COST ACCOUNTING

16th Edition

ISBN: 9781323694008

Author: Horngren

Publisher: PEARSON C

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.36E

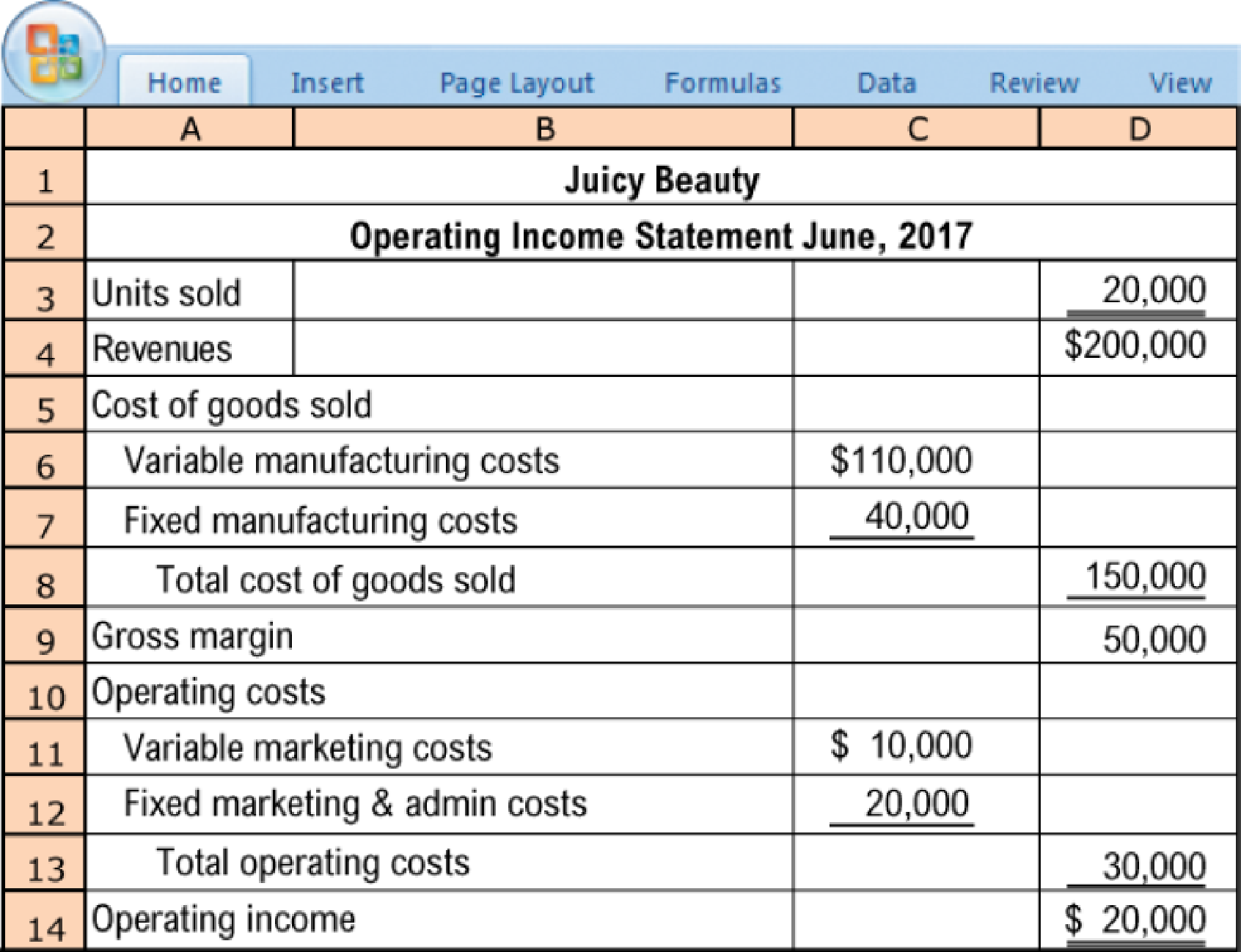

Contribution margin, gross margin, and margin of safety. Juicy Beauty manufactures and sells a face cream to small specialty stores in the greater Los Angeles area. It presents the monthly operating income statement shown here to George Lopez, a potential investor in the business. Help Mr. Lopez understand Juicy Beauty’s cost structure.

- 1. Recast the income statement to emphasize contribution margin.

Required

- 2. Calculate the contribution margin percentage and breakeven point in units and revenues for June 2017.

- 3. What is the margin of safety (in units) for June 2017?

- 4. If sales in June were only 16,000 units and Juicy Beauty’s tax rate is 30%, calculate its net income.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please given correct answer general Accounting

Hii ticher please given correct answer general Accounting

None

Chapter 3 Solutions

COST ACCOUNTING

Ch. 3 - Define costvolumeprofit analysis.Ch. 3 - Describe the assumptions underlying CVP analysis.Ch. 3 - Distinguish between operating income and net...Ch. 3 - Prob. 3.4QCh. 3 - Prob. 3.5QCh. 3 - Why is it more accurate to describe the subject...Ch. 3 - CVP analysis is both simple and simplistic. If you...Ch. 3 - Prob. 3.8QCh. 3 - Prob. 3.9QCh. 3 - Give an example of how a manager can decrease...

Ch. 3 - Give an example of how a manager can increase...Ch. 3 - What is operating leverage? How is knowing the...Ch. 3 - There is no such thing as a fixed cost. All costs...Ch. 3 - Prob. 3.14QCh. 3 - In CVP analysis, gross margin is a less-useful...Ch. 3 - Jacks Jax has total fixed costs of 25,000. If the...Ch. 3 - During the current year, XYZ Company increased its...Ch. 3 - Under the contribution income statement, a...Ch. 3 - A company needs to sell 10,000 units of its only...Ch. 3 - Once a company exceeds its breakeven level,...Ch. 3 - Prob. 3.21ECh. 3 - CVP computations. Garrett Manufacturing sold...Ch. 3 - CVP analysis, changing revenues and costs. Sunset...Ch. 3 - CVP exercises. The Deli-Sub Shop owns and operates...Ch. 3 - CVP exercises. The Doral Company manufactures and...Ch. 3 - CVP analysis, income taxes. Westover Motors is a...Ch. 3 - CVP analysis, income taxes. The Home Style Eats...Ch. 3 - CVP analysis, sensitivity analysis. Perfect Fit...Ch. 3 - CVP analysis, margin of safety. Suppose Morrison...Ch. 3 - Operating leverage. Cover Rugs is holding a 2-week...Ch. 3 - CVP analysis, international cost structure...Ch. 3 - Sales mix, new and upgrade customers. Chartz 1-2-3...Ch. 3 - Prob. 3.33ECh. 3 - Prob. 3.34ECh. 3 - Contribution margin, decision making. Welch Mens...Ch. 3 - Contribution margin, gross margin, and margin of...Ch. 3 - Uncertainty and expected costs. Kindmart is an...Ch. 3 - CVP analysis, service firm. Lifetime Escapes...Ch. 3 - CVP, target operating income, service firm....Ch. 3 - CVP analysis, margin of safety. Marketing Docs...Ch. 3 - CVP analysis, income taxes. (CMA, adapted) J.T....Ch. 3 - CVP, sensitivity analysis. The Derby Shoe Company...Ch. 3 - CVP analysis, shoe stores. The HighStep Shoe...Ch. 3 - CVP analysis, shoe stores (continuation of 3-43)....Ch. 3 - Prob. 3.45PCh. 3 - Prob. 3.46PCh. 3 - CVP analysis, income taxes, sensitivity. (CMA,...Ch. 3 - Choosing between compensation plans, operating...Ch. 3 - Prob. 3.49PCh. 3 - Multiproduct CVP and decision making. Crystal...Ch. 3 - Sales mix, two products. The Stackpole Company...Ch. 3 - Prob. 3.52PCh. 3 - Ethics, CVP analysis. Megaphone Corporation...Ch. 3 - Deciding where to produce. (CMA, adapted) Portal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Subject: general Accountingarrow_forwardHow much will you accumulated after 35 year?arrow_forwardOn a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License