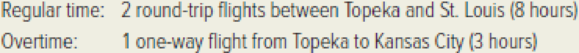

Heartland Airways operates commuter flights in three Midwestern states. Due to a political convention held in Topeka, the airline added several extra flights during a two-week period. Additional cabin crews were hired on a temporary basis. However, rather than hiring additional flight attendants, the airline used its current attendants on overtime. Monica Gaines worked the following schedule on August 10. All of Gaines’s flights on that day were extra flights that the airline would not normally fly.

Gaines earns $12 per hour and is paid time and a half when working overtime.

Required:

- 1. Compute the direct cost of compensating Gaines for her services on the flight from Topeka to Kansas City.

- 2. Compute the cost of Gaines’s services that is an indirect cost.

- 3. How should the cost computed in requirement (2) be treated for cost accounting purposes?

- 4. Gaines ended her workday on August 10 in Kansas City. However, her next scheduled flight departed Topeka at 11:00 a.m. on August 11. This required Gaines to “dead-head” back to Topeka on an early-morning flight. This means she traveled from Kansas City to Topeka as a passenger, rather than as a working flight attendant. Since the morning flight from Kansas City to Topeka was full, Gaines displaced a paying customer. The revenue lost by the airline was $82. What type of cost is the $82? To what flight, if any, is it chargeable? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Yami Enterprises began the accounting period with $75,000 of merchandise, and the net cost of purchases was $265,000. A physical inventory showed $85,000 of merchandise unsold at the end of the period. The cost of goods sold by York Enterprises for the period is ____.arrow_forwardA firm sells 2,800 units of an item each year. The carrying cost per unit is $3.26 and the fixed costs per order are $74. What is the economic order quantity? (Please round units to the nearest whole number) General Accountarrow_forwardAns general accounting questionarrow_forward

- Kavya Enterprises reported net sales of $65,000. The beginning accounts receivable was $12,000, and the ending accounts receivable was $18,500. What is the days sales collected for Kavya Enterprises? (Rounded answer to nearest day)arrow_forwardGeneral accounting and questionarrow_forwardWhat is the days sales collected for kavya enterprises?arrow_forward

- General Accountarrow_forwardHello expert give me solution this questionarrow_forwardE9.19B (LO 3) (Nonmonetary Exchange) Mathews Company exchanged equipment used in its manufacturing operations plus $6,000 in cash for similar equipment used in the operations of Biggio Company. The following information pertains to the exchange: Mathews Co. Equipment (cost) Accumulated depreciation Fair value of equipment Cash given up Instructions $56,000 38,000 25,000 6,000 Biggio Co. $56,000 20,000 31,000 a. Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange lacks commercial substance. b. Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange has commercial substance.arrow_forward

- Correct Answerarrow_forwardSophia sold land to Brian. The sales price was $250,000. Sophia paid a commission to a real estate broker of $15,000 and paid other selling expenses of $3,200. Sophia's basis in the land was $135,500. What was Sophia's gain realized on the sale of the land?arrow_forwardprovide answer general accountingarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT