expense is an expense, expense is increased. Hence, supplies expense account is debited.

- Since supplies is an asset, asset is decreased. Hence, supplies account is credited.

Recording depreciation expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Depreciation -Building | 70,000 | |||

| Accumulated depreciation-Building | 70,000 | |||

| (to record depreciation expense) |

Table (32)

- Since depreciation is an expense, expense is increased. Hence, depreciation-Building account is debited.

- Since accumulated depreciation is a contra asset, contra asset is increased. Hence, accumulated depreciation-Building account is credited.

Recording depreciation expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Depreciation -Equipment | 145,000 | |||

| Accumulated depreciation-Equipment | 145,000 | |||

| (to record depreciation expense) |

Table (33)

- Since depreciation is an expense, expense is increased. Hence, depreciation-Equipment account is debited.

- Since accumulated depreciation is a contra asset, contra asset is increased. Hence, accumulated depreciation-Equipment account is credited.

Recording wages payable:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Wages expense | 60,558 | |||

| Wages payable | 60,558 | |||

| (to record wages expense) |

Table (34)

- Since wages expense is an expense, expense is increased. Hence, wages expense account is debited.

- Since wages payable is a liability, liability is increased. Hence, wages payable account is credited.

Recording interest expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Interest expense | 30,000 | |||

| Interest Payable | 30,000 | |||

| (to record interest expense) |

Table (35)

- Since interestexpense is an expense, expense is increased. Hence, interestexpense account is debited.

- Since interest payable is a liability, liability is increased. Hence, interest payable account is credited.

Recording adjustment of prepaid advertisement:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Advertising Expense

| 125,226 | |||

| Prepaid advertising | 125,226 | |||

| (to record advertising adjustment) |

Table (36)

- Sinceadvertising expense is an expense, expense is increased. Hence, advertising expense account is debited.

- Since prepaid advertising is an asset, asset is decreased. Hence, prepaid advertising account is credited.

Recording income tax expense:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Income tax expense | 482,549 | |||

| Income tax payable | 482,549 | |||

| (to record income tax expense) |

Table (37)

- Since income tax is an expense, expense is increased. Hence, income tax account is debited.

- Since income tax payable is a liability, liability is increased. Hence, income tax payable account is credited.

Preparation of cash account in general ledger:

| Cash | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 92,100 | 92,100 | |||

| Service revenue | 686,838 | 778,938 | |||

| Accounts receivable | 286,172 | 1,065,110 | |||

| Prepaid advertisement | 138,100 | 927,010 | |||

| Accounts payable | 12,000 | 915,010 | |||

| Wages payable | 30,200 | 884,810 | |||

| Wages expenses | 666,142 | 218,668 | |||

| Drawings | 42,000 | 176,668 | |||

| Interest expense | 30,000 | 146,668 | |||

| Property tax | 1,70,000 | (23332) | |||

| Dividend | 25,000 | (48,332) | |||

Table (38)

Preparation of accounts receivable account in general ledger:

| Accounts receivable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 361,500 | 361,500 | |||

| Service revenue | 2,256,700 | 2,618,200 | |||

| Cash | 286,172 | 2,332,028 | |||

Table (39)

Preparation of supplies account in general ledger:

| Supplies | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 24,600 | 24,600 | |||

| Accounts payable | 27,200 | 51,800 | |||

| Supplies expense | 38,115 | 13,685 | |||

Table (40)

Preparation of prepaid advertising account in general ledger:

| Prepaid advertising | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 2,000 | 2,000 | |||

| Cash | 138,100 | 140,100 | |||

| Advertising expense | 125,226 | 14,874 | |||

Table (41)

Preparation of building account in general ledger:

| Building | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 2,190,000 | 2,190,000 | |||

Table (42)

Preparation of accumulated depreciation account in general ledger:

| Accumulated depreciation-Building | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 280,000 | ||||

| Depreciation | 70,000 | ||||

Table (43)

Preparation of equipment account in general ledger:

| Equipment | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 795,000 | 795,000 | |||

Table (44)

Preparation of accumulated depreciation account in general ledger:

| Accumulated depreciation-Equipment | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 580,000 | ||||

| Depreciation | 145,000 | ||||

Table (45)

Preparation of land account in general ledger:

| Land | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 304,975 | 304.975 | |||

Table (46)

Preparation of accounts payable account in general ledger:

| Accounts payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 17,600 | ||||

| Supplies | 27,200 | ||||

| Cash | 12,000 | ||||

Table (47)

Preparation of interest payable account in general ledger:

| Interest payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Interest expense | 30,000 | ||||

Table (48)

Preparation of wages payable account in general ledger:

| Wages payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 30,200 | ||||

| Cash | 30,200 | 0 | |||

| Wages expense | 60,558 | ||||

Table (49)

Preparation of income tax payable account in general ledger:

| Income tax payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Income tax expense | 482,549 | ||||

Table (50)

Preparation of notes payable account in general ledger:

| Notes payable | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 1,000,000 | ||||

Table (51)

Preparation of common stock account in general ledger:

| Common stock | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 1,400,000 | ||||

Table (52)

Preparation of retained earnings account in general ledger:

| Retained earnings | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Balance | 462,375 | ||||

Table (53)

Preparation of service revenue account in general ledger:

| Service revenue | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Accounts receivable | 2,256,700 | ||||

| Cash | 686,838 | ||||

Table (54)

Preparation of wages expense account in general ledger:

| Wages expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 666,142 | 666,142 | |||

| Wages payable | 60,558 | 726,700 | |||

Table (55)

Preparation of drawing account in general ledger:

| Drawing | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 42,000 | 42,000 | |||

Table (56)

Preparation of interest expense account in general ledger:

| Interest expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 30,000 | 30,000 | |||

| Interest payable | 30,000 | 60,000 | |||

Table (57)

Preparation of property tax account in general ledger:

| Property tax expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 170,000 | 170,000 | |||

Table (58)

Preparation of dividend account in general ledger:

| Dividend expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Cash | 25,000 | 25,000 | |||

Table (59)

Preparation of supplies expense in general ledger:

| Supplies expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Supplies | 38,115 | 38,115 | |||

Table (60)

Preparation of depreciation expense account in general ledger:

| Depreciation-building expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Accumulated depreciation | 70,000 | 70,000 | |||

Table (61)

Preparation of depreciation expense account in general ledger:

| Depreciation-equipment expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Accumulated depreciation | 145,000 | 145,000 | |||

Table (62)

Preparation of advertising expense in general ledger:

| Advertising expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Prepaid advertising | 125,226 | 125,226 | |||

Table (63)

Preparation of income tax expense in general ledger:

| Income tax expense | |||||

| Date | Particular | Post Ref. | Debit($) | Credit($) | Balance($) |

| Income tax payable | 482,549 | 482,549 | |||

Table (64)

3.

To prepare:Income statement.

Introduction: Income statement is prepared to ascertain net income of a company for a period. Net income shows operating efficiency of a company.

Explanation of Solution

Preparation of income statement for the year ending 31st December,2019:

| CompanyA | |||||

| Income Statement | |||||

| Amount ($) | Amount ($) | ||||

| Revenues: | |||||

| Service revenue | 2,943,538 | ||||

| Total Revenue | 2,943,538 | ||||

| Expenses: | |||||

| Wages expense | 726,700 | ||||

| Advertising expense | 125,226 | ||||

| Interest expense | 60,000 | ||||

| Supplies expense | 38,115 | ||||

| Property tax | 170,000 | ||||

| Depreciation-building expense | 70,000 | ||||

| Depreciation-equipment expense | 145,000 | ||||

| Income tax expense | 482,549 | ||||

| Total Expenses | 1,817,590 | ||||

| Net Income | 1,125,948 | ||||

Table (65)

4.

To prepare:Statement of retained earnings.

Introduction: Statement of retained earnings shows the net impact on retained earnings of the company, in a given period.

Explanation of Solution

Preparation of statement of retained earnings as on 31st December,2019:

| Company A | ||

| Statement of Retained Earning | ||

| Amount($) | Amount($) | |

| Owner’s Equity opening balance | 462,375 | |

| Add: Capital introduced by owner | ||

| Add: Net income | 1,125,948 | |

| Total: | 1,588,323 | |

| Less: Withdrawals | ||

| Less: Dividend | ||

| Closing Balance | 1,521,323 | |

Table (66)

5.

To prepare:Balance sheet of the company at the end of the accounting period.

Introduction: Balance sheet shows the status of assets and liabilities of the company, in which total assets equates with total liabilities and equity.

Explanation of Solution

Preparation of balance sheet as on 31st December,2019:

| Company A | |||||

| Balance Sheet | |||||

| Amount ($) | Amount($) | ||||

| Liabilities and Owners Equity | |||||

| Current Liabilities | |||||

| Accounts Payable | 32,800 | ||||

| Wages Payable | 60,558 | ||||

| Interest Payable | 30,000 | ||||

| Income tax payable | 482,549 | ||||

| Total Current Liabilities | 605,907 | ||||

| Non-Current Liabilities | |||||

| Note Payable (due in 2023) | 1,000,000 | ||||

| Total Non-Current Liabilities | 1,000,000 | ||||

| Total Liabilities | |||||

| Common Stock | 1,400,000 | ||||

| Retained Earnings | 1,521,323 | 2,921,323 | |||

| Total Liabilities and Owner’s Equity | 4,527,230 | ||||

| Current Assets | |||||

| Cash | (48,332) | ||||

| Accounts Receivable | 2,332,028 | ||||

| Supplies | 13,685 | ||||

| Prepaid advertising | 14,874 | ||||

| Total Current Assets | 2,312,255 | ||||

| Property, Plant and Equipment | |||||

| Building | 2,190,000 | ||||

| Less: accumulated depreciation | |||||

| Equipment | 795,000 | ||||

| Less: accumulated depreciation | |||||

| Land | 304975 | ||||

| Total Property, Plant and Equipment | 2,214,975 | ||||

| Total Assets | 4,527,230 | ||||

Table (67)

6.

To record:closing journal entries.

Introduction: Closing entries are posted to close all the temporary accounts of the accounting books. Closing entries zeros the balances of income statement items, drawings, and dividends.

Explanation of Solution

Recording closing entry for expense accounts:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Income summary | 1,817,590 | |||

| Wages expense | 726,700 | |||

| Interest expense | 60,000 | |||

| Propert tax expense | 170,000 | |||

| Supplies expense | 38,115 | |||

| Depreciation-building expense | 70,000 | |||

| Depreciation-equipment expense | 145,000 | |||

| Advertising expense | 125,226 | |||

| Income tax expense | 482,549 | |||

| (to record closing of expense accounts) |

Table (68)

- Since income summary is a temporary income account, temporary income is decreased. Hence, income summary account is debited.

- Since wages expense is an expense, expense is decreased. Hence, wagesexpenseaccount is credited.

- Since interest expense is an expense, expense is decreased. Hence, interestexpense account is credited.

- Since property tax is an expense, expense is decreased. Hence, property tax account is credited.

- Since supplies expense is an expense, expense is decreased. Hence, suppliesexpenseaccount is credited.

- Since depreceiation expense is an expense, expense is decreased. Hence, depreceiation -building expenseaccount is credited.

- Since depreceiation expense is an expense, expense is decreased. Hence, depreceiation-equipmentexpenseaccount is credited.

- Since advertising expense is an expense, expense is decreased. Hence, advertisingexpenseaccount is credited.

- Since income tax is an expense, expense is decreased. Hence, income tax account is credited.

Recording closing entry for revenue accounts:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Sales revenue | 2,943,538 | |||

| Income summary | 2,943,538 | |||

| (to record closing of revenue account) |

Table (69)

- Since sales revenue is an income, income is decreased. Hence, sales revenue account is debited.

- Since income summary is a temporary income account, temporary income is increased. Hence, income summary account is credited.

Recording transfer of income summary account:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Income summary | 1,125,948 | |||

| Retained earnings | 1,125,948 | |||

| (to record closing entry) |

Table (70)

- Since income summary is a temporary income account, temporary income is decreased. Hence, income summary account is debited.

- Since retained earnings is areserve, reserve is increased. Hence, retained earnings account is credited.

Transfering drawings and dividends to retained earnings:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Retained earnings | 67,000 | |||

| Drawings | 42,000 | |||

| Dividend | 25,000 | |||

| (to record closing entry) |

Table (71)

- Since retained earnings is areserve, reserve is decreased. Hence, retained earnings account is debited.

- Since drawings is capital, capital is increased. Hence, drawingss account is credited.

- Since dividends is expense, expense is decreased. Hence, dividends account is credited.

7.

Whether the given transaction relating to personal expense should be recorded in the books or not.

Introduction:Personal expenses are incurred by the owners for their personal useby utilizing the cash held within the company.

Explanation of Solution

Personal expenses should also be recorded in the books of the company because these expenses are incurred by using the cash of company. In case, such expenses are not included in the books then , cash account would not show the correct balance.

Personal expenses are shown as drawings by the owners. It is reduced from the equity component of the balance sheet by reducing the retained earnings.

Want to see more full solutions like this?

Chapter 3 Solutions

Cornerstones of Financial Accounting

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College