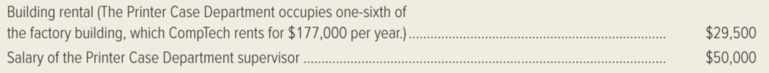

CompTech, Inc. manufactures printers for use with home computing systems. The firm currently manufactures both the electronic components for its printers and the plastic cases in which the devices are enclosed. Jim Cassanitti, the production manager, recently received a proposal from Universal Plastics Corporation to manufacture the cases for CompTech’s printers. If the cases are purchased outside, CompTech will be able to close down its Printer Case Department. To help decide whether to accept the bid from Universal Plastics Corporation, Cassanitti asked CompTech’s controller to prepare an analysis of the costs that would be saved if the Printer Case Department were closed. Included in the controller’s list of annual cost savings were the following items:

In a lunchtime conversation with the controller, Cassanitti learned that CompTech was currently renting space in a warehouse for $39,000. The space is used to store completed printers. If the Printer Case Department were discontinued, the entire storage operation could be moved into the factory building and occupy the space vacated by the closed department. Cassanitti also learned that the supervisor of the Printer Case Department would be retained by CompTech even if the department were closed. The supervisor would be assigned the job of managing the assembly department, whose supervisor recently gave notice of his retirement. All of CompTech’s department supervisors earn the same salary.

Required:

- 1. You have been hired as a consultant by Cassanitti to advise him in his decision. Write a memo to Cassanitti commenting on the costs of space and supervisory salaries included in the controller’s cost analysis. Explain in your memo about the “real” costs of the space occupied by the Printer Case Department and the supervisor’s salary. What types of costs are these?

- 2. Independent of your response to requirement (1), suppose that CompTech’s controller had been approached by his friend Jack Westford, the assistant supervisor of the Printer Case Department.

Westford is worried that he will be laid off if the Printer Case Department is closed down. He has asked his friend to understate the cost savings from closing the department, in order to slant the production manager’s decision toward keeping the department in operation. Comment on the controller’s ethical responsibilities.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning