Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 61E

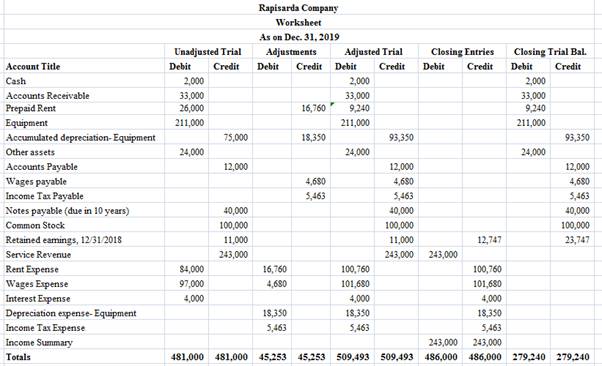

Exercise 3-61

Preparation of a Worksheet (Appendix 3A)

Unadjusted account balances at December 31, 2019, for Rapisarda Company are as follows:

The following data are not yet recorded:

Depreciation on the equipment is $18,350.- Unrecorded wages owed at December 31 , 2019: $4,680.

- Prepaid rent at December 3 1 , 2019: $9,240.

- Income taxes expense: $5,463.

Required:

Prepare a completed worksheet for Rapisarda Company.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Provide correct answer with accounting question

correct option ? general accounting

What is the direct labor A,B,C ?

Chapter 3 Solutions

Cornerstones of Financial Accounting

Ch. 3 - How does accural-basis net income differ from...Ch. 3 - Explain when revenue may be recognized and give an...Ch. 3 - What happens during the accounting cycle?Ch. 3 - Prob. 4DQCh. 3 - Why are adjusting entries needed?Ch. 3 - What accounting concepts require that adjusting...Ch. 3 - Prob. 7DQCh. 3 - Prob. 8DQCh. 3 - What is the difference between an accural and a...Ch. 3 - Prob. 10DQ

Ch. 3 - Prob. 11DQCh. 3 - Describe the effect on the financial statements...Ch. 3 - Prob. 13DQCh. 3 - Prob. 14DQCh. 3 - Prob. 15DQCh. 3 - Prob. 16DQCh. 3 - Prob. 17DQCh. 3 - Prob. 18DQCh. 3 - ( Appendix 3A) What is the relationship between...Ch. 3 - Prob. 20DQCh. 3 - Which of the following statements is true? Under...Ch. 3 - In December 2019, Swanstrom Inc. receives a cash...Ch. 3 - Which transaction would require adjustment at...Ch. 3 - Which of the following statements is false?...Ch. 3 - Dallas Company loaned to Ewing Company on December...Ch. 3 - Rons Diner received the following bills for...Ch. 3 - In September 2019, GolfWorld Magazine obtained...Ch. 3 - Hurd Inc. prepays rent every 3 months on March 1,...Ch. 3 - Which of the following statements is incorrect...Ch. 3 - Reinhardt Company reported revenues of $122,000...Ch. 3 - Prob. 11MCQCh. 3 - Cornerstone Exercise 3-12 Accrual- and Cash-Basis...Ch. 3 - Cornerstone Exercise 3-13 Accrual- and Cash-Basis...Ch. 3 - Prob. 14CECh. 3 - Prob. 15CECh. 3 - Cornerstone Exercise 3-16 Identification of...Ch. 3 - Cornerstone Exercise 3-17 Accrued Revenue...Ch. 3 - Cornerstone Exercise 3-18 Accrued Expense...Ch. 3 - Cornerstone Exercise 3-19 Deferred Revenue...Ch. 3 - Cornerstone Exercise 3-20 Deferred Expense...Ch. 3 - Cornerstone Exercise 3-21 Adjustment for Supplies...Ch. 3 - Cornerstone Exercise 3-22 Adjustment for...Ch. 3 - Prob. 23CECh. 3 - Cornerstone Exercise 3-24 Preparing an Income...Ch. 3 - Cornerstone Exercise 3-25 Preparing a Retained...Ch. 3 - Cornerstone Exercise 3-26 Preparing a Balance...Ch. 3 - Cornerstone Exercise 3-27 Preparing and Analyzing...Ch. 3 - Brief Exercise 3-28 Accrual- and Cash-Basis...Ch. 3 - Brief Exercise 3-29 Revenue and Expense...Ch. 3 - Brief Exercise 3-30 Identification of Adjusting...Ch. 3 - Brief Exercise 3-31 Adjusting Entries-Accruals...Ch. 3 - Brief Exercise 3-32 Adjusting Entries-Deferrals...Ch. 3 - Brief Exercise 3-33 Preparing an Income Statement...Ch. 3 - Brief Exercise 3-34 Preparing a Retained Earnings...Ch. 3 - Prob. 35BECh. 3 - Brief Exercise 3-36 Preparing and Analyzing...Ch. 3 - Prob. 37BECh. 3 - Exercise 3-38 Accrual- and Cash-Basis Expense...Ch. 3 - Exercise 3-39 Revenue Recognition Each of the...Ch. 3 - Exercise 3-40 Revenue and Expense Recognition...Ch. 3 - Exercise 3-41 Cash-Basis and Accrual-Basis...Ch. 3 - Exercise 3-42 Revenue and Expense Recognition...Ch. 3 - Exercise 3-43 Recognizing Expenses Treadway Dental...Ch. 3 - Exercise 3-44 Revenue Expense and Recognition...Ch. 3 - Exercise 3-45 Identification of Adjusting Entries...Ch. 3 - Exercise 3-46 Identification and Analysis of...Ch. 3 - Exercise 3-47 Revenue Adjustments Sentry Transport...Ch. 3 - Expense Adjustments Faraday Electronic Service...Ch. 3 - Prob. 49ECh. 3 - Exercise 3-50 Prepayment of Expenses JDM Inc. made...Ch. 3 - Exercise 3-51 Adjustment for Supplies The downtown...Ch. 3 - Adjusting Entries Exercise 3-52 Allentown Services...Ch. 3 - Prob. 53ECh. 3 - Exercise 3-54 Recreating Adjusting Entries...Ch. 3 - Exercise 3-55 Effect of Adjustments on the...Ch. 3 - Exercise 3-56 Preparing an Income Statement Oxmoor...Ch. 3 - Exercise 3-57 Preparing a Retained Earnings...Ch. 3 - Exercise 3-58 Preparing a Balance Sheet Refer to...Ch. 3 - Exercise 3-59 Preparation of Closing Entries Grand...Ch. 3 - Exercise 3-60 Preparation of Closing Entries James...Ch. 3 - Exercise 3-61 Preparation of a Worksheet (Appendix...Ch. 3 - Problem 3-62A Cash-Basis and Accrual-Basis Income...Ch. 3 - Problem 3-63A Revenue and Expense Recognition...Ch. 3 - Problem 3-64A Identification and Preparation of...Ch. 3 - Problem 3-65A Preparation of Adjusting Entries...Ch. 3 - Problem 3-66A Effects of Adjusting Entries on the...Ch. 3 - Problem 3-67A Adjusting Entries and Financial...Ch. 3 - Problem 3-68A Inferring Adjusting Entries from...Ch. 3 - Problem 3-69A Preparation of Closing Entries and...Ch. 3 - Problem 3-70B Comprehensive Problem: Reviewing the...Ch. 3 - Problem 3-71 A Preparing a Worksheet (Appendix 3A)...Ch. 3 - Prob. 62BPSBCh. 3 - Problem 3-63B Revenue and Expense Recognition Aunt...Ch. 3 - Problem 3-64B Identification and Preparation of...Ch. 3 - Problem 3-65B Preparation of Adjusting Entries...Ch. 3 - Problem 3-66A Effects of Adjusting Entries on the...Ch. 3 - Problem 3-67B Adjusting Entries and Financial...Ch. 3 - Problem 3-68B Inferring Adjusting Entries from...Ch. 3 - Problem 3-69B Preparation of Closing Entries and...Ch. 3 - Problem 3-70B Comprehensive Problem: Reviewing the...Ch. 3 - Problem 3-71B Preparing a Worksheet (Appendix 3A)...Ch. 3 - Case 3-72 Cash- or Accrual-Basis Accounting Karen...Ch. 3 - Case 3-73 Recognition of Service Contract Revenue...Ch. 3 - Case 3-73 Recognition of Service Contract Revenue...Ch. 3 - Case 3-73 Recognition of Service Contract Revenue...Ch. 3 - Case 3-74 Revenue Recognition Melaney Parks...Ch. 3 - Prob. 74.2CCh. 3 - Prob. 75CCh. 3 - Prob. 76CCh. 3 - Prob. 77.1CCh. 3 - Prob. 77.2CCh. 3 - Prob. 78.1CCh. 3 - Prob. 78.2CCh. 3 - Case 3-78 Interpreting Closing Entries Barnes...Ch. 3 - Case 3-79 Research and Analysis Using the Annual...Ch. 3 - Prob. 79.2CCh. 3 - Prob. 79.3CCh. 3 - Prob. 79.4CCh. 3 - Prob. 79.5CCh. 3 - Prob. 80.1CCh. 3 - Refer to the 10-K reports of Under Armour, Inc.,...Ch. 3 - Prob. 80.3CCh. 3 - Prob. 80.4CCh. 3 - Prob. 81.1CCh. 3 - Prob. 81.2CCh. 3 - Prob. 81.3CCh. 3 - Prob. 81.4CCh. 3 - Prob. 81.5CCh. 3 - Prob. 81.6CCh. 3 - Prob. 81.7C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2022. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired. Demers earns income and pays dividends as follows: 2022 2023 2024 Net income $ 100,000 $ 120,000 $ 130,000 Dividends 40,000 50,000 60,000 Assume the partial equity method is applied. Compute the noncontrolling interest in Demers at December 31, 2024. Multiple Choice $146,800 $160,800 $107,800 $80,000 $140,000arrow_forwardProvide General Accounting Questionarrow_forwardProvide answer pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY