Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 2PB

Cost of production report

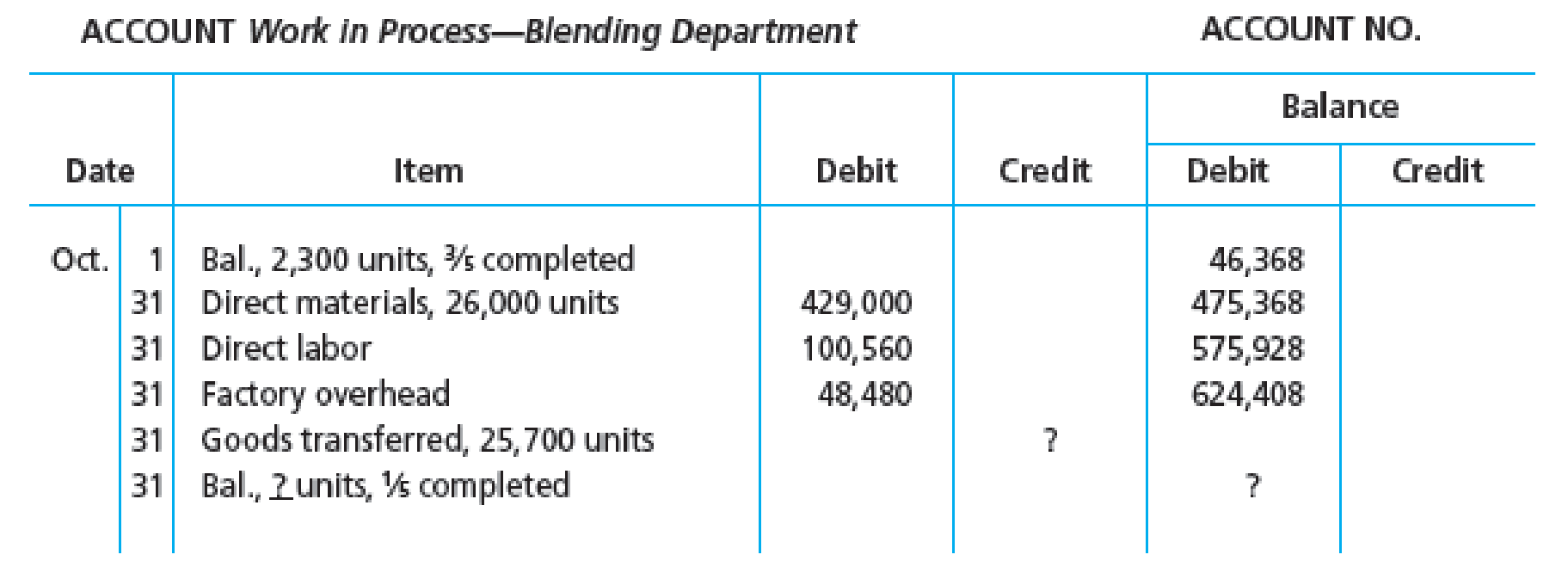

Bavarian Chocolate Company processes chocolate into candy bars. The process begins by placing direct materials (raw chocolate, milk, and sugar) into the Blending Department. All materials are placed into production at the beginning of the blending process. After blending, the milk chocolate is then transferred to the Molding Department, where the milk chocolate is formed into candy bars. The following is a partial work in process account of the Blending Department at October 31:

Instructions

- 1. Prepare a cost of production report, and identify the missing amounts for Work in Process—Blending Department.

- 2. Assuming that the October 1 work in process inventory includes direct materials of $38,295, determine the increase or decrease in the cost per equivalent unit for direct materials and conversion between September and October.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

How can I solve this financial accounting problem using the appropriate financial process?

None

Provide Answer

Chapter 3 Solutions

Managerial Accounting

Ch. 3 - Which type of cost system, process or job order,...Ch. 3 - In job order cost accounting, the three elements...Ch. 3 - In a job order cost system, direct labor and...Ch. 3 - Why is the cost per equivalent unit often...Ch. 3 - What is the purpose for determining the cost per...Ch. 3 - Rameriz Company is a process manufacturer with two...Ch. 3 - What is the most important purpose of the cost of...Ch. 3 - How are cost of production reports used for...Ch. 3 - Job order versus process costing Which of the...Ch. 3 - Kraus Steel Company has two departments, Casting...

Ch. 3 - The Rolling Department of Kraus Steel Company had...Ch. 3 - The Rolling Department of Kraus Steel Company had...Ch. 3 - The cost of direct materials transferred into the...Ch. 3 - The costs per equivalent unit of direct materials...Ch. 3 - In October, the cost of materials transferred into...Ch. 3 - Prob. 8BECh. 3 - Entries for materials cost flows in a process cost...Ch. 3 - Flowchart of accounts related to service and...Ch. 3 - Radford Inc. manufactures a sugar product by a...Ch. 3 - The cost accountant for River Rock Beverage Co....Ch. 3 - The Converting Department of Worley Company had...Ch. 3 - Data for the two departments of Kimble Pierce...Ch. 3 - The following information concerns production in...Ch. 3 - a. Based upon the data in Exercise 17-7, determine...Ch. 3 - Equivalent units of production Kellogg Company...Ch. 3 - Costs per equivalent unit Georgia Products Inc....Ch. 3 - The charges to Work in ProcessAssembly Department...Ch. 3 - a. Based on the data in Exercise 17-11, determine...Ch. 3 - Errors in equivalent unit computation Napco...Ch. 3 - Cost per equivalent unit The following information...Ch. 3 - Costs per equivalent unit and production costs...Ch. 3 - Cost of production report The debits to Work in...Ch. 3 - Cost of Production report The Cutting Department...Ch. 3 - Prob. 18ECh. 3 - Prob. 19ECh. 3 - Prob. 20ECh. 3 - The Converting Department of Tender Soft Tissue...Ch. 3 - Units of production data for the two departments...Ch. 3 - The following information concerns production in...Ch. 3 - Prob. 24ECh. 3 - The following information concerns production in...Ch. 3 - Prob. 26ECh. 3 - Prepare a cost of production report for the...Ch. 3 - Entries for process cost system Port Ormond Carpet...Ch. 3 - Cost of production report Hana Coffee Company...Ch. 3 - Equivalent units and related costs; cost of...Ch. 3 - Work in process account data for two months; cost...Ch. 3 - Sunrise Coffee Company roasts and packs coffee...Ch. 3 - Entries for process cost system Preston Grover...Ch. 3 - Cost of production report Bavarian Chocolate...Ch. 3 - Equivalent units and related costs; cost of...Ch. 3 - Work in process account data for two months; cost...Ch. 3 - Blue Ribbon Flour Company manufactures flour by a...Ch. 3 - Dura-Conduit Corporation manufactures plastic...Ch. 3 - Analyzing process cost elements across product...Ch. 3 - Analyzing process cost elements over time Pix...Ch. 3 - Determining cost relationships Midst ate...Ch. 3 - Ethics in Action You are the Cookie division...Ch. 3 - Communications Jamarcus Bradshaw, plant manager of...Ch. 3 - Accounting for materials costs In papermaking...Ch. 3 - During December, Krause Chemical Company had the...Ch. 3 - Jones Corporation uses a first-in, first-out...Ch. 3 - Kimbeth Manufacturing uses a process cost system...Ch. 3 - A company is using process costing with the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardCan you demonstrate the accurate method for solving this General accounting question?arrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY