COST ACCOUNTING

16th Edition

ISBN: 9781323694008

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 3.31E

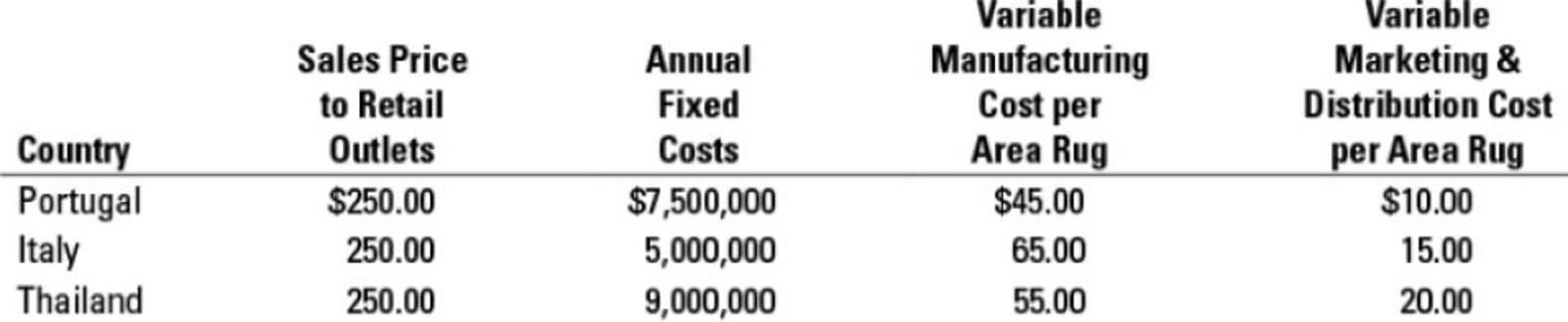

CVP analysis, international cost structure differences. Braided Rugs, Inc., is considering three possible countries for the sole manufacturing site of its newest area rug: Italy, Portugal, and Thailand. All area rugs are to be sold to retail outlets in the United States for $250 per unit. These retail outlets add their own markup when selling to final customers. Fixed costs and variable cost per unit (area rug) differ in the three countries.

- 1. Compute the breakeven point for Braided Rugs, Inc., in each country in (a) units sold and (b) revenues.

Required

- 2. If Braided Rugs, Inc., plans to produce and sell 80,000 rugs in 2017, what is the budgeted operating income for each of the three manufacturing locations? Comment on the results.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Fixed order quantity model?

Direct labor hours required in May would be?

can you please solve this managerial accounting

Chapter 3 Solutions

COST ACCOUNTING

Ch. 3 - Define costvolumeprofit analysis.Ch. 3 - Describe the assumptions underlying CVP analysis.Ch. 3 - Distinguish between operating income and net...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Why is it more accurate to describe the subject...Ch. 3 - CVP analysis is both simple and simplistic. If you...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Give an example of how a manager can decrease...

Ch. 3 - Give an example of how a manager can increase...Ch. 3 - What is operating leverage? How is knowing the...Ch. 3 - There is no such thing as a fixed cost. All costs...Ch. 3 - Prob. 3.14QCh. 3 - In CVP analysis, gross margin is a less-useful...Ch. 3 - Jacks Jax has total fixed costs of 25,000. If the...Ch. 3 - During the current year, XYZ Company increased its...Ch. 3 - Under the contribution income statement, a...Ch. 3 - A company needs to sell 10,000 units of its only...Ch. 3 - Once a company exceeds its breakeven level,...Ch. 3 - Prob. 3.21ECh. 3 - CVP computations. Garrett Manufacturing sold...Ch. 3 - CVP analysis, changing revenues and costs. Sunset...Ch. 3 - CVP exercises. The Deli-Sub Shop owns and operates...Ch. 3 - CVP exercises. The Doral Company manufactures and...Ch. 3 - CVP analysis, income taxes. Westover Motors is a...Ch. 3 - CVP analysis, income taxes. The Home Style Eats...Ch. 3 - CVP analysis, sensitivity analysis. Perfect Fit...Ch. 3 - CVP analysis, margin of safety. Suppose Morrison...Ch. 3 - Operating leverage. Cover Rugs is holding a 2-week...Ch. 3 - CVP analysis, international cost structure...Ch. 3 - Sales mix, new and upgrade customers. Chartz 1-2-3...Ch. 3 - Prob. 3.33ECh. 3 - Prob. 3.34ECh. 3 - Contribution margin, decision making. Welch Mens...Ch. 3 - Contribution margin, gross margin, and margin of...Ch. 3 - Uncertainty and expected costs. Kindmart is an...Ch. 3 - CVP analysis, service firm. Lifetime Escapes...Ch. 3 - CVP, target operating income, service firm....Ch. 3 - CVP analysis, margin of safety. Marketing Docs...Ch. 3 - CVP analysis, income taxes. (CMA, adapted) J.T....Ch. 3 - CVP, sensitivity analysis. The Derby Shoe Company...Ch. 3 - CVP analysis, shoe stores. The HighStep Shoe...Ch. 3 - CVP analysis, shoe stores (continuation of 3-43)....Ch. 3 - Prob. 3.45PCh. 3 - Prob. 3.46PCh. 3 - CVP analysis, income taxes, sensitivity. (CMA,...Ch. 3 - Choosing between compensation plans, operating...Ch. 3 - Prob. 3.49PCh. 3 - Multiproduct CVP and decision making. Crystal...Ch. 3 - Sales mix, two products. The Stackpole Company...Ch. 3 - Prob. 3.52PCh. 3 - Ethics, CVP analysis. Megaphone Corporation...Ch. 3 - Deciding where to produce. (CMA, adapted) Portal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is Transfer Pricing for Small Businesses?; Author: Nomad Capitalist;https://www.youtube.com/watch?v=_Q6nN3s1Xjs;License: Standard Youtube License