Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 35P

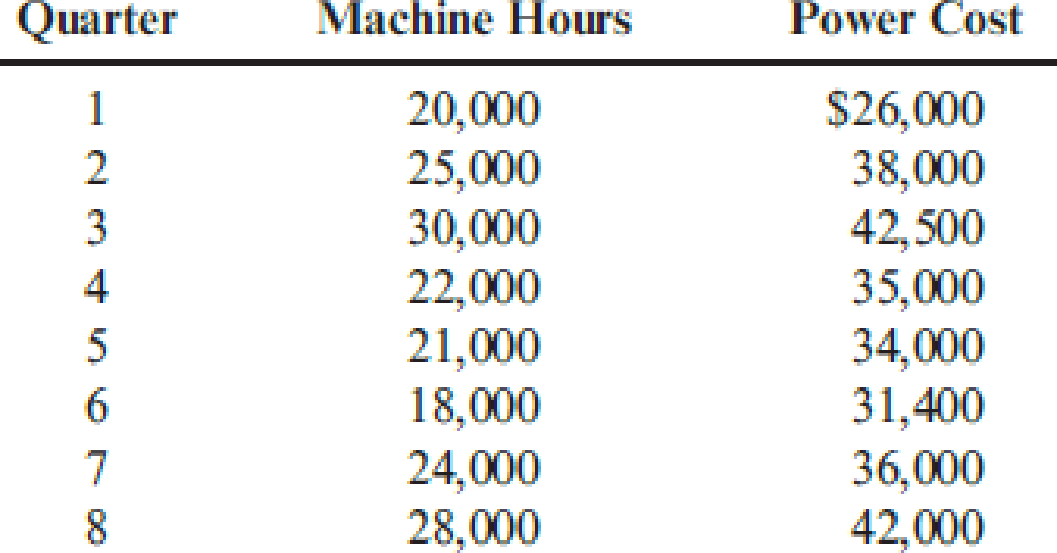

The management of Wheeler Company has decided to develop cost formulas for its major

Required:

- 1. Prepare a scattergraph by plotting power costs against machine hours. Does the scatter-graph show a linear relationship between machine hours and power cost?

- 2. Using the high and low points, compute a power cost formula.

- 3. Use the method of least squares to compute a power cost formula. Evaluate the coefficient of determination.

- 4. Rerun the regression and drop the point (20,000; $26,000) as an outlier. Compare the results from this regression to those for the regression in Requirement 3. Which is better?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

aurora's 2023 operating leverage?

I don't need ai answer accounting questions

Financial Accounting

Chapter 3 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 3 - Why is knowledge of cost behavior important for...Ch. 3 - How does the length of the time horizon affect the...Ch. 3 - Prob. 3DQCh. 3 - What is the relationship between flexible...Ch. 3 - What is the relationship between committed...Ch. 3 - Describe the difference between a variable cost...Ch. 3 - Why do mixed costs pose a problem when it comes to...Ch. 3 - Why is a scattergraph a good first step in...Ch. 3 - What are the advantages of the scatterplot method...Ch. 3 - Prob. 10DQ

Ch. 3 - What is meant by the best-fitting line? Is the...Ch. 3 - When is multiple regression required to explain...Ch. 3 - Explain the meaning of the learning curve. How do...Ch. 3 - Assume you are the manager responsible for...Ch. 3 - Some firms assign mixed costs to either the fixed...Ch. 3 - Callies Gym is a complete fitness center. Owner...Ch. 3 - Corazon Manufacturing Company has a purchasing...Ch. 3 - Darnell Poston, owner of Poston Manufacturing,...Ch. 3 - Dohini Manufacturing Company had the following 12...Ch. 3 - Refer to Cornerstone Exercise 3.4 for data on...Ch. 3 - The controller for Dohini Manufacturing Company...Ch. 3 - Prob. 7CECh. 3 - State Universitys football team just received a...Ch. 3 - Classify the following costs of activity inputs as...Ch. 3 - SmokeCity, Inc., manufactures barbeque smokers....Ch. 3 - Cashion Company produces chemical mixtures for...Ch. 3 - For the following activities and their associated...Ch. 3 - Prob. 13ECh. 3 - Vargas, Inc., produces industrial machinery....Ch. 3 - Penny Davis runs the Shear Beauty Salon near a...Ch. 3 - Shirrell Blackthorn is the accountant for several...Ch. 3 - Deepa Dalal opened a free-standing radiology...Ch. 3 - Prob. 18ECh. 3 - The controller of the South Charleston plant of...Ch. 3 - Lassiter Company used the method of least squares...Ch. 3 - Sweet Dreams Bakery was started five years ago by...Ch. 3 - Ginnian and Fitch, a regional accounting firm,...Ch. 3 - Bordner Company manufactures HVAC (heating,...Ch. 3 - Sharon Glessing, controller for Janson Company,...Ch. 3 - The graphs below represent cost behavior patterns...Ch. 3 - Starling Co. manufactures one product with a...Ch. 3 - Alard Manufacturing Company has a billing...Ch. 3 - Prob. 28ECh. 3 - Prob. 29ECh. 3 - Natur-Gro, Inc., manufactures composters. Based on...Ch. 3 - Rolertyme Company manufactures roller skates. With...Ch. 3 - St. Teresas Medical Center (STMC) offers a number...Ch. 3 - Big Mikes, a large hardware store, has gathered...Ch. 3 - Kimball Company has developed the following cost...Ch. 3 - The management of Wheeler Company has decided to...Ch. 3 - DeMarco Company is developing a cost formula for...Ch. 3 - Weber Valley Regional Hospital has collected data...Ch. 3 - Friendly Bank is attempting to determine the cost...Ch. 3 - Randy Harris, controller, has been given the...Ch. 3 - The Lockit Company manufactures door knobs for...Ch. 3 - Harriman Industries manufactures engines for the...Ch. 3 - Thames Assurance Company sells a variety of life...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY