Concept explainers

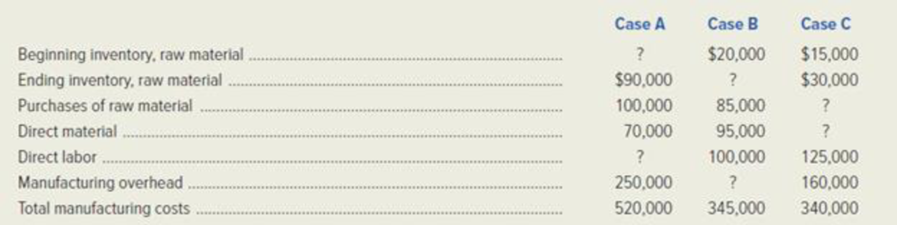

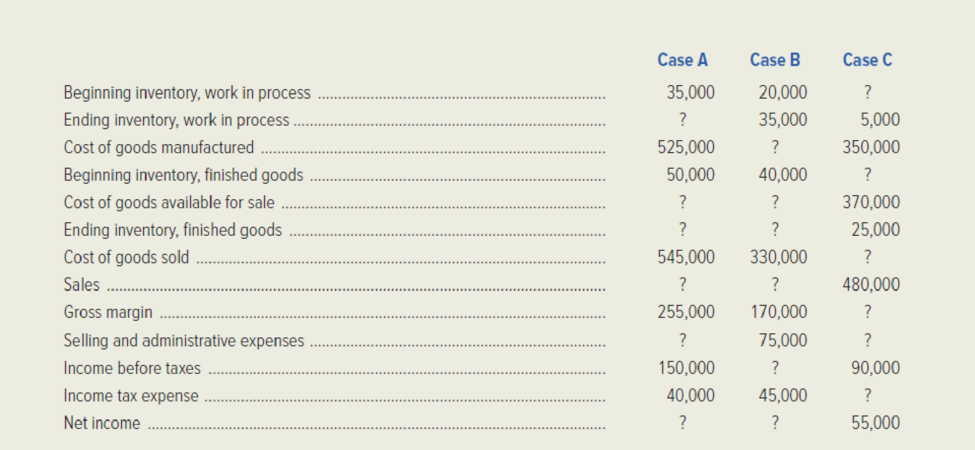

Determine the missing amounts in each of the following independent cases.

Determine the missing amounts in all the cases.

Explanation of Solution

Determine the missing amounts in all the cases.

| Particulars | Case A | Case B | Case C |

| Amount ($) | Amount ($) | Amount ($) | |

| Beginning inventory, raw material | 60,000 (a) | 20,000 | 15,000 |

| Ending inventory, raw material | 90,000 | 10,000(i) | 30,000 |

| Purchases of raw material | 100,000 | 85,000 | 70,000(q) |

| Direct material used | 70,000 | 95,000 | 55,000(r) |

| Direct labor | 200,000(b) | 100,000 | 125,000 |

| Manufacturing overhead | 250,000 | 150,000(j) | 160,000 |

| Total manufacturing costs | 520,000 | 345,000 | 340,000 |

| Beginning inventory, work in process | 35,000 | 20,000 | 15,000(s) |

| Ending inventory, work in process | 30,000(c) | 35,000 | 5,000 |

| Cost of goods manufactured | 525,000 | 330,000(k) | 350,000 |

| Beginning inventory, finished goods | 50,000 | 40,000 | 20,000(t) |

| Cost of goods available for sale | 575,000(d) | 370,000(l) | 370,000 |

| Ending inventory, finished goods | 30,000(e) | 40,000(m) | 25,000 |

| Cost of goods sold | 545,000 | 330,000 | 345,000(u) |

| Sales | 800,000(f) | 500,000(n) | 480,000 |

| Gross margin | 255,000 | 170,000 | 135,000(v) |

| Selling and administrative expenses | 105,000(g) | 75,000 | 45,000(w) |

| Income before taxes | 150,000 | 95,000(o) | 90,000 |

| Income tax expense | 40,000 | 45,000 | 35,000(x) |

| Net income | 110,000(h) | 50,000(p) | 55,000 |

Table (1)

Working Notes in Case A:

(a) Calculate the beginning inventory of raw material.

| Particulars | Amount ($) |

| Add: Direct material used | 70,000 |

| Ending inventory of raw material | 90,000 |

| Total raw material available for use | 160,000 |

| Less: Raw material purchased during the period | (100,000) |

| Beginning inventory of raw material | 60,000 |

Table (1)

(b) Calculate the direct labor.

| Particulars | Amount ($) |

| Direct Material | 70,000 |

| Manufacturing overhead | 250,000 |

| Less: Total manufacturing costs | (520,000) |

| Direct labor | 200,000 |

Table (2)

(c) Calculate the ending inventory, work in process.

| Particulars | Amount ($) |

| Add: Beginning inventory, work in process | 35,000 |

| Direct material used | 70,000 |

| Direct labor | 200,000 |

| Manufacturing overhead | 250,000 |

| Less: Cost of goods manufactured | (525,000) |

| Ending inventory, work in process | 30,000 |

Table (3)

(d) Calculate the cost of goods available for sales.

| Particulars | Amount ($) |

| Add: Cost of goods manufactured | 525,000 |

| Beginning inventory, finished goods | 50,000 |

| Cost of goods available for sales | 575,000 |

Table (4)

(e) Calculate the ending inventory, finished goods.

| Particulars | Amount ($) |

| Add: Beginning inventory, finished goods | 525,000 |

| Cost of goods manufactured | 50,000 |

| Cost of goods available for sales | 575,000 |

| Less: Cost of goods sold | (545,000) |

| Ending inventory, finished goods | 30,000 |

Table (5)

(f) Calculate the sales.

| Particulars | Amount ($) |

| Add: Cost of goods sold | 545,000 |

| Gross margin | 255,000 |

| Sales | 800,000 |

Table (6)

(g) Calculate the selling and administrative expenses.

| Particulars | Amount ($) |

| Gross Margin | 255,000 |

| Less: Income before taxes | (150,000) |

| selling and administrative expenses | 105,000 |

Table (7)

(h) Calculate net income.

| Particulars | Amount ($) |

| Add: Selling and administrative expenses | 105,000 |

| Income tax expense | 40,000 |

| Total expense | 145,000 |

| Less: Gross margin | (255,000) |

| Net income | 105,000 |

Table (8)

Working Notes in Case B:

(i) Calculate the ending inventory, raw material.

| Particulars | Amount ($) |

| Less: Direct materials used | 95,000 |

| Purchase of raw material | 85,000 |

| Ending inventory, raw material | 10,000 |

Table (8)

(j) Calculate the manufacturing overhead.

| Particulars | Amount ($) |

| Total manufacturing costs | 345,000 |

| Less: Direct labor | (100,000) |

| Direct material used | 95,000 |

| Manufacturing overhead | 150,000 |

Table (9)

(k) Calculate the cost of goods manufactured.

| Particulars | Amount ($) |

| Add: Direct material used | 95,000 |

| Direct labor | 100,000 |

| Manufacturing overhead | 150,000 |

| Beginning inventory, work in process | 20,000 |

| Total manufacturing cost | 365,000 |

| Less: Ending inventory, work in process | (35,000) |

| Cost of goods manufactured for the year | 335,000 |

Table (10)

(l) Calculate the cost of goods available for sales.

| Particulars | Amount ($) |

| Add: Cost of goods manufactured | 330,000 |

| Beginning inventory, finished goods | 40,000 |

| Cost of goods available for sales | 370,000 |

Table (11)

(m) Calculate the ending inventory, finished goods.

| Particulars | Amount ($) |

| Add: Beginning inventory, finished goods | 40,000 |

| Cost of goods manufactured | 330,000 |

| Cost of goods available for sales | 370,000 |

| Less: Cost of goods sold | (330,000) |

| Ending inventory, finished goods | 40,000 |

Table (12)

(n) Calculate the sales.

| Particulars | Amount ($) |

| Add: Cost of goods sold | 330,000 |

| Gross margin | 170,000 |

| Sales | 500,000 |

Table (13)

(o) Calculate income before tax.

| Particulars | Amount ($) |

| Gross margin | 170,000 |

| Less: Selling and administrative expenses | (75,000) |

| Income before tax | 95,000 |

Table (14)

(p) Calculate net income.

| Particulars | Amount ($) |

| Add: Selling and administrative expenses | 75,000 |

| Income tax expense | 45,000 |

| Total expense | 120,000 |

| Less: Gross margin | (170,000) |

| Net income | 50,000 |

Table (15)

Working Notes in Case C:

(q) Calculate the purchase of raw material.

| Particulars | Amount ($) |

| Direct labor | 125,000 |

| Less: Ending inventory, raw material | (30,000) |

| Beginning inventory, raw material | 15,000 |

| Purchase of raw material | 70,000 |

Table (16)

(r) Calculate the direct material used.

| Particulars | Amount ($) |

| Add: Purchases of raw material | 70,000 |

| Beginning inventory, raw material | 15,000 |

| Total manufacturing cost | 85,000 |

| Less: Ending inventory, raw material | (30,000) |

| Total direct material used | 55,000 |

Table (17)

(s) Calculate the Beginning inventory, work in process.

| Particulars | Amount ($) |

| Add: Direct material used | 55,000 |

| Direct labor | 125,000 |

| Manufacturing overhead | 160,000 |

| Less: Cost of goods manufactured | (350,000) |

| Ending inventory, work in process | 5,000 |

| Beginning inventory, work in process | 15,000 |

Table (18)

(t) Calculate the beginning inventory, finished goods.

| Particulars | Amount ($) |

| Cost of goods available for sale | 370,000 |

| Less: Cost of goods manufactured | (350,000) |

| Beginning inventory, finished goods | 20,000 |

Table (19)

(u) Calculate the cost of goods sold.

| Particulars | Amount ($) |

| Cost of goods available for sale | 370,000 |

| Less: Ending inventory, finished goods | (25,000) |

| Cost of goods sold | 345,000 |

Table (20)

(v) Calculate the gross margin.

| Particulars | Amount ($) |

| Sales | 480,000 |

| Less: Cost of goods sold | (345,000) |

| Gross Margin | 135,000 |

Table (21)

(w) Calculate the selling and administrative expense.

| Particulars | Amount ($) |

| Gross Margin | 135,000 |

| Less: Income before taxes | (90,000) |

| Selling and administrative expenses | 45,000 |

Table (22)

(x) Calculate the income tax expenses.

| Particulars | Amount ($) |

| Income before tax | 90,000 |

| Less: Net Income | (55,000) |

| Income tax expenses | 35,000 |

Table (23)

Want to see more full solutions like this?

Chapter 2 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- What is the direct labor rate variance?(Account)arrow_forwardZephyr Electronics sells high-end speakers. The unit selling price is $110, the unit variable costs are $52.50, fixed costs are $200,000, and current sales are 14,000 units. How much will operating income change if sales increase by 6,000 units?arrow_forwardneed help this questions general accountingarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,