Allocate the service department costs of company R using the reciprocal-services method in combination with the dual-allocation approach.

Explanation of Solution

Reciprocal-services method: The term reciprocal service refers to the circumstances under which two or more service departments provide services to each other. Under this method, in order to reflect the reciprocal provision of services among all other service departments, a system of simultaneous equations is established. When once it is established, “all other service departments’ costs are allocated among the departments that use the various service departments’ output of services”. Moreover, this is the only cost allocation method that fully accounts for the reciprocal provision of services among departments.

Allocate the service department costs of company R using the reciprocal-services method in combination with the dual-allocation approach as follows:

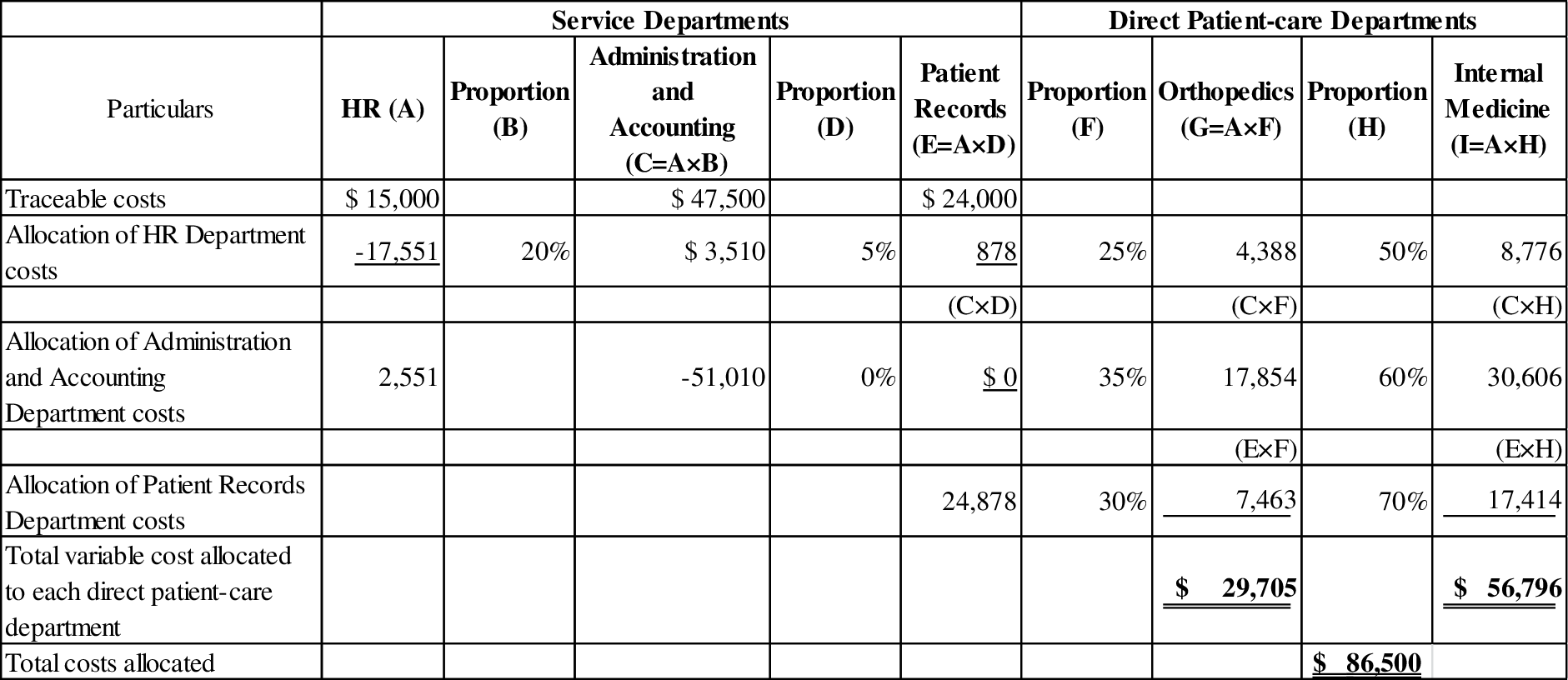

Variable costs under short-run proportions:

Table (1)

Working note (1):

Assume that:

- The total variable cost of Human resources is denoted as H.

- The total variable cost of Administration and Accounting is denoted as A, and

- The total variable cost of patient records is denoted as R.

The equations are as follows:

Now, Substitute equation (3) in equation (2).

Then, Substitute the computed value of H in equation (1) and (3):

Equation (1):

Equation (3):

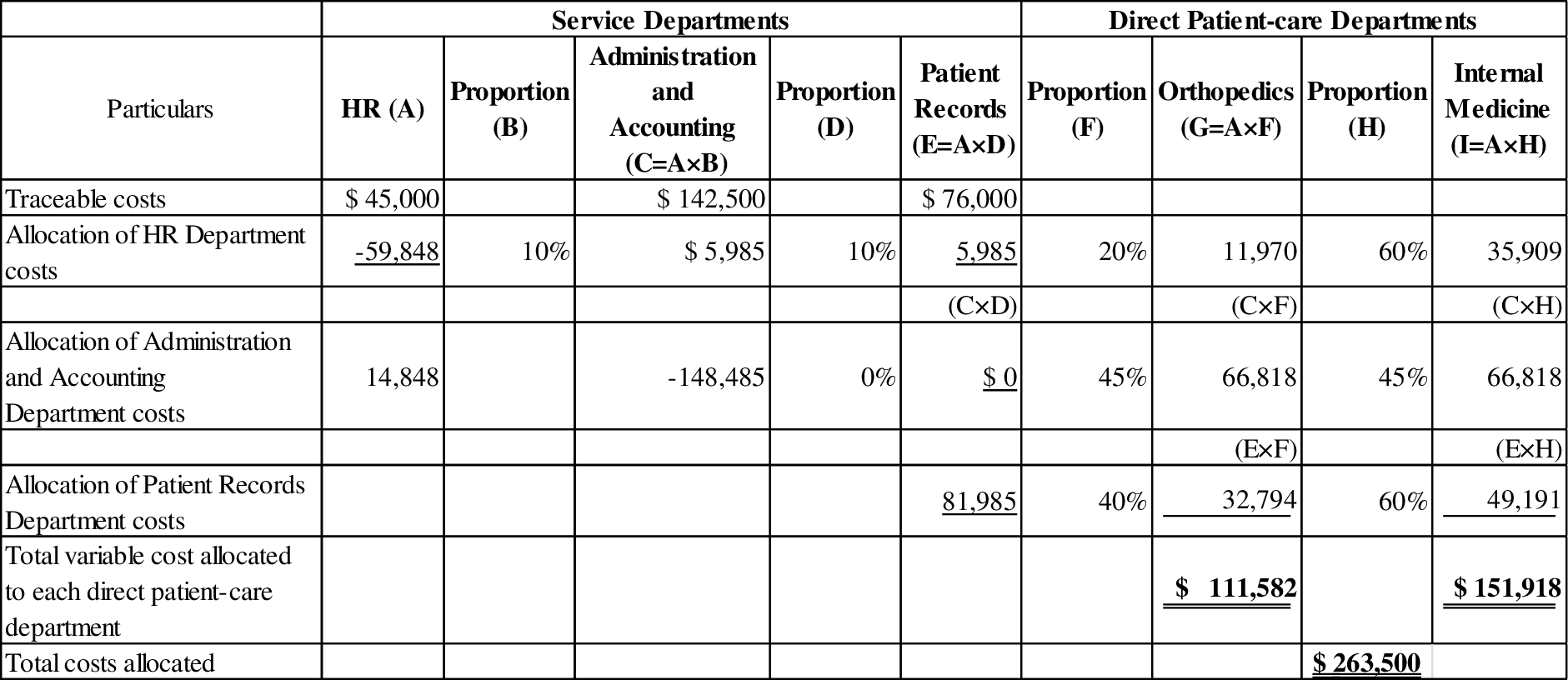

Fixed costs under long-run proportions:

Table (2)

Working note (2):

Assume that:

- The total variable cost of Human resources is denoted as H.

- The total variable cost of Administration and Accounting is denoted as A, and

- The total variable cost of patient records is denoted as R.

The equations are as follows:

Now, Substitute equation (6) in equation (5).

Then, Substitute the computed value of H in equation (4) and (6):

Equation (4):

Equation (6):

Total cost allocated:

| Particulars | Orthopedics | Internal Medicine |

| Variable costs | $ 29,705 | $ 56,796 |

| Add: Fixed costs | $ 111,582 | $ 151,918 |

| Total costs | $ 141,286 | $ 208,714 |

| Grand total | $350,000 | |

Table (3)

Want to see more full solutions like this?

Chapter 17 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- Based on the screenshot, what is the maximim flow?arrow_forwardI want question answer financial accountingarrow_forwardForeign currency remeasurement—Total assets A U.S.-based parent company acquired a European Union–based subsidiary many years ago. The subsidiary is in the service sector, and earns revenues and incurs expenses evenly throughout the year. The following preclosing trial balance includes the subsidiary’s original Euros-based accounting information for the year ended December 31, 2022, immediately prior to closing the company’s nominal accounts into the corresponding balance sheet accounts. It also includes the information converted into $US based on the indicated exchange rates: $US Conversion Weighted- Debits (Credits) Euros Current Average Historical Monetary Assets € 180,000.00 $216,000 $221,400 $234,000 Nonmonetary assets 720,000 864,000 885,600 936,000 Monetary Liabilities (90,000) (108,000) (110,700) (117,000) Nonmonetary liabilities (450,000) (540,000) (553,500) (585,000) Contributed capital (216,000) (259,200) (265,680) (302,400) Retained earnings…arrow_forward

- Foreign currency remeasurement—Stockholders’ equity A U.S.-based parent company acquired a European Union–based subsidiary many years ago. The subsidiary is in the service sector, and earns revenues and incurs expenses evenly throughout the year. The following preclosing trial balance includes the subsidiary’s original Euros-based accounting information for the year ended December 31, 2022, immediately prior to closing the company’s nominal accounts into the corresponding balance sheet accounts. It also includes the information converted into $US based on the indicated exchange rates: $US Conversion Weighted- Debits (Credits) Euros Current Average Historical Monetary Assets € 160,000.00 $192,000 $196,800 $208,000 Nonmonetary assets 640,000 768,000 787,200 832,000 Monetary Liabilities (80,000) (96,000) (98,400) (104,000) Nonmonetary liabilities (400,000) (480,000) (492,000) (520,000) Contributed capital (192,000) (230,400) (236,160) (268,800) Retained…arrow_forward? ? Financial accounting questionarrow_forwardThe income statement of a merchandising company includes Cost of Goods Sold (COGS) and gross profit, which are not found on a service company’s income statement. This is because merchandising companies sell physical products, while service companies provide intangible services. Service company income statements are simpler, usually showing revenue from services minus operating expenses like salaries, rent, and supplies. In short, the main difference is that merchandising firms track product costs and gross profit, while service companies do not. Respond to this post. agree or disagreearrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College