Determining cost relationships

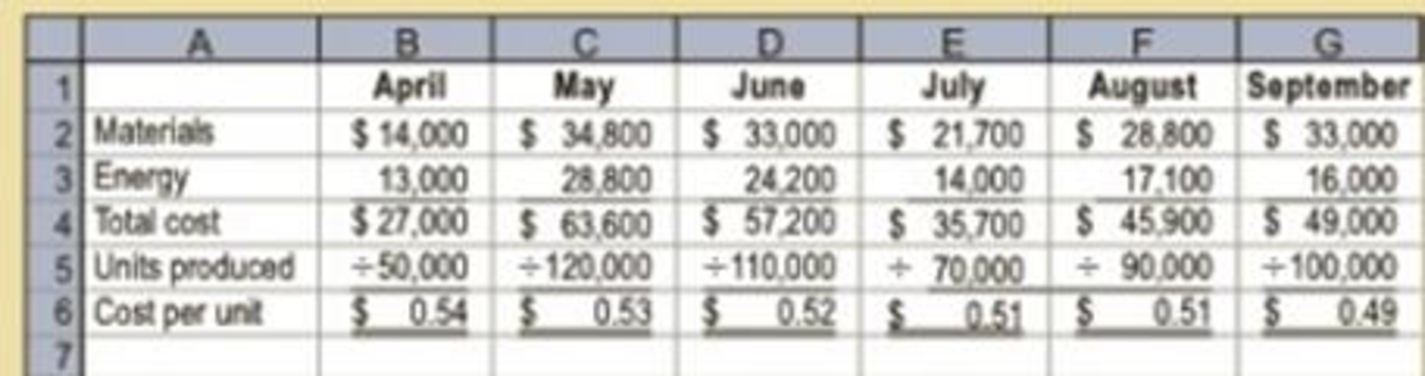

Midst ate Containers Inc. manufactures cans for the canned food industry. The operations manager of a can manufacturing operation wants to conduct a cost study investigating the relationship of tin content in the material (can stock) to the energy cost for enameling the cans. The enameling was necessary to prepare the cans for labeling. A higher percentage of tin content in the can stock increases the cost of material. The operations manager believed that a higher tin content in the can stock would reduce the amount of energy used in enameling. During the analysis period, the amount of tin content in the steel can stock was increased for every month, from April to September. The following operating reports were available from the controller:

Differences in materials unit costs were entirely related to the amount of tin content. In addition, inventory changes are negligible and are ignored in the analysis.

Interpret this information and report to the operations manager your recommendations with respect to tin content.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting

- Please provide the answer to this general accounting question using the right approach.arrow_forwardPlease provide the solution to this financial accounting question with accurate financial calculations.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardA business purchased a machine for $120,000 with an estimated useful life of 8 years and salvage value of $24,000. What is the annual straight-line depreciation amount?arrow_forwardI am searching for the most suitable approach to this financial accounting problem with valid standards.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College