Concept explainers

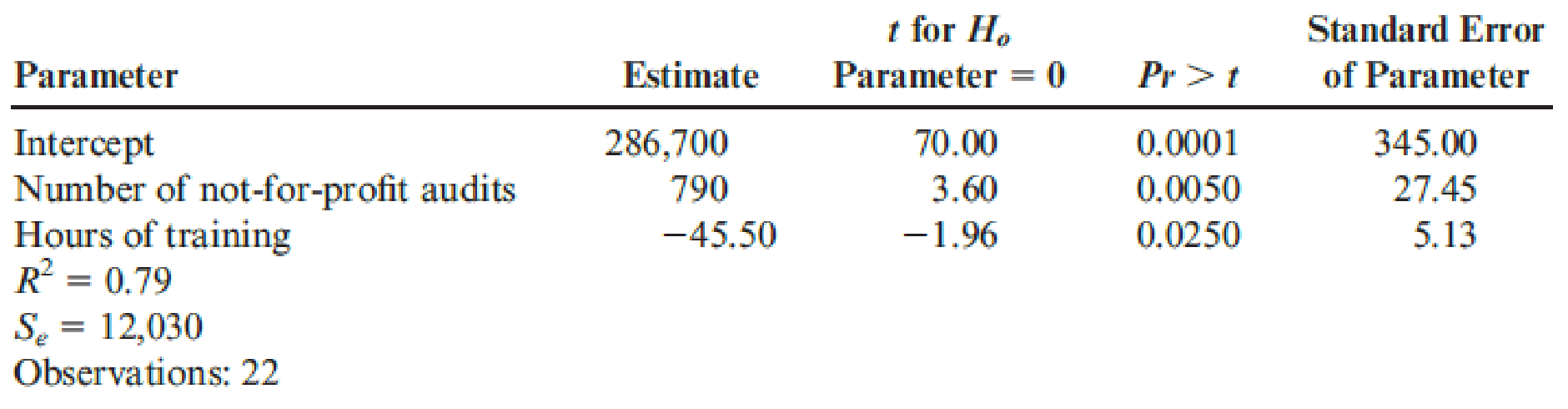

Ginnian and Fitch, a regional accounting firm, performs yearly audits on a number of different for-profit and not-for-profit entities. Two years ago, Luisa Mellina, Ginnian’s partner in charge of operations, became concerned about the amount of audit time required by not-for-profit entities. As a result, she instituted a series of training programs focusing on the auditing of not-forprofit entities. Now, she would like to see if the training seemed to work. So, she ran a multiple regression on 22 months of data for Ginnian for three variables: the total monthly cost of audit professional time, the number of not-for-profit audits, and the hours of training in the audit of not-for-profit entities. The following printout was obtained:

Required:

- 1. Write out the cost equation for Ginnian’s audit professional time.

- 2. If Ginnian expects to have 9 audits of not-for-profits next month and expects that audit professionals will have a total of 130 hours of not-for-profit training, what is the anticipated cost of professional time?

- 3. Are the hours spent auditing not-for-profit entities positively or negatively correlated with audit professional costs? Is percentage of experienced team members positively or negatively correlated with audit professional cost?

- 4. What does R2 mean in this equation? Overall, what is your evaluation of the cost equation that was developed for the cost of audit professionals?

Trending nowThis is a popular solution!

Chapter 3 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- I want the correct answer with accountingarrow_forwardI want the correct answer with accounting questionarrow_forwardOriole Company sells product 2005WSC for $55 per unit and uses the LIFO method. The cost of one unit of 2005WSC is $52, and the replacement cost is $51. The estimated cost to dispose of a unit is $6, and the normal profit is 40% of selling price. At what amount per unit should product 2005WSC be reported, applying lower-of-cost-or-market?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,