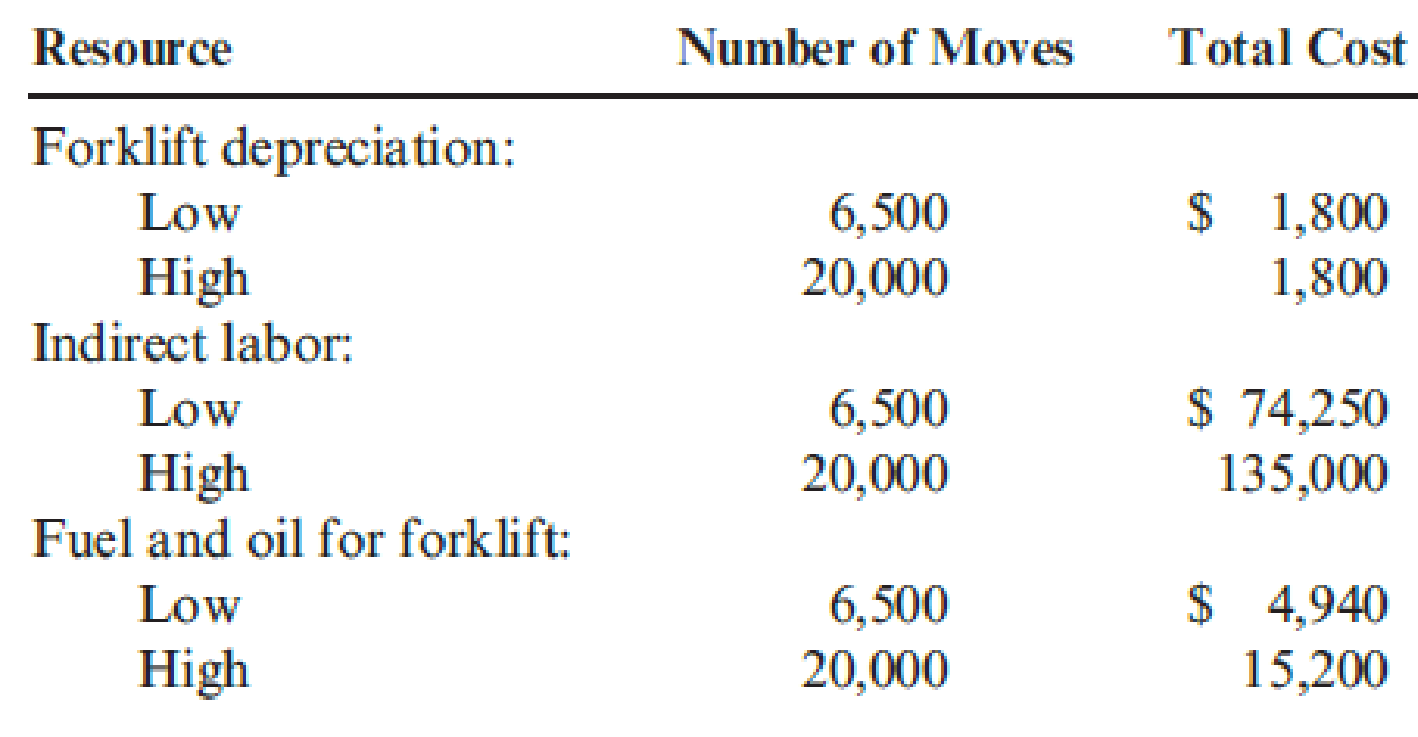

The controller of the South Charleston plant of Ravinia, Inc., monitored activities associated with materials handling costs. The high and low levels of resource usage occurred in September and March for three different resources associated with materials handling. The number of moves is the driver. The total costs of the three resources and the activity output, as measured by moves for the two different levels, are presented as follows:

Required:

- 1. Determine the cost behavior formula of each resource. Use the high-low method to assess the fixed and variable components.

- 2. Using your knowledge of cost behavior, predict the cost of each item for an activity output level of 9,000 moves.

- 3. Construct a cost formula that can be used to predict the total cost of the three resources combined. Using this formula, predict the total materials handling cost if activity output is 9,000 moves. In general, when can cost formulas be combined to form a single cost formula?

1.

Calculate the cost behavior formula of each resource use the high to low method to assess the fixed cost and variable components.

Explanation of Solution

High-low method: In the high-low method, the semi variable-cost approximation is calculated by using the exact data points. The high and low activity levels are selected from the data set that is available.

Calculate the cost behavior formula of each resource use the high to low method to assess the variable components.

Calculate variable cost per unit for fuel and oil forklift:

Therefore, variable cost per unit for forklift depreciation is $0 per unit.

Calculate fixed cost:

Note: Number of moves and total cost taken from high cost and high units.

Therefore, total fixed cost is $1,800.

Therefore, variable cost per unit for indirect labor is $4.50 per unit.

Calculate variable cost per unit for fuel and oil forklift:

Note: Number of moves and total cost taken from high cost and high units.

Therefore, total fixed cost is $45,000.

Calculate variable cost per unit for fuel and oil forklift:

Therefore, variable cost per unit for fuel and oil forklift is $0.76 per unit.

Calculate fixed cost.

Note: Number of moves and total cost taken from high cost and high units.

Therefore, total fixed cost is $0.

2.

Predict the cost of each item for an activity output level of 9,000 moves using the knowledge of cost behavior.

Explanation of Solution

Predict the cost of each item for an activity output level of 9,000 moves using the knowledge of cost behavior.

Calculate total cost for forklift depreciation.

Therefore, total cost for forklift depreciation is $1,800.

Calculate total cost for indirect labor.

Therefore, total cost for direct labor is $85,500.

Calculate total cost for fuel and oil for forklift.

Therefore, total cost for fuel and oil for forklift is $6,840.

3.

Construct the cost formula to predict the total cost of the three resources combined, using the formula predict the total material handling cost, if the activity output is 9,000 moves.

Explanation of Solution

Cost equation for material handling cost.

Calculate total cost for material handling if activity output is 9,000 moves.

Therefore, total cost for material handling is $94,140.

Want to see more full solutions like this?

Chapter 3 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Compute the depreciation chargearrow_forwardFor its inspecting cost pool, Brilliant Professor Mullen Company expected an overhead cost of $360,000 and an estimated 14,200 inspections. The actual overhead cost for that cost pool was $395,000 for 16,000 actual inspections. The activity-based overhead rate (ABOR) used to assign the costs of the inspecting cost pool to products is __.arrow_forwardCan you help me with accounting questionsarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning