Concept explainers

Rolertyme Company manufactures roller skates. With the exception of the rollers, all parts of the skates are produced internally. Neeta Booth, president of Rolertyme, has decided to make the rollers instead of buying them from external suppliers. The company needs 100,000 sets per year (currently it pays $1.90 per set of rollers).

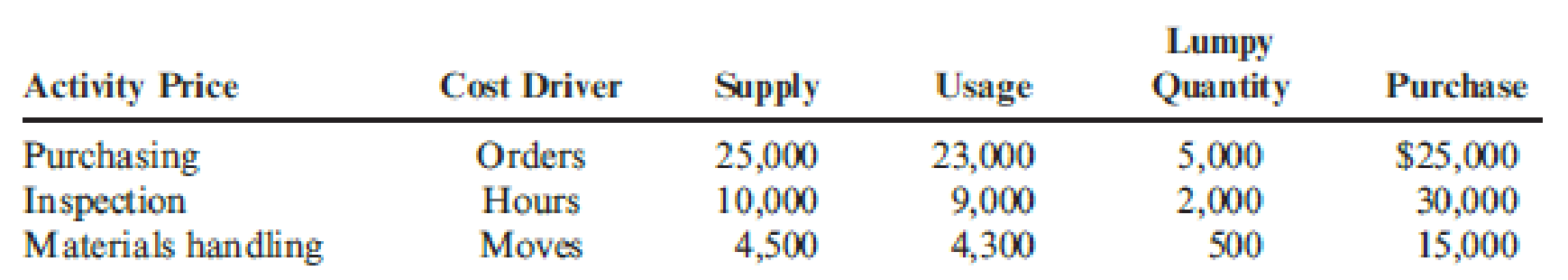

The rollers can be produced using an available area within the plant. However, equipment for production of the rollers would need to be leased ($30,000 per year lease payment). Additionally, it would cost $0.50 per machine hour for power, oil, and other operating expenses. The equipment will provide 60,000 machine hours per year. Direct material costs will average $0.75 per set, and direct labor will average $0.25 per set. Since only one type of roller would be produced, no additional demands would be made on the setup activity. Other

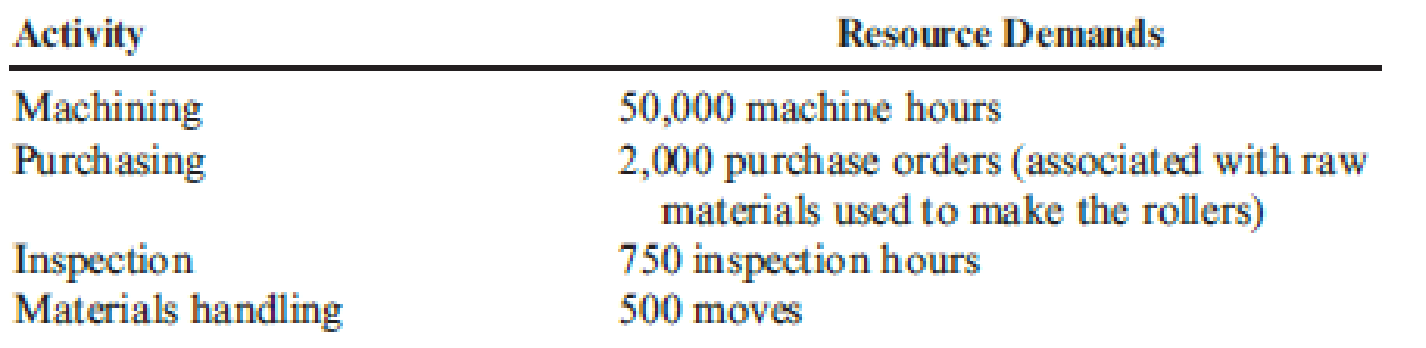

Production of rollers would place the following demands on the overhead activities:

Producing the rollers also means that the purchase of outside rollers will cease. Thus, purchase orders associated with the outside acquisition of rollers will drop by 5,000. Similarly, the moves for the handling of incoming orders will decrease by 200. The company has not inspected the rollers purchased from outside suppliers.

Required:

- 1. Classify all resources associated with the production of rollers as flexible resources and committed resources. Label each committed resource as a short- or long-term commitment. How should we describe the cost behavior of these short- and long-term resource commitments? Explain.

- 2. Calculate the total annual resource spending (for all activities except for setups) that the company will incur after production of the rollers begins. Break this cost into fixed and variable activity costs. In calculating these figures, assume that the company will spend no more than necessary. What is the effect on resource spending caused by production of the rollers?

- 3. Refer to Requirement 2. For each activity, break down the cost of activity supplied into the cost of activity output and the cost of unused activity.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- account questionsarrow_forwardcompared to the individual risks of constituting assets. Question 5 (6 marks) The common shares of Almond Beach Inc, have a beta of 0.75, offer a return of 9%, and have an historical standard deviation of return of 17%. Alternatively, the common shares of Palm Beach Inc. have a beta of 1.25, offer a return of 10%, and have an historical standard deviation of return of 13%. Both firms have a marginal tax rate of 37%. The risk-free rate of return is 3% and the expected rate of return on the market portfolio is 9½%. 1. Which company would a well-diversified investor prefer to invest in? Explain why and show all calculations. 2. Which company Would an investor who can invest in the shares of only one firm prefer to invest in? Explain why. RELEASED BY THE CI, MGMT2023, MARCH 2, 2025 5 Use the following template to organize and present your results: Theoretical CAPM Actual offered prediction for expected return (%) return (%) Standard deviation of return (%) Beta Almond Beach Inc. Palm Beach…arrow_forwardprovide correct answerarrow_forward

- Please solve. The screen print is kind of split. Please look carefully.arrow_forwardCoronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardCoronado Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000+ 10,200)]. Estimated annual manufacturing overhead is $1,566,090. Thus, the predetermined overhead rate is $16.26 or ($1,566,090 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forward

- The completed Payroll Register for the February and March biweekly pay periods is provided, assuming benefits went into effect as anticipated. Required: Using the payroll registers, complete the General Journal entries as follows: February 10 Journalize the employee pay. February 10 Journalize the employer payroll tax for the February 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base. February 14 Issue the employee pay. February 24 Journalize the employee pay. February 24 Journalize the employer payroll tax for the February 24 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employee will exceed the FUTA or SUTA wage base. February 28 Issue the employee pay. February 28 Issue payment for the payroll liabilities. March 10 Journalize the employee pay. March 10 Journalize the employer payroll tax for the March 10 pay period. Use 5.4 percent SUTA and 0.6 percent FUTA. No employees will exceed the FUTA or SUTA wage base.…arrow_forwardPlease given step by step explanation general accounting questionarrow_forwardDon't use ai solution please given answer general accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning