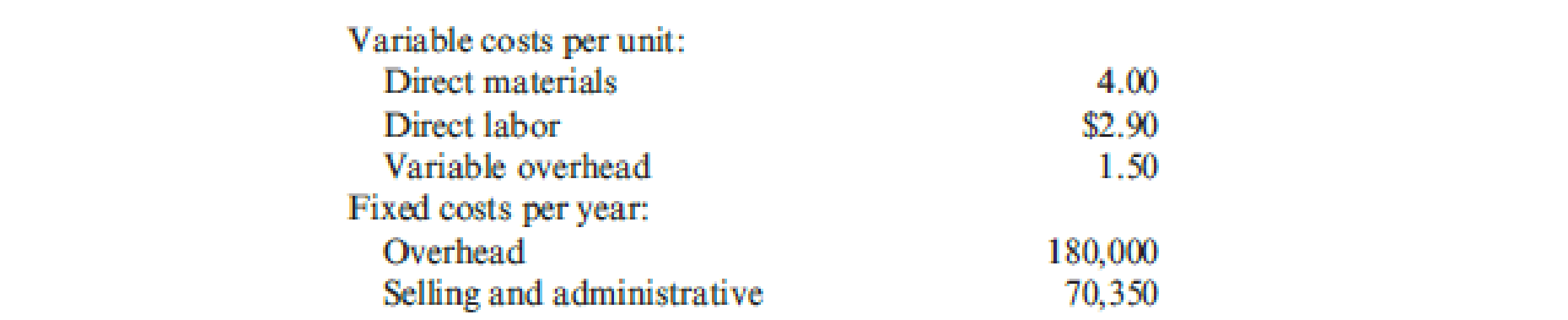

Jellison Company had the following operating data for its first two years of operations:

Jellison produced 90,000 units in the first year and sold 80,000. In the second year, it produced 80,000 units and sold 90,000 units. The selling price per unit each year was $12. Jellison uses an actual costing system for product costing.

Required:

- 1. Prepare income statements for both years using absorption costing. Has firm performance, as measured by income, improved or declined from Year 1 to Year 2?

- 2. Prepare income statements for both years using variable costing. Has firm performance, as measured by income, improved or declined from Year 1 to Year 2?

- 3. Which method do you think most accurately measures firm performance? Why?

1.

Prepare income statement for both years using absorption costing and explain whether the firm performance has improved or declined.

Explanation of Solution

Absorption costing income statement: It is one of the important types of income statement, in which the cost of goods sold are deducted from the revenue, company’s contribution margin will get. Net income can be calculated by deducting total selling and administrative expenses from the contribution margin of the company.

Prepare and income statement using absorption costing for Year 1 ad Year 2:

| Company J | ||

| Absorption Costing income statement | ||

| For Year 1 and Year 2 | ||

| Particulars | Year 1 | Year 2 |

| Sales | $960,000 | $1,080,000 |

| Less: Cost of goods sold (3) | ($832,000) | ($956,000) |

| Gross profit | $128,000 | $124,000 |

| Less: Selling and administrative expenses | ($70,350) | ($70,350) |

| Operating income | $57,650 | $53,650 |

Table (1)

Note: The units sold in Year 1 and Year 2 is 80,000 and 90,000 respectively.

From table (1), the operating income for Year 1 and Year 2 is $57,650 and $53,650 respectively. Hence, the firm performance has declined in Year 2 from Year 1.

Working note 1: Determine the cost of goods manufactured for Year 1 and Year 2:

| Computation of cost of goods manufactured | ||

| Particulars | Year 1 | Year 2 |

| Units produced (A) | 90,000 | 80,000 |

| Direct materials | $4.00 | $4.00 |

| Direct labor | $2.90 | $2.90 |

| Variable overhead | $1.50 | $1.50 |

| Fixed overhead | $2.00 | $2.25 |

| Total cost (B) | $10.40 | $10.65 |

| Cost of goods manufactured | $936,000 | $852,000 |

Table (2)

Working note 2: Calculate the ending inventory for Year 1:

Working note 3: Determine the total cost of goods sold for Year 1 and Year 2:

| Computation of cost of goods sold | ||

| Particulars | Year 1 | Year 2 |

| Beginning inventory | $0 | $104,000 |

| Add: Cost of goods manufactured (1) | $936,000 | $852,000 |

| Goods available for sale | $936,000 | $956,000 |

| Less: Ending inventory (2) | ($104,000) | $0 |

| Cost of goods sold | $832,000 | $956,000 |

Table (3)

2.

Prepare income statement for both years using variable costing and explain whether the firm performance has improved or declined.

Explanation of Solution

Variable costing income statement: It is one of the important types of income statement, in which the entire variable costs are deducted from the revenue and the company’s contribution margin would be determined. Deducting all the fixed expenses from the contribution margin would result in company’s net income.

Prepare an income statement using variable costing:

| Company J | ||

| Variable Costing income statement | ||

| For Year 1 and Year 2 | ||

| Particulars | Year 1 | Year 2 |

| Sales | $960,000 | $1,080,000 |

| Less: Variable cost of goods sold (6) | ($672,000) | ($756,000) |

| Contribution margin | $288,000 | $324,000 |

| Less: | ||

| Fixed overhead | ($180,000) | ($180,000) |

| Fixed selling and administrative expenses | ($70,350) | ($70,350) |

| Operating income | $37,650 | $73,650 |

Table (4)

Note: The units sold in Year 1 and Year 2 is 80,000 and 90,000 respectively.

From table (4), the operating income for Year 1 and Year 2 is $37,650 and $73,650 respectively. Hence, the firm performance has improved in Year 2 from Year 1.

Working note 4: Determine the variable cost of goods manufactured for Year 1 and Year 2:

| Computation of variable cost of goods manufactured | ||

| Particulars | Year 1 | Year 2 |

| Units produced (A) | 90,000 | 80,000 |

| Direct materials | $4.00 | $4.00 |

| Direct labor | $2.90 | $2.90 |

| Variable overhead | $1.50 | $1.50 |

| Total cost (B) | $8.40 | $8.40 |

| Cost of goods manufactured | $756,000 | $672,000 |

Table (5)

Working note 5: Calculate the ending inventory for Year 1:

Working note 6: Determine the variable cost of goods sold for Year 1 and Year 2:

| Computation of cost of goods sold | ||

| Particulars | Year 1 | Year 2 |

| Beginning inventory | $0 | $84,000 |

| Add: Variable cost of goods manufactured (4) | $756,000 | $672,000 |

| Goods available for sale | $756,000 | $756,000 |

| Less: Ending inventory (5) | ($84,000) | $0 |

| Variable Cost of goods sold | $672,000 | $756,000 |

Table (6)

3.

Identify the method that evaluates the performances accurately and explain the same.

Explanation of Solution

The costs remaining the same, the sales have also increased. The operating income has increased under variable costing due to the absence of fixed costs in ending inventory cost. On the other hand, the operating income has decreased under absorption costing as the fixed costs in ending inventory cost have been included. Therefore, variable costing is better and evaluates the performances accurately reflecting the economic performance

Want to see more full solutions like this?

Chapter 18 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Chapter 18 Homework 8 1 points QS 18-4 (Algo) Measuring costs using high-low method LO P1 The following information is available for a company's maintenance cost over the last seven months. Month June July Units Produced 190 eBook 110 140 200 230 August September October November December Maintenance Cost $ 3,950 5,390 4,110 5,558 6,038 3,150 Using the high-low method, estimate both the fixed and variable components of its maintenance cost. Print References High-Low method - Calculation of variable cost per unit produced Cost at highest volume - Cost at lowest volume Highest volume - Lowest volume Total cost at the highest volume Variable costs at highest volume Highest volume Variable cost per unit produced Total variable costs at highest volume Total fixed costs Total cost at the lowest volume Variable costs at lowest volume: Lowest volume Variable cost per unit produced Total variable costs at lowest volume Total fixed costs Mc Graw Hill Help Save & Exit Submit Check my workarrow_forwardGiven answer with step by step solutionarrow_forwardneed help this questionsarrow_forward

- provide correct answerarrow_forwardWhat is the gross profit rate ?arrow_forwardWhitney received $75,200 of taxable income in 2024. All of the income was salary from her employer. What is her income tax liability in each of the following alternative situations. She is married but files a separate tax return. Her taxable income is $75,200. What is her income tax liability?arrow_forward

- Lacy is a single taxpayer. In 2024, her taxable income is $56,000. What is her tax liability in each of the following alternative situations.Her $56,000 of taxable income includes $10,000 of qualified dividends. What is her tax liability?arrow_forwardAccounting problemarrow_forwardPlease help me this question solutionarrow_forward

- Debt equity ratioarrow_forwardPlease help me with part B of this problem. I am having trouble. Fill all necessary cells as shown. I have provided the dropdown that includes the accounts.arrow_forwardWhat is a good response to this post? My chosen product is an ergonomic pet bed similar to a large bean bag called a Pooch Poof. And my proposed markets are the United States, as it currently has the largest share of pet product sales, Europe as the pet population is 324.4 million currently, and South America, as this country is expected to be one of the fastest growing markets for pet accessories and food (Shahbandeh, 2024). With my product in two stable markets, and one emerging market, financial risks will be minimized as much as possible when expanding into the emerging market of South America by the stability of the American and European markets that are established. My slogan will be “Pamper your pooch with softness and watch your worries about your pup’s good night sleep go “Poof”. A “poofed” pet is a proper pet!” This slogan works as in the United States and Europe, dogs are generally considered family members, and allowed in public spaces, and socialization, training, health…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub