Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

11th Edition

ISBN: 9781259727788

Author: Hilton & Platt

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 30P

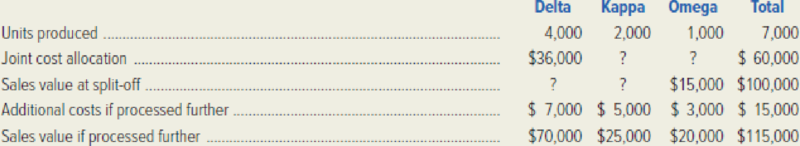

Berger Company manufactures products Delta, Kappa, and Omega from a joint process. Production, sales, and cost data for July follow.

Required:

- 1. Assuming that joint costs are allocated using the relative-sales-value method, what were the joint costs allocated to products Kappa and Omega?

- 2. Assuming that joint costs are allocated using the relative-sales-value method, what was the sales value at split-off for product Delta?

- 3. Use the net-realizable-value method to allocate the joint production costs to the three products. (CPA, adapted)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The following information is available for a manufacturing company which produces multiple products:

The product mix ratio

Contribution to sales ratio for each product

General fixed costs

Method of apportioning general fixed costs

Which of the above are required in order to calculate the break-even sales revenue for the company?

Using sales value at split-off, what amount of joint processing cost is allocated to Product Alpha?

Using a physical measurement method, what amount of joint processing cost is allocated to Product Gamma?

Using net realizable value at split-off, what amount of joint processing cost is allocated to Product Delta?

Required:

1. Assume that the company uses absorption costing.

a. Calculate the unit product cost.

b. Prepare an income statement for May.

2. Assume that the company uses variable costing.

a. Calculate the unit product cost.

b. Prepare a contribution format income statement for May.

Chapter 17 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

Ch. 17 - Prob. 1RQCh. 17 - Prob. 2RQCh. 17 - Should actual or budgeted service department costs...Ch. 17 - Prob. 4RQCh. 17 - Why does dual cost allocation improve the...Ch. 17 - What potential behavioral problem can result when...Ch. 17 - Should actual or budgeted service department costs...Ch. 17 - Explain the difference between two-stage...Ch. 17 - Define the following terms: joint production...Ch. 17 - Prob. 10RQ

Ch. 17 - Describe the relative-sales-value method of joint...Ch. 17 - Define the term net realizable value, and explain...Ch. 17 - Are joint cost allocations useful? If they are,...Ch. 17 - For what purpose should the managerial accountant...Ch. 17 - Prob. 15ECh. 17 - Refer to the data given in the preceding exercise....Ch. 17 - Tuscaloosa National Bank has two service...Ch. 17 - Refer to the data given in the preceding exercise....Ch. 17 - Breakfasttime Cereal Company manufactures two...Ch. 17 - Refer to the data given in the preceding exercise....Ch. 17 - Refer to the data given in Exercise 1720....Ch. 17 - Prob. 23ECh. 17 - Prob. 24PCh. 17 - Prob. 25PCh. 17 - Celestial Artistry Company is developing...Ch. 17 - Snake River Sawmill manufactures two lumber...Ch. 17 - Travelcraft Company manufactures a complete line...Ch. 17 - Biondi Industries is a manufacturer of chemicals...Ch. 17 - Berger Company manufactures products Delta, Kappa,...Ch. 17 - Prob. 31PCh. 17 - Lafayette Company manufactures two products out of...Ch. 17 - Refer to the data given in Problem 1726 for...Ch. 17 - Prob. 34PCh. 17 - Top Quality Fruit Company, based on Oahu, grows,...Ch. 17 - Prob. 36C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company manufactures two joint products at a joint cost of 1,000. These products can be sold at split-off, or when further processed at an additional cost, sold as higher quality items. The decision to sell at split-off or further process should be based on the: A. allocation of the 1,000 joint cost using the quantitative unit measure B. assumption that the 1,000 joint cost is irrelevant C. allocation of the $1,000 joint cost using the relative sales value approach D. assumption that the 1,000 joint cost must be allocated using a physical-measure approach E. allocation of the 1,000 joint cost using any equitable and rational allocation basisarrow_forwardCARAMEL Inc. manufactures three joint products. The following production data were provided by CARAMEL Inc. for the current period: Product Name Units Produced X Y Z Joint product costs for the current period were as follows: Raw materials Direct labor Factory overhead Costs before separation Costs after separation: X 1,000 2,000 3,000 The company uses the net realizable value method for allocating joint costs. 8. What is the Gross profit/(loss) on the sale of all X products? Y Z Production for April, in pounds: Z Additional Processing Final Selling Price Cost after Split Off 9. What is the total gross profit (loss) on the sale of all the joint products? MACCHIATO Company produces two main products jointly. X and Y. and Z. which is a by- product of Y. X and Y are produced from the same raw material. Z is manufactured from the residue of the process creating Y. Sales for April: Costs before separation are apportioned between the two main products by the net realizable value method. The…arrow_forwardArdmore Company produces two main products jointly, A and B, and C, which is a by-product of B. A and B are produced from the same raw material. C is manufactured from the residue of the process creating B. Costs before separation are apportioned between the two main products by the net realizable value method. The net revenue realized from the sale of C is deducted from the cost of B. Data for April were as follows: Costs before separation P200,000 Costs after separation: A 50,000 B 32,000 C 4,000 Production for April, in pounds: A 800,000 B 200,000 C 20,000 Sales for April: A 640,000 pounds @ P0.4375 B 180,000 pounds @ 0.65 C 20,000 pounds @ 0.30 Determine the gross profit for April.arrow_forward

- Vicerelandu, Inc. manufactures X, Y, and Z from a joint process. Joint product costs were P60,000. Additional information are as follows:(see pic) 1. Assuming that joint costs are allocated using the physical measures (units produced) approach, what were the total costs allocated to product X ________________________ Y ______________________ Z ______________________2. Assuming that joint product costs are allocated using the relative sales value at split-off approach, what were the total costs allocated to product X_________________________ y ______________________ Z ______________________arrow_forwardWhat is the Total joint costs? Show all workings related to the answer.arrow_forwardT or F Conversion cost per equivalent unit equals total conversion costs for the period divided by total equivalent units of conversion costs. T or F Product costs must be allocated to the units transferred out of thedepartment and the partially completed units on hand at the end of the period. T or F Ford is a process manufacturer.arrow_forward

- Atlanta Systems produces two different products, Product A, which sells for $450 per unit, and Product B, which sells for $800 per unit, using three different activities: Design, which uses Engineering Hours as an activity driver; Machining, which uses machine hours as an activity driver; and Inspection, which uses number of batches as an activity driver. The cost of each activity and usage of the activity drivers are as follows: Usage by Product A Usage by Product B Cost Design (Engineering Hours) Machining (Machine Hours) Inspection (Batches) $ 190,000 $1,800,000 $ 108 142 2,160 2,840 160,000 42 38 8 Atlanta manufactures 12,500 units of Product A and 10,200 units of Product B per month. Each unit of Product A uses $100 of direct materials and $45 of direct labor, while each unit of Product B uşes $140 of direct materials and $75 of direct labor.arrow_forwardSubject - account Please help me. Thankyou.arrow_forwardUsing a physical measurement method, what amount is joint processing cost is allocated to product Wan? Using net realizable value at split-off, what amount of joint processing cost is allocated to product tri?arrow_forward

- The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 3,800 sets per year. Annual cost data at full capacity follow: Direct labor Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation, administrative office equipment Lease cost, factory equipment Indirect materials, factory Depreciation, factory building Administrative office supplies (billing) Administrative office salaries Direct materials used (wood, bolts, etc.) Utilities, factory $ 89,000 $ 103,000 $70,000 $ 23,000 $ 65,000 $ 6,000 $ 2,000 $ 17,000 $ 18,000 $ 106,000 $ 5,000 $ 111,000 $ 426,000 $ 46,000 Required: 1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two ways: first, as variable or fixed with respect to the number of units produced and sold; and second, as a selling…arrow_forwardPatterson Company produces wafers for integrated circuits. Data for the most recent year are provided: aCalculated using number of dies as the single unit-level driver. bCalculated by multiplying the consumption ratio of each product by the cost of each activity. Required: 1. Using the five most expensive activities, calculate the overhead cost assigned to each product. Assume that the costs of the other activities are assigned in proportion to the cost of the five activities. 2. Calculate the error relative to the fully specified ABC product cost and comment on the outcome. 3. What if activities 1, 2, 5, and 8 each had a cost of 650,000 and the remaining activities had a cost of 50,000? Calculate the cost assigned to Wafer A by a fully specified ABC system and then by an approximately relevant ABC approach. Comment on the implications for the approximately relevant approach.arrow_forwardContribution margin by segment The following information is for LaPlanche Industries Inc.: Determine the contribution margin for (A) Product YY and (B) West Region.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY