Concept explainers

San Mateo Optics, Inc., specializes in manufacturing lenses for large telescopes and cameras used in space exploration. As the specifications for the lenses are determined by the customer and vary considerably, the company uses a

Manufacturing

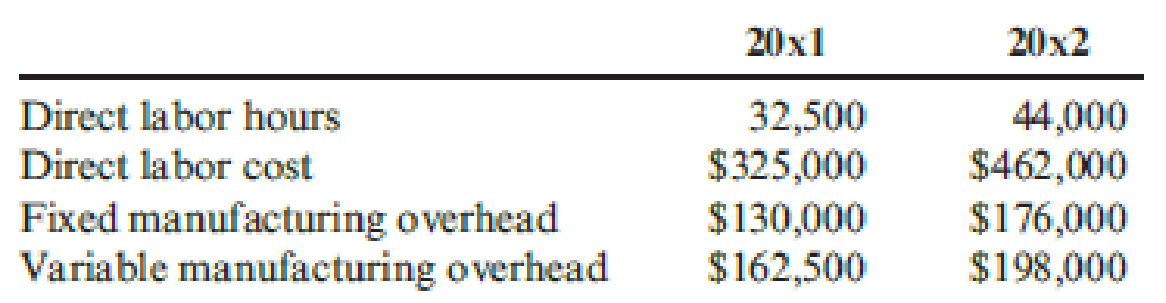

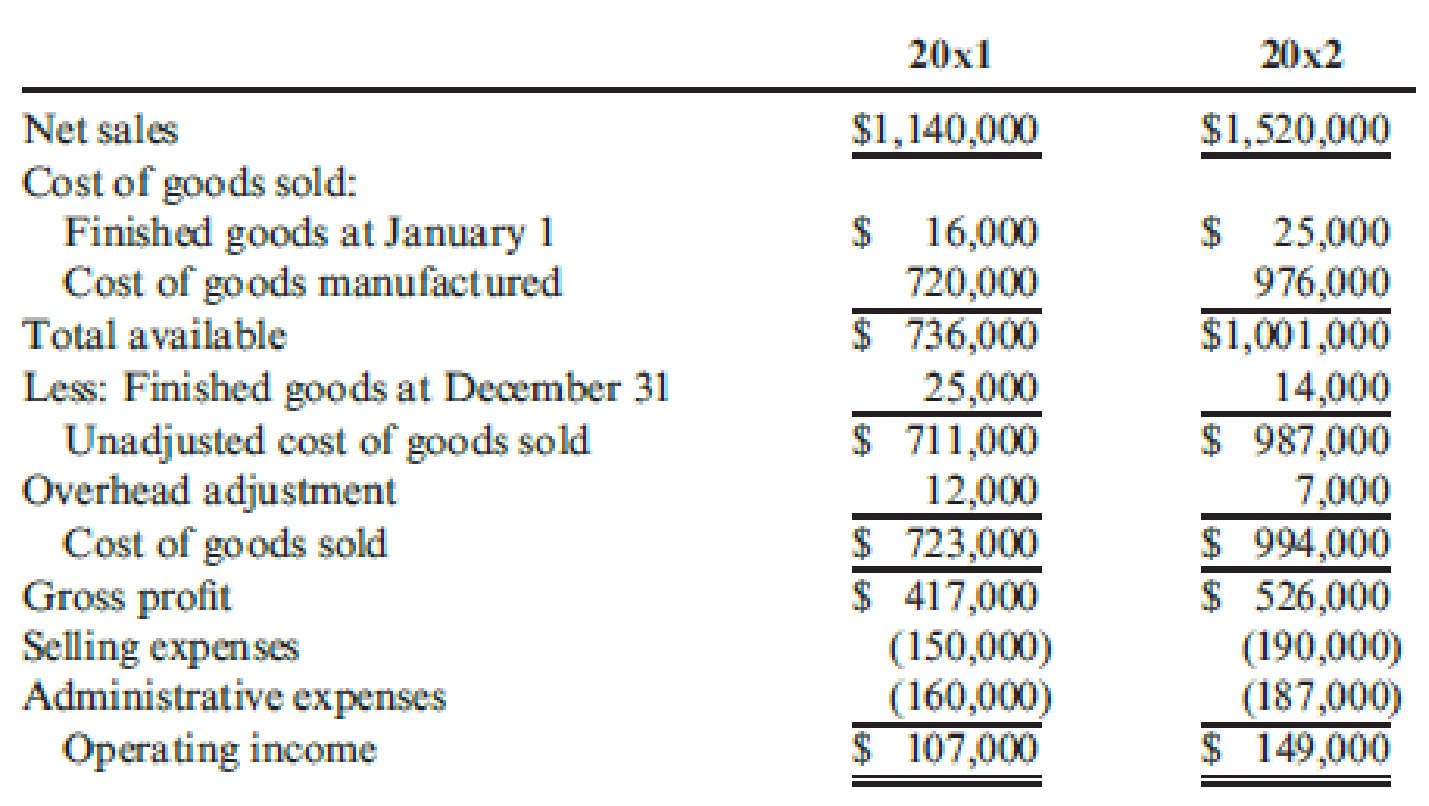

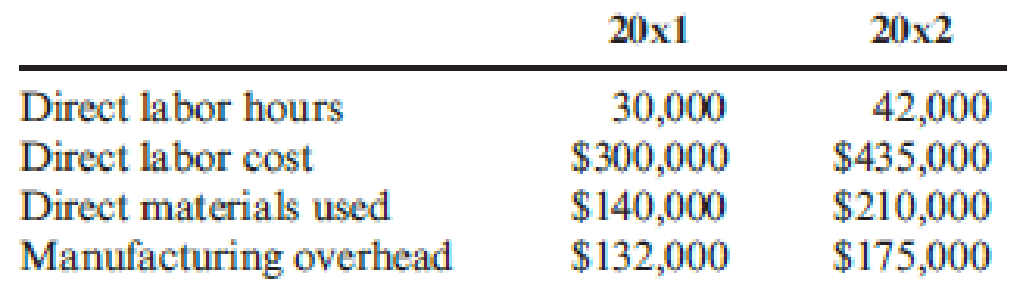

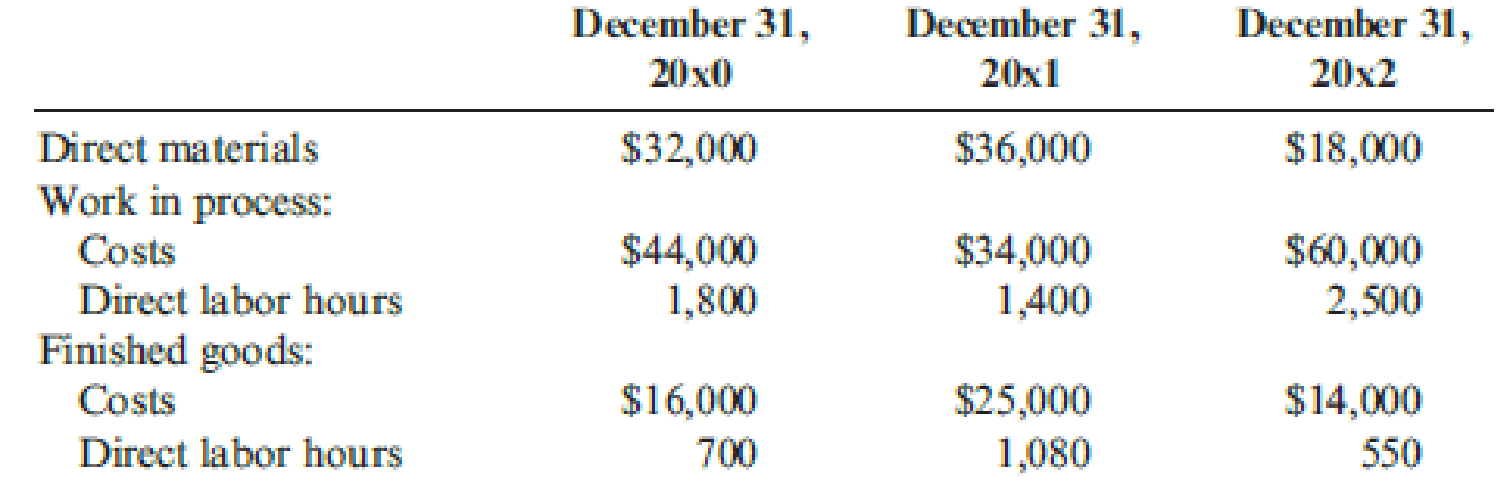

Jim Cimino, San Mateo’s controller, would like to use variable (direct) costing for internal reporting purposes as he believes statements prepared using variable costing are more appropriate for making product decisions. In order to explain the benefits of variable costing to the other members of San Mateo’s management team, Cimino plans to convert the company’s income statement from absorption costing to variable costing. He has gathered the following information for this purpose, along with a copy of San Mateo’s 20x1 and 20x2 comparative income statement.

San Mateo Optics, Inc. Comparative Income Statement For the Years 20x1 and 20x2

San Mateo’s actual manufacturing data for the two years are as follows:

The company’s actual inventory balances were as follows:

For both years, all administrative expenses were fixed, while a portion of the selling expenses resulting from an 8 percent commission on net sales was variable. San Mateo reports any over-or underapplied overhead as an adjustment to the cost of goods sold.

Required:

- 1. For the year ended December 31, 20x2, prepare the revised income statement for San Mateo Optics, Inc., utilizing the variable-costing method. Be sure to include the contribution margin on the revised income statement.

- 2. Describe two advantages of using variable costing rather than absorption costing. (CMA adapted)

Trending nowThis is a popular solution!

Chapter 18 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Home Insert Draw Page Layout Formulas Data Review View Automate Developer Calibri (Body) 12 ✓ Α Αν Conditional Formatting ✓ ☑Insert v Σ Custom Paste B I U ✓ ✓ $ ✓ %9 0 .00 →0 Format as Table ✓ Cell Styles ▾ Delete ✓ Format ✓ C26 fx A B D E F G 1 Instruction: 2 1. Please complete the following budget plan using appropriate cell references format (the cells highlighted in grey) 3 2. Please use fill handler to complete the table. E.g. in cell C16, build one formula and generate other formulas to D16 and E16 with fill handler. 4 3. For "Cost of Goods Sold" section (before "COGS Subtotal"), build one formula in cell C19, and generate formulas until E21. Overhead (B21) is 20% (B10) of the labor cost (B20). 5 4. For "COGS Subtotal", build one formula in C22, and generate the formulas to E22. 6 5. Similar requirements for "Selling Expenses" and "Projected Earnings" section. 7 6. Please be noted, for all items under "Cost of Goods Sold", and "Selling Expenses" the cost is per ONE shoe, not per…arrow_forwardProvide correct solution and accountingarrow_forwardSolve this question accountingarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning