Analyzing

Pix Paper Inc. produces photographic paper for printing digital images. One of the processes for this operation is a coating (solvent spreading) operation, where chemicals are coated onto paper stock. There has been some concern about the cost performance of this operation. As a result, you have begun an investigation. You first discover that all materials and conversion prices have been stable for the last six months. Thus, increases in prices for inputs are not an explanation for increasing costs. However, you have discovered three possible problems from some of the operating personnel whose quotes follow:

Operator 1: “I’ve been keeping an eye on my operating room instruments. I feel as though our energy consumption is becoming less efficient.”

Operator 2: “Everyone the coating machine goes down, we produce waste on shutdown and subsequent startup. It seems like during the last half-year we have had more unscheduled machine shutdowns than m the past. Thus, I feel as though our yields must be dropping.”

Operator 3: “My sense is that our coating costs are going up It seems to me like we are spreading a thicker coating than we should. Perhaps the coating machine needs to be recalibrated.”

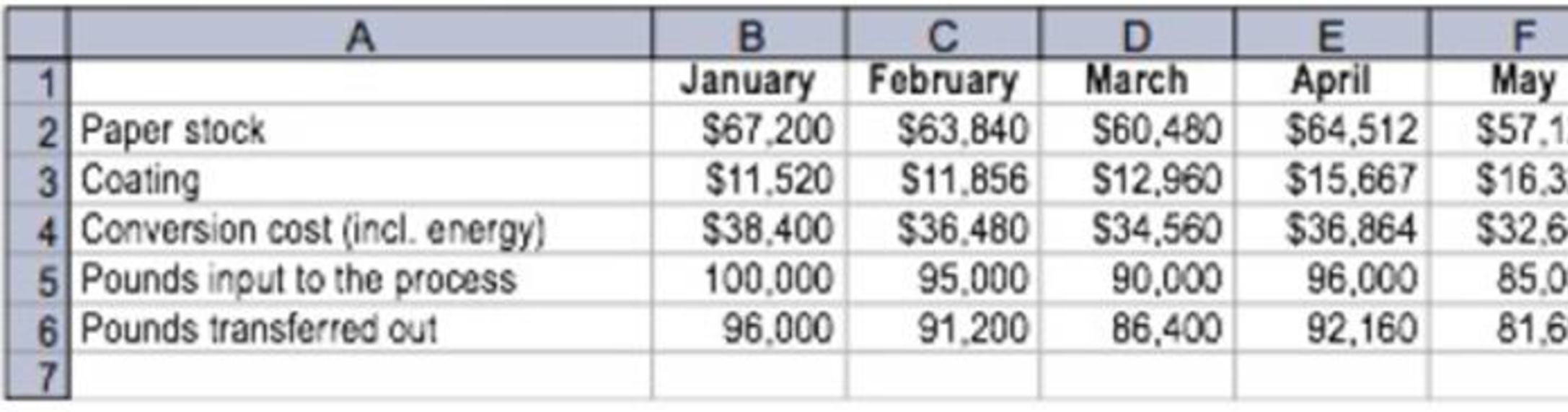

The Coating Department had no beginning or ending inventories for any month during the study period. The following data from die cost of production report are made available:

- A. Prepare a table showing the paper cost per output pound, coating cost per output pound, conversion cost per output pound, and yield (pounds transferred out/pounds input) for each month. Round costs to the nearest cent and yield to the nearest whole percent.

- B. Interpret your table results.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning