Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

11th Edition

ISBN: 9781259727788

Author: Hilton & Platt

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 17, Problem 17E

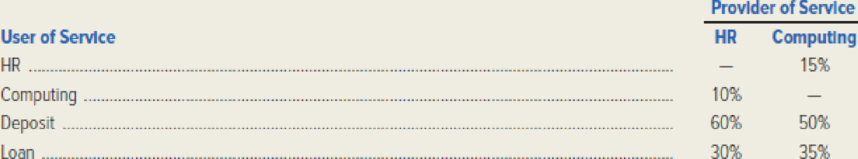

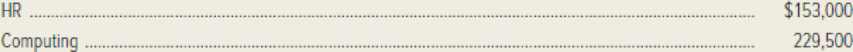

Tuscaloosa National Bank has two service departments, the Human Resources (HR) Department and the Computing Department. The bank has two other departments that directly service customers, the Deposit Department and the Loan Department. The usage of the two service departments’ output for the year is as follows:

The budgeted costs in the two service departments for the year are as follows:

Required: Use the direct method to allocate the budgeted costs of the HR and Computing departments to the Deposit and Loan departments.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Tuscaloosa National Bank has two service departments, the Human Resources (HR) Department and the Computing Department. The

bank has two other departments that directly service customers, the Deposit Department and the Loan Department. The usage of the

two service departments' output for the year is as follows:

User of Service

HR

Computing

Deposit

Loan

Provider of Service

HR

Computing

15%

20%

50%

50%

30%

35%

The budgeted costs in the two service departments for the year are as follows:

HR

Computing

$158,000

238,000

Required:

Use the direct method to allocate the budgeted costs of the HR and Computing departments to the Deposit and Loan departments.

(Do not round intermediate calculations.)

Tuscaloosa National Bank has two service departments, the Human Resources (HR) Department and the Computing Department. The

bank has two other departments that directly service customers, the Deposit Department and the Loan Department. The usage of the

two service departments' output for the year is as follows:

Provider of Service

User of Service

Computing

HR

HR

15%

15%

60%

25%

ed

Computing

Deposit

Loan

55%

30%

The budgeted costs in the two service departments for the year are as follows:

HR

$499, 000

Computing

728, 500

Required:

Use the reciprocal-services method to allocate the budgeted costs of the HR and Computing departments to the Deposit and Loan

departments. (Do not round your intermediate calculations and round final answers to the nearest dollar amount.)

Provider of Service

Deposit

Loan

Allocation of HR Department costs

373,366 O S

186,683

Allocation of Computing Department costs

410,921 X

246,552 O

Total costs allocated to each department

784.287

433.235

*Red text indicates…

Tuscaloosa National Bank has two service departments, the Human Resources (HR) Department and the Computing

Department. The bank has two other departments that directly service customers, the Deposit Department and the

Loan Department. The usage of the two service departments' output for the year is as follows:

Provider of Service

HR

0

Computing

15%

15%

0

60%

55%

25%

30%

User of Service

HR

Computing

Deposit

Loan

The budgeted costs in the two service departments for the year are as follows:

HR

Computing

Required:

$ 499,000

728,500

Use the reciprocal-services method to allocate the budgeted costs of the HR and Computing departments to the

Deposit and Loan departments.

Note: Do not round your Intermediate calculations and round final answers to the nearest dollar amount.

Provider of Service

Allocation of HR Department costs

Allocation of Computing Department costs

Total costs allocated to each department

Deposit

Loan

Chapter 17 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

Ch. 17 - Prob. 1RQCh. 17 - Prob. 2RQCh. 17 - Should actual or budgeted service department costs...Ch. 17 - Prob. 4RQCh. 17 - Why does dual cost allocation improve the...Ch. 17 - What potential behavioral problem can result when...Ch. 17 - Should actual or budgeted service department costs...Ch. 17 - Explain the difference between two-stage...Ch. 17 - Define the following terms: joint production...Ch. 17 - Prob. 10RQ

Ch. 17 - Describe the relative-sales-value method of joint...Ch. 17 - Define the term net realizable value, and explain...Ch. 17 - Are joint cost allocations useful? If they are,...Ch. 17 - For what purpose should the managerial accountant...Ch. 17 - Prob. 15ECh. 17 - Refer to the data given in the preceding exercise....Ch. 17 - Tuscaloosa National Bank has two service...Ch. 17 - Refer to the data given in the preceding exercise....Ch. 17 - Breakfasttime Cereal Company manufactures two...Ch. 17 - Refer to the data given in the preceding exercise....Ch. 17 - Refer to the data given in Exercise 1720....Ch. 17 - Prob. 23ECh. 17 - Prob. 24PCh. 17 - Prob. 25PCh. 17 - Celestial Artistry Company is developing...Ch. 17 - Snake River Sawmill manufactures two lumber...Ch. 17 - Travelcraft Company manufactures a complete line...Ch. 17 - Biondi Industries is a manufacturer of chemicals...Ch. 17 - Berger Company manufactures products Delta, Kappa,...Ch. 17 - Prob. 31PCh. 17 - Lafayette Company manufactures two products out of...Ch. 17 - Refer to the data given in Problem 1726 for...Ch. 17 - Prob. 34PCh. 17 - Top Quality Fruit Company, based on Oahu, grows,...Ch. 17 - Prob. 36C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tuscaloosa National Bank has two service departments, the Human Resources (HR) Department and the Computing Department. The bank has two other departments that directly service customers, the Deposit Department and the Loan Department. The usage of the two service departments' output for the year is as follows: User of Service HR Computing Deposit Loan HR Computing Provider of Service HR Computing 10% The budgeted costs in the two service departments for the year are as follows: $466,000 699,000 10% 70% 20% 45% 45% Required: Use the step-down method to allocate the budgeted costs of the HR and Computing departments to the Deposit and Loan departments. Tuscaloosa National Bank allocates the costs of the HR Department first. (Do not round intermediate calculations.) Allocation of HR Department costs Allocation of Computing Department costs Total costs allocated to each department $ Deposit 0 $ Loan 0arrow_forwardFor this assignment you are to assume that you are involved in the preparation of your company's master budget. The company's sales team provides information concerning expected unit sales and pricing for use in preparation of the sales budget. Further, you are aware that a portion of the sale team's compensation is based on their ability to meet the sales budget. What would the memorandum be to the vice president of finance outlining your concerns about this practice. Include any concerns that you have about potential bias in the information provided by the sales team.arrow_forwardVishalarrow_forward

- Tri-County Social Service Agency is a not-for-profit organization in the Midwest. Use the following information to complete the cash budget for the year ending December 31. The Board of Trustees requires that Tri-County maintain a minimum cash balance of $8,000. If cash is short, the agency may borrow from an endowment fund the amount required to maintain the $8,000 minimum. It is anticipated that the year will begin with an $11,000 cash balance. Contract revenue is received evenly during the year. Mental health income is expected to grow by $5,000 in the second and third quarters; no change is expected in the fourth quarter. Required: 2. Complete the cash budget for each quarter and the year as a whole. 3. Determine the amount that the agency will owe the endowment fund at year-end.arrow_forwardTri-County Social Service Agency is a not-for-profit organization in the Midwest. Use the following Information to complete the cash budget for the year ending December 31. The Board of Trustees requires that Tri-County maintain a minimum cash balance of $8,000. If cash is short, the agency may borrow from an endowment fund the amount required to maintain the $8,000 minimum. It is anticipated that the year will begin with an $11,000 cash balance. Contract revenue is received evenly during the year. Mental health Income is expected to grow by $5,000 in the second and third quarters; no change is expected in the fourth quarter. Required: 2. Complete the cash budget for each quarter and the year as a whole. 3. Determine the amount that the agency will owe the endowment fund at year-end. Complete this question by entering your answers in the tabs below. Required 2 Required 3 Complete the cash budget for each quarter and the year as a whole. (Cash deficiency and repayments should be…arrow_forwardRoberds Tech is a for-profit vocational school. The school bases its budgets on two measures of activity (i.e., cost drivers), namely student and course. The school uses the following data in its budgeting: Revenue Faculty wages Course supplies Administrative expenses Actual students Actual courses Revenue Expenses: Faculty wages Course supplies Administrative expenses Total expense Net operating income In March, the school budgeted for 1,720 students and 69 courses. The school's income statement showing the actual results for the month appears below: Roberds Tech Income Statement For the Month Ended March 31 Students Courses Revenue Expenses: Fixed element per month Faculty wages Course supplies Administrative expenses $0 $0 $0 $ 25,550 Total expense Net operating income Variable element per student $203 $0 $33 Required: Prepare a flexible budget performance report showing both the school's activity variances and revenue and spending variances for March. Label each variance as…arrow_forward

- The management of Mecca Copy, a photocopying center located on University Avenue, has compiled the following data to use in preparing its budgeted balance sheet for next year:arrow_forwardOne of the LGOs deals with the administration of a local property tax department wants to introduce activity based budgeting. One of the ac involved in is dealing with enquiries from taxpayers. The driver fo enquiries, which is expected to be 28,800 per year. Each enquiry take: on average. Staff costs for dealing with such enquiries is $20,000 per staff works 8 hours per day for 240 days a year. A team supervisor is of $35,000 per year. Each member of staff and the supervisor require which is leased at a cost of $200 per terminal. What is the budgeted cost of one enquiry? ABCD $10.41 $11.74 $46.96 $84.65arrow_forwardKellogg Company’s financial managers are meeting with the company’s bank to renew their line of credit and discuss their investment needs. They have prepared the company’s operating cash budget for the last six months of the year. The following budget assumptions were used to construct the budget: • Kellogg’s total sales for each month were first calculated in the sales budget and are reflected on the first line of the cash budget. • Kellogg’s sales are made on credit with terms of 2/10, net 30. Kellogg’s experience is that 25% is collected from customers who take advantage of the discount, 65% is collected in the second month, and the last 10% is collected in the third month after the sale. The budget assumes that there are no bad debts. • The cost of materials averages 55% of Kellogg’s finished product. The purchases are generally made one month in advance of the sale, and Kellogg pays its suppliers in 30 days. Accordingly, if July sales are forecasted at $110.00 million,…arrow_forward

- Springfield Corporation operates on a calendar-year basis. Tt begins the annual budgeting process in late August, when the president establishes targets for total sales dollars and net operating income before taxes for the next year. The sales target is given to the Marketing Department, where the marketing manager formulates a sales budget by product line in both units and dollars. From this budget, sales quotas by Product line in units and dollars are established for each of the corporation’s sales districts. The marketing manager also estimates die cost of the marketing activities required to support the target sales volume and prepares a tentative marketing expense budget. The executive vice president uses the sales and profit targets, the sales budget by product line, and the tentative marketing expense budget to determine the dollar amounts that can be devoted to manufacturing and corporate office expense. The executive vice president prepares the budget for corporate expenses,…arrow_forwardFairview Medical Supply has applied for a loan. First American Bank has requested a budgeted balance sheet as of April 30, and a combined cash budget for April. As Fairview Medical Supply's controller, you have assembled the following information: a. March 31 equipment balance, $52,700; accumulated depreciation, $41,100. b. April capital expenditures of $42,700 budgeted for cash purchase of equipment. c. April depreciation expense, $500. d. Cost of goods sold, 60% of sales. e. Other April operating expenses, including income tax, total $13,400, 30%of which will be paid in cash and the remainder accrued at April 30. f. March 31 owners' equity, $93,600. g. March 31 cash balance, $40,100. h. April budgeted sales, $91,000, 70% of which is for cash. Of the remaining 30%, half will be collected in April and half in May. i. April cash collections on March sales, $29,200. j. April cash payments of March 31 liabilities incurred…arrow_forwardThe Finch Management Association held its annual public relations luncheon in April Year 2. Based on the previous year’s results, the organization allocated $24,312 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: The meal cost per person was expected to be $12.40. The cost driver for meals was attendance, which was expected to be 1,460 individuals. Postage was based on $0.56 per invitation and 3,300 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. The facility charge is $1,600 for a room that will accommodate up to 1,600 people; the charge for one to hold more than 1,600 people is $2,100. A fixed amount was designated for printing, decorations, the speaker’s gift, and publicity. FINCH MANAGEMENT ASSOCIATION…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY