COST ACCOUNTING

16th Edition

ISBN: 9781323694008

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.32E

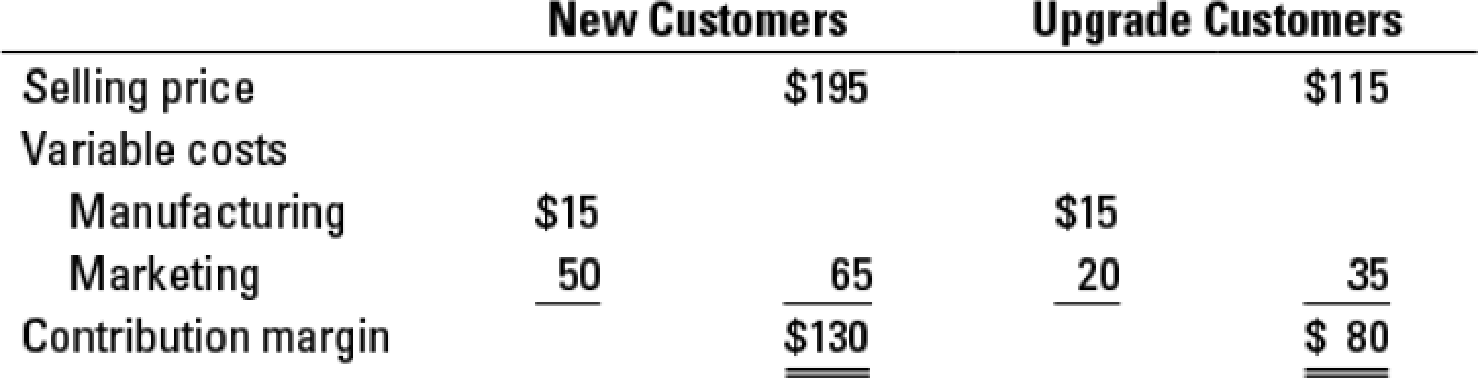

Sales mix, new and upgrade customers. Chartz 1-2-3 is a top-selling electronic spreadsheet product. Chartz is about to release version 5.0. It divides its customers into two groups: new customers and upgrade customers (those who previously purchased Chartz 1-2-3 4.0 or earlier versions). Although the same physical product is provided to each customer group, sizable differences exist in selling prices and variable marketing costs:

The fixed costs of Chartz 1-2-3 5.0 are $16,500,000. The planned sales mix in units is 60% new customers and 40% upgrade customers.

- 1. What is the Chartz 1-2-3 5.0 breakeven point in units, assuming that the planned 60%/40% sales mix is attained?

Required

- 2. If the sales mix is attained, what is the operating income when 170,000 total units are sold?

- 3. Show how the breakeven point in units changes with the following customer mixes:

- a. New 40% and upgrade 60%

- b. New 80% and upgrade 20%

- c. Comment on the results.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

5 Revenue mix, new and upgrade customers. Zapo 1-2-3 is a top-selling spreadsheet product. Zapo is about to release Version 5.0. It groups its customers into two

groups new customers and upgrade customers (those who previously purchased Zapo 1-2-3 Version 4.0 or earlier). Although the same physical product is

provided to each customer group, sizable differences exist in their selling prices and variable marketing costs:

Selling price

Variable cost:

Manufacturing

Marketing

New

Customers

$25

65

$210

90

a. New 50%/upgrade 50%.

b. New 90% / upgrade 10%

Upgrade

Customers

$120

$25

15

40

The fixed costs of Zapo 5.0 are $14,000,000.

The planned revenue mix in units is 60% new customers and 40% upgrade customers.

REQUIRED

1. What is the Zapo 1-2-3 Version 5.0 breakeven point in units, assuming that the planned 60/40 mix is maintained?

2. If the mix is maintained, what is the operating income when 200,000 units are sold?

3. Show how the breakeven point in units changes with the following…

(Q.7) Data 1-2-3 is a top-selling electronic spreadsheet product Data is about to release version 5.0. 11

divides its customers into two groups: new customers and upgrade customers (those who previously

purchased Data 1-2-3, 4.0 or earlier versions). Although the same physical product is provided to each

customer group, sizable differences exist in selling prices and variable marketing costs:

New Customers

$275

Selling price

Variable costs

Manufacturing

Marketing

Contribution margin

$35

65

100

$175

Upgrade Customers

$100

$35

15

50

$ 50

The fixed costs of Data 1-2-3, 5.0 are $15,000,000. The planned sales mix in units is 60% new

customers and 40% upgrade customers.

Questions:

1. Calculate the Data 1-2-3, 5.0 breakeven point in units (number of bundles, new customers, upgrade

customers) assuming that the planned 60% 40% sales mix is attained?

2. If the sales mix is altained, what is the operating income when 220,000 total units are sold?

9

Onawa Ltd manufactures a top-selling electronic spreadsheet product called Cell 123. Onawa is aboutto release version 8. It divides its customers into 2 groups: new customers and upgrade customers(those who previously purchased Cell 123, version 7 or earlier versions). Although the same physicalproduct is provided to each customer group, sizeable differences exist in selling prices and variablemarketing costs

New customers

Upgrade customers

N$

N$

Selling price

210

120

Variable costs:

Manufacturing

(25)

(25)

Marketing

(65)

(15)

The fixed costs of Cell 8 are N514 000 000. The planned ratio of new customers to upgrade customers isexpected to be 6:4 respectively

requirement:a) Calculate Onawa Ltd individual break-even point both in units and sales revenue, assuming thatthe customers will come as planned.b) Ifthe planned sales mix is attained, calculate the operating income when 200 000 units are sold.c) The CVP analysis as any management tool has some limitations.…

Chapter 3 Solutions

COST ACCOUNTING

Ch. 3 - Define costvolumeprofit analysis.Ch. 3 - Describe the assumptions underlying CVP analysis.Ch. 3 - Distinguish between operating income and net...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Why is it more accurate to describe the subject...Ch. 3 - CVP analysis is both simple and simplistic. If you...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Give an example of how a manager can decrease...

Ch. 3 - Give an example of how a manager can increase...Ch. 3 - What is operating leverage? How is knowing the...Ch. 3 - There is no such thing as a fixed cost. All costs...Ch. 3 - Prob. 3.14QCh. 3 - In CVP analysis, gross margin is a less-useful...Ch. 3 - Jacks Jax has total fixed costs of 25,000. If the...Ch. 3 - During the current year, XYZ Company increased its...Ch. 3 - Under the contribution income statement, a...Ch. 3 - A company needs to sell 10,000 units of its only...Ch. 3 - Once a company exceeds its breakeven level,...Ch. 3 - Prob. 3.21ECh. 3 - CVP computations. Garrett Manufacturing sold...Ch. 3 - CVP analysis, changing revenues and costs. Sunset...Ch. 3 - CVP exercises. The Deli-Sub Shop owns and operates...Ch. 3 - CVP exercises. The Doral Company manufactures and...Ch. 3 - CVP analysis, income taxes. Westover Motors is a...Ch. 3 - CVP analysis, income taxes. The Home Style Eats...Ch. 3 - CVP analysis, sensitivity analysis. Perfect Fit...Ch. 3 - CVP analysis, margin of safety. Suppose Morrison...Ch. 3 - Operating leverage. Cover Rugs is holding a 2-week...Ch. 3 - CVP analysis, international cost structure...Ch. 3 - Sales mix, new and upgrade customers. Chartz 1-2-3...Ch. 3 - Prob. 3.33ECh. 3 - Prob. 3.34ECh. 3 - Contribution margin, decision making. Welch Mens...Ch. 3 - Contribution margin, gross margin, and margin of...Ch. 3 - Uncertainty and expected costs. Kindmart is an...Ch. 3 - CVP analysis, service firm. Lifetime Escapes...Ch. 3 - CVP, target operating income, service firm....Ch. 3 - CVP analysis, margin of safety. Marketing Docs...Ch. 3 - CVP analysis, income taxes. (CMA, adapted) J.T....Ch. 3 - CVP, sensitivity analysis. The Derby Shoe Company...Ch. 3 - CVP analysis, shoe stores. The HighStep Shoe...Ch. 3 - CVP analysis, shoe stores (continuation of 3-43)....Ch. 3 - Prob. 3.45PCh. 3 - Prob. 3.46PCh. 3 - CVP analysis, income taxes, sensitivity. (CMA,...Ch. 3 - Choosing between compensation plans, operating...Ch. 3 - Prob. 3.49PCh. 3 - Multiproduct CVP and decision making. Crystal...Ch. 3 - Sales mix, two products. The Stackpole Company...Ch. 3 - Prob. 3.52PCh. 3 - Ethics, CVP analysis. Megaphone Corporation...Ch. 3 - Deciding where to produce. (CMA, adapted) Portal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Data 1-2-3 is a top-selling electronic spreadsheet product. Data is about to release version 5.0. It divides its customers into two groups: new custo physical product is provided to each customer group, sizable differences exist in selling prices and variable marketing costs: (Click the icon to view the price and cost information.) The fixed costs of Data 1-2-3 5.0 are $10,500,000. The planned sales mix in units is 60% new customers and 40% upgrade customers. Read the requirements bugh the same 1. What is the Data 1-2-3 5.0 breakeven point in units, assuming that the planned 60% / 40% sales mix is attained? 2. If the sales mix is attained, what is the operating income when 230.000 total units are sold? 3. Show how the breakeven point in units changes with the following customer mixes: Requirement 1. What is the Data 1-2-3 5.0 breakeven point in units, assuming that the planned 60% / 40% sales mix is attained? Begin by determining the sales mix. For every bundle. 3 units are sold to new…arrow_forwardPlease do not give solution in image format thankuarrow_forwardsdarrow_forward

- Please do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forwardWhich of the following are reasonable ways to deal with excess supply? (select ALL correct answers) reduce prices increase advertising use all available capacity to make the product with the highest CM per unit of capacity find special orders at a discounted price "fire" small customersarrow_forward

- Subject :- Accountingarrow_forwardA company is providing its product to the consumer through the wholesalers. The managing director of the company thinks that if the company starts selling through retailers or to the consumers directly, it can increase its sales, charge higher prices and make more profit. On the basis of the following information and consider variable cost is rial 2.50 per unit and fixed cost is rial 50000. (a) Advise the managing director whether the company should change its channel of distribution or not (with calculation and Justification). (b) Provide suggestions and recommendations on the basis of analysis.arrow_forwardSuppose that Stillwater Designs has two classes of distributors: JIT distributors and non-JIT distributors. The JIT distributor places small, frequent orders, and the non-JIT distributor tends to place larger, less frequent orders. Both types of distributors are buying the same product. Stillwater Designs provides the following information about customer-related activities and costs for the most recent quarter: Sales orders Sales calls Service calls Average order size Manufacturing cost/unit Customer costs: Processing sales orders Selling goods Servicing goods Sales (in units) Sales Allocation Ordering costs Selling costs Service costs Total 9.23 per unit JIT $ JIT Distributors $3,180,000 1,120,000 1,050,000 $5,350,000 Total 1. Calculate the total revenues per distributor category, and assign the customer costs to each distributor type by using revenues as the allocation base. Selling price for one unit is $150. Round calculations to the nearest dollar. 650,000 97,500,000 2,675,000…arrow_forward

- Unit cost per order of a given size 2. An analysis of selling costs shows: (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) nces ? Management may want to consider offering discounts for large orders. ? Small orders are preferable to medium sized orders. 2 Large orders are preferable to medium sized orders. ? Marketing should be focused on small sized orders. raw lill insert Oelete F9 F10 F11 F12 F6arrow_forwardThat is, it is unacceptable to manually compute the solutions and simply insert the answers into the cells of an excel spreadsheet.) Raiders Ltd CVP Problem Prepare an Excel worksheet that illustrates cost-volume-profit (CVP) analysis, also referred to as breakeven analysis. Assume that a particular product sold at Raiders Ltd a US based toy company has a sales price per unit of $4.00; variable cost per unit of $2.20; and total fixed cost of $100,000. Task 1) Calculate the contribution margin per unit, the break-even point in units of sales, and the break-even point in dollars of sales. In the inputarea, show sales price per unit, variable cost per unit, and total fixed cost. In the output area, show contribution margin per unit, breakeven point in units, and breakeven point in dollars computed using appropriate formulas. Task 2) Assume that the planning team at Raiders Ltd estimates that for the next planning period selling price for this product will increase 50%; variable expenses…arrow_forwardA computer hardware firm sells both laptop computers and printers. Through the magic of focus groups, their pricing team determines that they have an equal number of three types of customers, and that these customers' reservation prices are as illustrated in the figure below. Printer $100 Bundle $950 $1,000 $750 Laptop $850 Customer A Customer B $950 $600 $50 $150 Customer C Assume for simplicity the marginal cost of production for laptops and printers is zero. If the firm were to charge only individual prices (not use the bundle price), what prices should it set for its laptops and printers to maximize profit? Assuming for simplicity that the firm has only one customers of each type, how much does it earn in total? To maximize profit using individual prices, the firm should charge a price for laptops of p= 650 and a price for printers of p= 100 (Enter your responses as whole numbers.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Pricing Decisions; Author: Rutgers Accounting Web;https://www.youtube.com/watch?v=rQHbIVEAOvM;License: Standard Youtube License