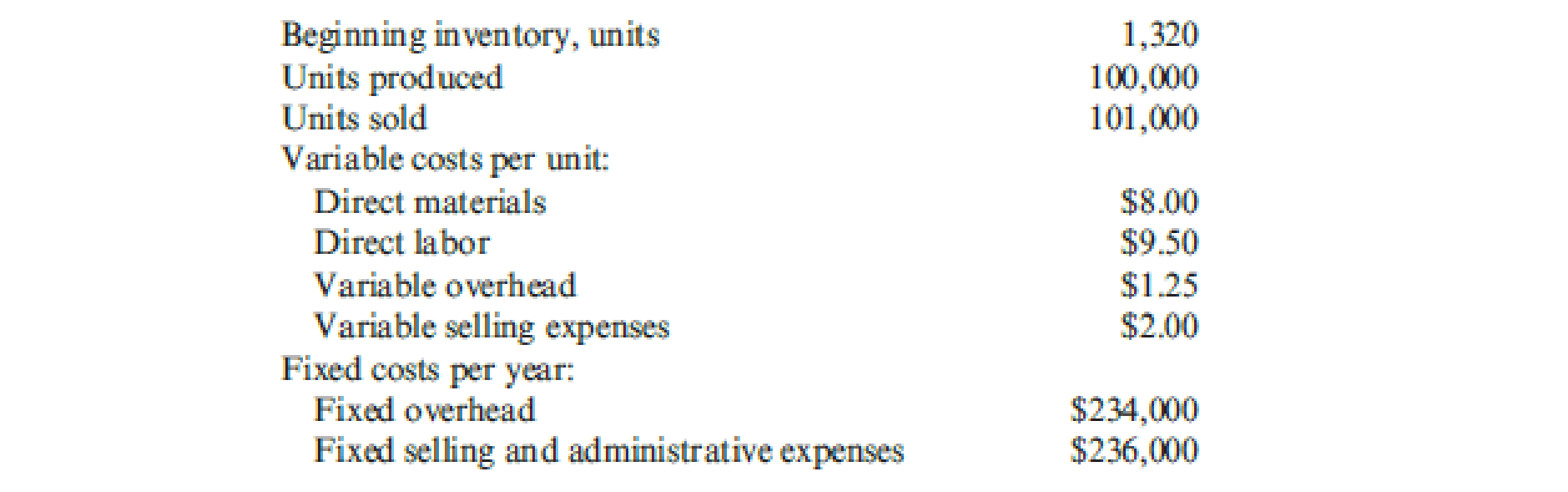

The following information pertains to Vladamir, Inc., for last year:

There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual

Required:

- 1. How many units are in ending inventory?

- 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income.

- 3. Assume the selling price per unit is $29. Prepare an income statement using (a) variable costing and (b) absorption costing.

1.

Determine the units of ending inventory.

Explanation of Solution

Determine the units of ending inventory:

| Particulars | Units |

| Beginning inventory | 1,320 |

| Add: Units produced | 100,000 |

| 101,320 | |

| Less: Units sold | (101,000) |

| Ending inventory | 320 |

Table (1)

Thus, the ending inventory is 320 units.

2.

Determine the difference between variable costing income and absorption costing income without preparing income statement.

Explanation of Solution

Variable Costing: The variable costing is the method of costing in which only the variable production costs such as the direct material, direct cost, and variable overhead costs are included in that time period in which they are incurred.

Absorption Costing: Absorption costing is a method for calculating the full cost or total cost of a single product in production process. It includes the total cost assigned to products.

Determine the difference between variable costing income and absorption costing income:

Thus, the difference between variable costing income and absorption costing income is ($2,340).

Working note 1: Calculate the fixed overhead rate:

3 (a).

Prepare an income statement using variable costing.

Explanation of Solution

Variable costing income statement: It is one of the important types of income statement, in which the entire variable costs are deducted from the revenue and the company’s contribution margin would be determined. Deducting all the fixed expenses from the contribution margin would result in company’s net income.

Prepare an income statement using variable costing:

| Incorporation V | |

| Variable Costing income statement | |

| For last year | |

| Particulars | Amount |

| Sales | $2,929,000 |

| Less: Variable expenses: | |

| Variable cost of goods sold | ($1,893,750) |

| Variable selling expenses | ($202,000) |

| Contribution margin | $833,250 |

| Less: Fixed expenses: | |

| Fixed overhead | ($234,000) |

| Fixed selling and administrative expenses | ($236,000) |

| Operating income | $363,250 |

Table (2)

Therefore, the operating income under variable costing is $363,250.

Working note 2: Determine the total cost of goods sold per unit:

3 (b).

Prepare an income statement using absorption costing.

Explanation of Solution

Absorption costing income statement: It is one of the important types of income statement, in which the cost of goods sold are deducted from the revenue, company’s contribution margin will get. Net income can be calculated by deducting total selling and administrative expenses from the contribution margin of the company.

Prepare and income statement using absorption costing:

| Incorporation V | |

| Absorption Costing income statement | |

| For last year | |

| Particulars | Amount |

| Sales | $2,929,000 |

| Less: Cost of goods sold | ($2,130,090) |

| Gross profit | $798,910 |

| Less: Selling and administrative expenses (4) | ($438,000) |

| Operating income | $360,910 |

Table (3)

Hence, the operating income under absorption costing is $360,910.

Working note 3: Determine the total cost of goods sold per unit:

Working note 4: Determine the total selling and administrative expenses:

Want to see more full solutions like this?

Chapter 18 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Maplewood Textiles reported $1,100,000 in net sales and $720,000 in cost of goods sold. If operating expenses totaled $250,000, what is the company's gross profit and operating income?arrow_forwardNonearrow_forwardHarbor Freight Equipment issued $800,000 in bonds with a 7% annual interest rate for a term of 6 years. The company makes semiannual interest payments. What will be the total interest expense over the bond's life?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning