Dana Baird was manager of a new Medical Supplies Division. She had just finished her second year and had been visiting with the company’s vice president of operations. In the first year, the operating income for the division had shown a substantial increase over the prior year. Her second year saw an even greater increase. The vice president was extremely pleased and promised Dana a $5,000 bonus if the division showed a similar increase in profits for the upcoming year. Dana was elated. She was completely confident that the goal could be met. Sales contracts were already well ahead of last year’s performance, and she knew that there would be no increases in costs.

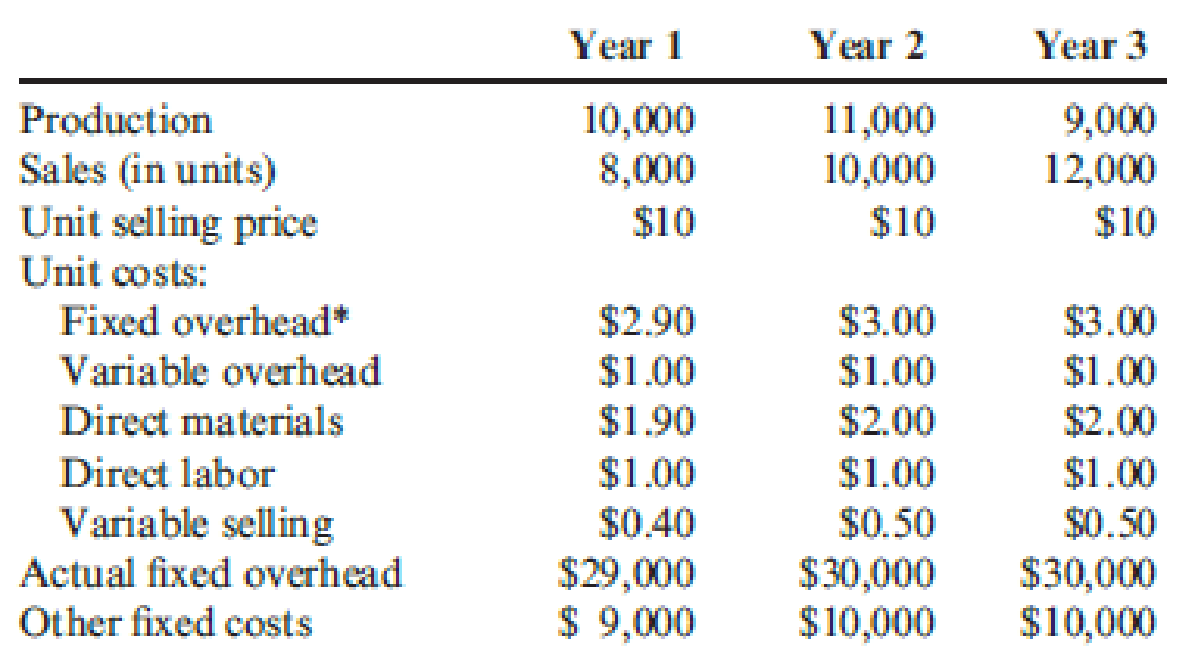

At the end of the third year, Dana received the following data regarding operations for the first three years:

*The predetermined fixed

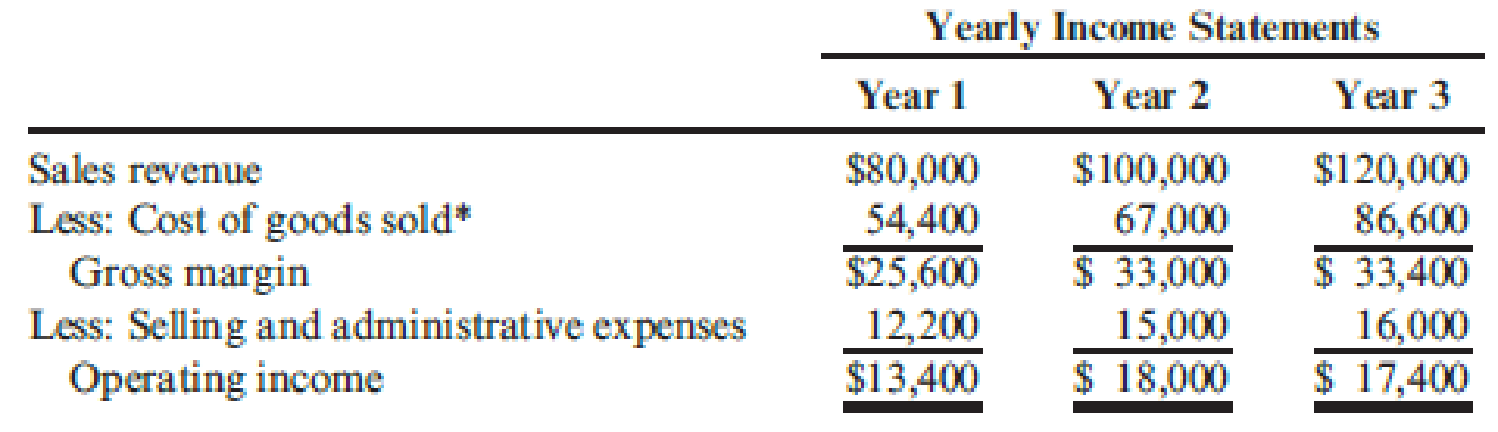

*Assumes a LIFO inventory flow.

Upon examining the operating data, Dana was pleased. Sales had increased by 20 percent over the previous year, and costs had remained stable. However, when she saw the yearly income statements, she was dismayed and perplexed. Instead of seeing a significant increase in income for the third year, she saw a small decrease. Surely, the Accounting Department had made an error.

Required:

- 1. Explain to Dana why she lost her $5,000 bonus.

- 2. Prepare variable-costing income statements for each of the three years. Reconcile the differences between the absorption-costing and variable-costing incomes.

- 3. If you were the vice president of Dana’s company, which income statement (variable-costing or absorption-costing) would you prefer to use for evaluating Dana’s performance? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 18 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Calculate the firm's estimated free cash flowarrow_forward#10. Recall that Unique Industries had estimated $1,055,000 of MOH for the year and 64,500 DL hours, resulting in a predetermined MOH rate of $14/DL hour. By the end of the year, the company had actually incurred $925,000 of MOH costs and used a total of 64,000 DL hours on jobs. By how much had Unique Industries overallocated or underallocated MOH for the year? Part 1 Compute the underallocated or overallocated overhead. (Use parentheses or a minus sign for overallocated overhead.) Actual MOH – Allocated MOH = (Over) Under Allocated - =arrow_forwardSterling Equipment Ltd. purchased machinery for $80,000 with a salvage value of $5,000 and a 6-year useful life. The company initially used the straight-line method, but after two years, switched to the double-declining balance method. What is the depreciation expense for Year 3?arrow_forward

- How many units were completed during the period?arrow_forwardI need correct answer general accounting questionarrow_forwardBased on the following data, what are total liabilities? Accounts payable $65000 Accounts receivable 69000 Cash 75000 Inventory 154000 Buildings 165000 Bonds payable 509000 Supplies 8900 Notes payable 58000 Equipment 367000arrow_forward

- At September 1, 2010, Kern Enterprises reported a cash balance of $45,000. During the month, Kern collected cash of $15,000 and made disbursements of $25,000. At September 31, 2010, what is the cash balance? A. $25,000 credit B. $35,000 credit C. $60,000 debit D. $35,000 debitarrow_forwardFalmouth Pools manufactures swimming pool equipment. Falmouth estimates total manufacturing overhead costs next year to be $1,500,000. Falmouth also estimates it will use 18,750 direct labor hours and incur $1,250,000 of direct labor cost next year. In addition, the machines are expected to be run for 50,000 hours.arrow_forwardPlease provide correct answer general accounting questionarrow_forward

- Given answer financial accounting questionarrow_forwardSweeten Corporation had sales of $1,050,000. The beginning accounts receivable balance was $80,000, and the ending accounts receivable balance was $250,000. How much is the cash collected from customers for this reporting period? a. $880,000 b. $1,220,000 c. $980,000 d. $1,150,000arrow_forwardWhat is the direct labor time variance?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningBusiness Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning