Concept explainers

Biondi Industries is a manufacturer of chemicals for various purposes. One of the processes used by Biondi produces HTP–3, a chemical used in hot tubs and swimming pools; PST–4, a chemical used in pesticides; and RJ–5, a product that is sold to fertilizer manufacturers. Biondi uses the net-realizable-value method to allocate joint production costs. The ratio of output quantities to input quantities of direct material used in the joint process remains consistent from month to month. Biondi Industries uses FIFO (first-in, first-out) in valuing its finished-goods inventories.

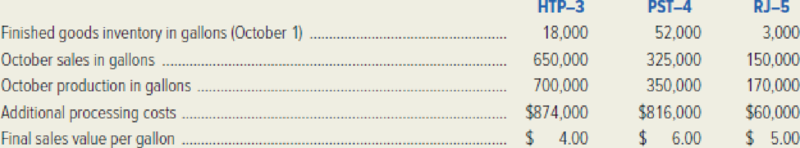

Data regarding Biondi’s operations for the month of October are as follows. During this month, Biondi incurred joint production costs of $1,700,000 in the manufacture of HTP–3, PST–4, and RJ–5.

Required:

- 1. Determine Biondi Industries’ allocation of joint production costs for the month of October. (Carry calculation of relative proportions to four decimal places.)

- 2. Determine the dollar values of the finished-goods inventories for HTP–3, PST–4, and RJ–5 as of October 31. (Round the cost per gallon to the nearest cent.)

- 3. Suppose Biondi Industries has a new opportunity to sell PST–4 at the split-off point for $3.80 per gallon. Prepare an analysis showing whether the company should sell PST–4 at the split-off point or continue to process this product further.

Want to see the full answer?

Check out a sample textbook solution

Chapter 17 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- Larsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardHummer Company uses manufacturing cells to produce its products (a cell is a manufacturing unit dedicated to the production of subassemblies or products). One manufacturing cell produces small motors for lawn mowers. Suppose that the motor manufacturing cell is the cost object. Assume that all or a portion of the following costs must be assigned to the cell. Required: Classify each of the costs as a direct cost or an indirect cost to the motor manufacturing cell. a. Salary of cell supervisor b. Power to heat and cool the plant in which the cell is located c. Materials used to produce the motors d. Maintenance for the cell's equipment (provided by the maintenance department) e. Labor used to produce motors f. Cafeteria that services the plant's employees g. Depreciation on the plant h. Depreciation on equipment used to produce the motors i. Ordering costs for materials used in…arrow_forwardA manufacturing company, Mani Co, has two divisions: Division EX and Division YX. Both divisions make a single standardised product. Division EX makes component TEX, which is supplied to both Division YX and external customers. Division YX makes product YAS using one unit of component TEX and other materials. It then sells the completed product YAS to external customers. To date, Division YX has always bought component TEX from Division EX. The following information is available: Division EX Division YX $ $ Selling price 40 96 Direct materials: Component TEX (40) Direct materials (12) (17) Direct labour (6) (9) Variable overheads (2) (3) Selling and distribution costs (4) (1) Contribution per unit before fixed costs 16 26 Annual fixed costs $500,000 $200,000 Annual external demand (units) 160,000 120,000 Capacity of plant 300,000 130,000 Division EX charges the same price for…arrow_forward

- Pancake Company produces two main products and a by-product out of a joint process. The ratio of output quantities to input quantities of direct materials used in the joint process remains consistent from month to month. Pancake has employed the physical measures method to allocate joint production costs to the two main products. The net realizable value of the by-products is used to reduce the joint production costs before the joint costs are allocated to the main products. Data regarding Pancake's operations for the current month are presented in the table below. During the month, Pancake incurred joint production costs of £2,520,000. The main products are not marketable at the split-off point and, therefore, have to be processed further. First Main Second Product Monthly outputs (kgs) 90,000 I Selling price per kg £30 Separable process costs Required: £540,000 Main Product 150,000 £14 £660,000 By-product 60,000 £2 1. Calculate the net realizable value of the by-product. What is the…arrow_forwardYalland Manufacturing Company makes two different products, M and N. The company’s two departments are named after the products; for example, Product M is made in Department M. Yalland’s accountant has identified the following annual costs associated with these two products. Identify the costs that are (1) direct costs of Department M, (2) direct costs of Department N, and (3) indirect costs. Select the appropriate cost drivers for the indirect costs and allocate these costs to Departments M and N. Determine the total estimated cost of the products made in Departments M and N. Assume that Yalland produced 2,000 units of Product M and 4,000 units of Product N during the year. If Yalland prices its products at cost plus 40 percent of cost, what price per unit must it charge for Product M and for Product N?arrow_forwardChrzan, Inc., manufactures and sells two products: Product E0 and Product N0. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: Expected Production Direct Labor-Hours Per Unit Total Direct Labor-Hours Product E0 330 9.3 3,069 Product N0 1,150 8.3 9,545 Total direct labor-hours 12,614 The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Estimated Expected Activity Activity Cost Pools Activity Measures Overhead Cost Product E0 Product N0 Total Labor-related DLHs $ 297,890 3,069 9,545 12,614 Production orders orders 57,087 450 550 1,000 Order size MHs 581,366 5,150 4,850 10,000 $ 936,343 The activity rate for the Order Size activity cost pool under activity-based costing is closest to: Multiple Choice A. $57.09 per MH B.…arrow_forward

- Hummer Company uses manufacturing cells to produce its products (a cell is a manufacturingunit dedicated to the production of subassemblies or products). One manufacturing cell produces small motors for lawn mowers. Suppose that the motor manufacturing cell is the costobject. Assume that all or a portion of the following costs must be assigned to the cell.a. Salary of cell supervisorb. Power to heat and cool the plant in which the cell is locatedc. Materials used to produce the motorsd. Maintenance for the cell’s equipment (provided by the maintenance department)e. Labor used to produce motorsf. Cafeteria that services the plant’s employeesg. Depreciation on the planth. Depreciation on equipment used to produce the motorsi. Ordering costs for materials used in productionj. Engineering support (provided by the engineering department)k. Cost of maintaining the plant and groundsl. Cost of the plant’s personnel officem. Property tax on the plant and landRequired:Classify each of the costs…arrow_forwardTisNTat, Inc., manufactures and sells two products: Product V5 and Product X3. Data concerning the expected production of each product and the expected total direct labour-hours (DLHs) required to produce that output appear below: Expected Production Direct Labour-Hours Per Unit Total Direct Labour-Hours Product V5 900 5.0 4,500 Product X3 1,000 3.0 3,000 Total direct labour-hours 7,500 The company's total manufacturing overhead is $372,695. If the company allocates all of its overhead based on direct labour-hours, what is the amount of overhead assigned to product V5? Question 11 options: 1) $42,021 2) $46,690 3) $186,348 4) $223,605arrow_forwardTAC Industries, Inc. sells heavy equipment to large corporations and federal, state, and local governments. Corporate sales are the result of a competitive bidding process, where TAC competes against other companies based on selling price. Sales to government, however, are determined on a cost plus basis, where the selling price is determined by adding a fixed markup percentage to the total job cost. Tandy Lane is the cost accountant for the Equipment Division of TAC Industries, Inc. The division is under pressure from senior management to improve income from operations. As Tandy reviewed the division's job cost sheets, she realized that she could increase the division's income from operations by moving a portion of the direct labor hours that had been assigned to the job order cost sheets of corporate customers onto the job order cost sheets of government customers. She believed this would create a "win-win" situation for the division by (1) reducing the cost of corporate jobs, and…arrow_forward

- Alcoa Inc. is the world’s largest producer of aluminum products. One product that Alcoa manufactures is aluminum sheet products for the aerospace industry. The entire output of the Smelting Department is transferred to the Rolling Department. Part of the fully processedgoods from the Rolling Department are sold as rolled sheet, and the remainder of the goods are transferred to the Converting Department for further processing into sheared sheet. Prepare a diagram using T accounts showing the flow of costs from the processing department accounts into the finished goods accounts and then into the cost of goods sold account. The relevant accounts are as follows:Attachmentarrow_forwardAssume you are the department B manager for Marley's Manufacturing. Marley's operates under a cost-based transfer structure. Assume you receive the majority of your raw materials from department A, which sells only to department B (they have no outside sales). After calculating the operating income in dollars and operating income in percentage, analyze the following financial information to determine costs that may need further investigation.arrow_forwardLarge, Inc., manufactures and sells two products: Product G8 and Product 00. Historically, the firm has used a traditional costing system, with direct laborurs as an activity base, to allocated manufaturing overhead to products. Data concerning the expected production of each product and the expected total direct labor-hours (DLHS) required to produce that output appear below: Product GS Product 00 Total direct labor-hours Product G8 Product 00 Activity Cost Pools Labor-related Expected Production 780 380 The direct labor rate is $22.90 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $121.10 $121.50 Machine setups Order size Activity Measures DLHS setups MHS Direct Labor-Hours Per Unit The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: 5.8 2.8 Estimated Overhead Cost $ 59,555 58,390 369,508 $487,453 Total Direct Labor- Hours…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning