Concept explainers

Problem 3-71 A Preparing a Worksheet (Appendix 3A)

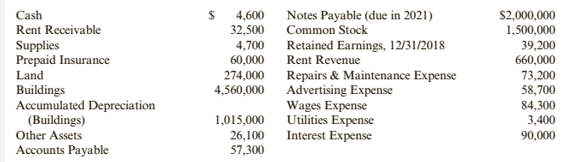

Marsteller Properties Inc. owns apartments that it rents to university students. At December 31,

2019, the following unadjusted account balances were available:

The following information is available for

- An analysis of apartment rental contracts indicates that S3,800 of apartment rent is unbilled and unrecorded at year end.

- A physical count Of supplies reveals that $1,400 of supplies are on hand at December 31 , 2019.

- Annual

depreciation on the buildings is $204,250. - An examination of insurance policies indicates that $12,000 Of the prepaid insurance applies to coverage for 2019.

- Six months' interest at 9% is unrecorded and unpaid on the notes payable.

1.

To prepare: Worksheet of the company A.

Introduction:.Worksheet is a statement that represents the unadjusted balances of ledgers, adjustment entries and the balances after such adjustments. Adjusted balances are the final balances that are presented in the financial statements of a company.

Explanation of Solution

Preparation of worksheet for the period ending 31st December, 2019:

| Account Title | UnadjustedTrial balance | Adjustments | AdjustedTrial balance | |||||

| Dr. | Cr. | Dr. | Cr. | Dr. | Cr. | |||

| Cash | 4,600 | 4,600 | ||||||

| Rent receivable | 32,500 | 3,800 | 36,300 | |||||

| Supplies | 4,700 | 3,300 | 1,400 | |||||

| Prepaid insurance | 60,000 | 12,000 | 48,000 | |||||

| Land | 274,000 | 274,000 | ||||||

| Building | 4,560,000 | 4,560,000 | ||||||

| Accumulated depriciation-building | 1,015,000 | 204,250 | 1,219,250 | |||||

| Other assets | 26,100 | 26,100 | ||||||

| Accounts payable | 57,300 | 57,300 | ||||||

| Interest payable | 90,000 | 90,000 | ||||||

| Notes payable | 2,000,000 | 2,000,000 | ||||||

| Common stock | 1,500,000 | 1,500,000 | ||||||

| Retained earnings opening | 39,200 | 39,200 | ||||||

| Rent revenue | 660,000 | 3,800 | 663,800 | |||||

| Repair and maintenance expense | 73,200 | 73,200 | ||||||

| Advertising expense | 58,700 | 58,700 | ||||||

| Wages expense | 84,300 | 84,300 | ||||||

| Utilities expense | 3,400 | 3,400 | ||||||

| Interest expense | 90,000 | 90,000 | 180,000 | |||||

| Supplies expense | 3,300 | 3,300 | ||||||

| Depreciation expense | 204,250 | 204,250 | ||||||

| Insurance expense | 12,000 | 12,000 | ||||||

| Total | 5,271,500 | 5,271,500 | 313,350 | 313,350 | 5,569,550 | 5,569,550 | ||

Table (1)

2.

To prepare: Income statement, statement of retained earnings and balance sheet.

Introduction: Income statement, statement of retained earnings and balance sheet are financial statements. These statements are prepared for reporting purposes.

Explanation of Solution

Preparation of income statement for the Year ending 31st December, 2019:

| CompanyA | |||||

| Income Statement,For the Year ending on 31stDecember, 2019 | |||||

| Amount ($) | Amount ($) | ||||

| Revenues: | |||||

| Rent revenue | 663,800 | ||||

| Total Revenue | 663,800 | ||||

| Expenses: | |||||

| Repair and maintenance expense | 73,200 | ||||

| Advertising expense | 58,700 | ||||

| Wages Expense | 84,300 | ||||

| Utilities Expense | 3,400 | ||||

| Insurance Expense | 12,000 | ||||

| Interest Expense | 180,000 | ||||

| Supplies expense | 3,300 | ||||

| Depreciation expense | 204,250 | ||||

| Total Expenses | 619,150 | ||||

| Net Income | 44,650 | ||||

Table (2)

Preparation of balance sheet as on 31st December, 2019:

| Company A | ||

| Balance Sheet as on 31stDecember 2019 | ||

| Amount ($) | Amount($) | |

| Liabilities and Owners Equity | ||

| Current Liabilities | ||

| Accounts Payable | 57,300 | |

| Interest Payable | 90,000 | |

| Total Current Liabilities | 147,300 | |

| Non-Current Liabilities | ||

| Note Payable | 2,000,000 | |

| Total Non-Current Liabilities | 2,000,000 | |

| Total Liabilities | ||

| Common Stock | 1,500,000 | |

| Retained Earnings | 83,850 | 1,583,850 |

| Total Liabilities and Owner’s Equity | 3,731,150 | |

| Current Assets | ||

| Cash | 4,600 | |

| Rent Receivable | 36,300 | |

| Supplies | 1,400 | |

| Prepaid insurance | 48,000 | |

| Other Assets | 26,100 | |

| Total Current Assets | 116,400 | |

| Property, Plant and Equipment | ||

| Land | 274,000 | |

| Building | 4,560,000 | |

| Less: accumulated depreciation | ||

| Total Property, Plant and Equipment | 3,614,750 | |

| Total Assets | 3,731,150 | |

Table (3)

Preparation of statement of retained earnings as on 31st December, 2019:

| Company A | ||

| Statement of Retained Earning | ||

| Amount($) | Amount($) | |

| Owner’s Equity opening balance | 39,200 | |

| Add: Capital introduced by owner | ||

| Add: Net income | 44,650 | |

| Total: | 83,850 | |

| Less: Withdrawals | ||

| Closing Balance | 83,850 | |

Table (4)

6.

To record: closing journal entries.

Introduction: Closing entries are posted to close all the temporary accounts of the accounting books. Closing entries zeros the balances of income statement items, drawings, and dividends.

Explanation of Solution

Recording closing entry for expense accounts:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Income summary | 619,150 | |||

| Repair and maintenance expense | 73,200 | |||

| Advertising expense | 58,700 | |||

| Wages expense | 84,300 | |||

| Utilities expense | 3,400 | |||

| Insurance expense | 12,000 | |||

| Interest expense | 180,000 | |||

| Supplies expense | 3,300 | |||

| Depreciation expense | 204,250 | |||

| (to record closing of expense accounts) |

Table (5)

- Since income summary is a temporary income account, temporary income is decreased. Hence, income summary account is debited.

- Since repair and maintenance expense is an expense, expense is decreased. Hence, repair and maintenance expense account is credited.

- Since advertising expense is an expense, expense is decreased. Hence, advertising expense account is credited.

- Since wages expense is an expense, expense is decreased. Hence, wages expense account is credited.

- Since utilities expense is an expense, expense is decreased. Hence, utilities expense account is credited.

- Since insurance expense is an expense, expense is decreased. Hence, insurance expense account is credited.

- Since interest expense is an expense, expense is decreased. Hence, interest expense account is credited.

- Since supplies expense is an expense, expense is decreased. Hence, supplies expense account is credited.

- Since depreceiation expense is an expense, expense is decreased. Hence, depreceiation -building expense account is credited.

Recording closing entry for revenue accounts:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Rent revenue | 663,800 | |||

| Income summary | 663,800 | |||

| (to record closing of revenue account) |

Table (6)

- Since rent revenue is an income, income is decreased. Hence, rent revenue account is debited.

- Since income summary is a temporary income account, temporary income is increased. Hence, income summary account is credited.

Recording transfer of income summary account:

| Date | Account Title and Explanation | Post Ref. | Debit($) | Credit($) |

| Income summary | 44,650 | |||

| Retained earnings | 44,650 | |||

| (to record closing entry) |

Table (7)

- Since income summary is a temporary income account, temporary income is decreased. Hence, income summary account is debited.

- Since retained earnings is a reserve, reserve is increased. Hence, retained earnings account is credited.

Want to see more full solutions like this?

Chapter 3 Solutions

Cornerstones of Financial Accounting

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub