Concept explainers

1.

Allocate the company’s service department costs using the direct method combined with dual allocation.

1.

Explanation of Solution

Service department: A service department is a division in an organization which is not involved directly in producing the goods or services of an organization. But, the service department also offers a service that aids the organization to take place the goods or services that are produced.

Allocate the company’s service department costs using the direct method combined with dual allocation as follows:

Variable costs:

| Provider of Service | Cost to be allocated (a) | Production Departments | |||

| Machining | Assembly | ||||

| Proportion (b) | Amount ($) | Proportion (c) | Amount | ||

| Human resource | $50,000 | $22,222 | $27,778 | ||

| Maintenance | 80,000 | 37,333 | 42,667 | ||

| Computer aided design | 50,000 | 37,500 | 12,500 | ||

| Total | $180,000 | $97,055 | $82,945 | ||

| Grand total | $830,000 | ||||

Table (1)

Note:

The proportions are based on short-run usage.

Fixed costs:

| Provider of Service | Cost to be allocated (a) | Production Departments | |||

| Machining | Assembly | ||||

| Proportion (b) | Amount ($) | Proportion (c) | Amount | ||

| Human resource | $200,000 | $82,353 | $117,647 | ||

| Maintenance | 150,000 | 100,000 | 50,000 | ||

| Computer aided design | 300,000 | 240,000 | 60,000 | ||

| Total | $650,000 | $422,353 | $227,647 | ||

| Grand total | $650,000 | ||||

Table (2)

Note:

The proportions are based on long-run usage.

Total cost allocated:

| Particulars | Machining | Assembly |

| Variable costs | $ 97,055 | $ 82,945 |

| Fixed costs | 422,353 | 227,647 |

| Total costs | $519,408 | $310,592 |

| Grand total | 830,000 | |

Table (3)

2.

Allocate the company’s service department costs using the step-down method combined with dual allocation.

2.

Explanation of Solution

Allocate the company’s service department costs using the step-down method combined with dual allocation:

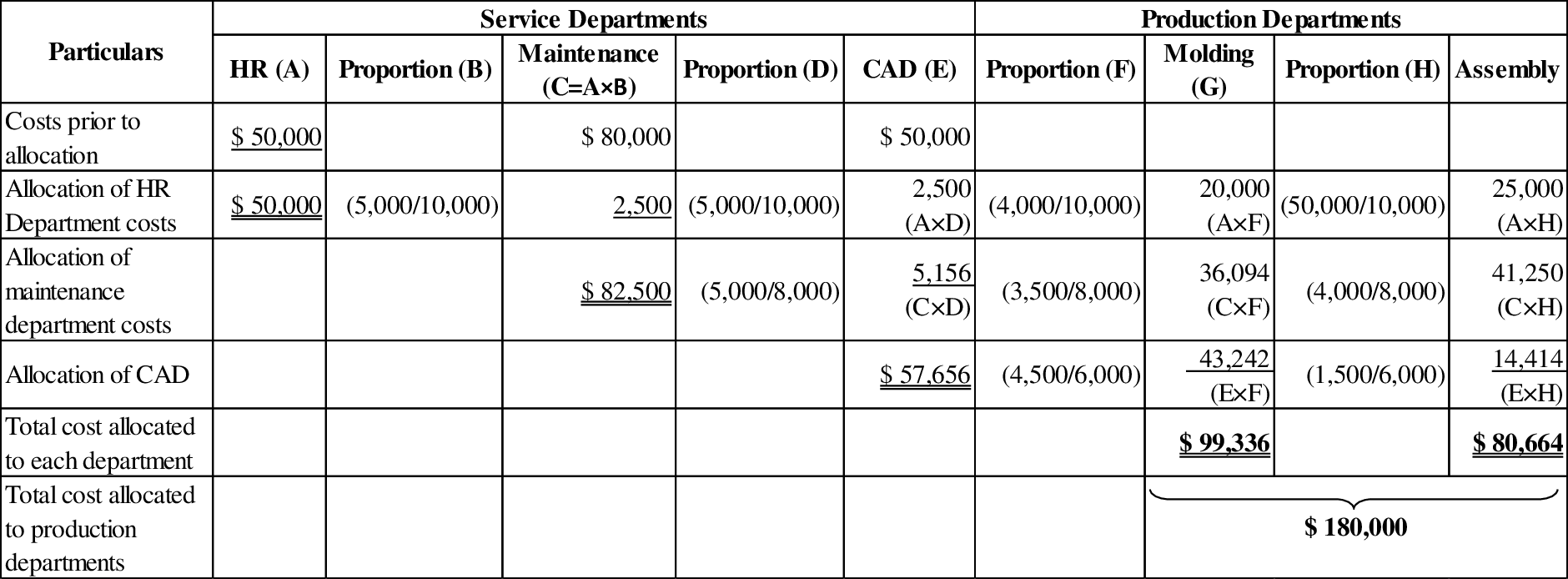

Variable costs:

Table (4)

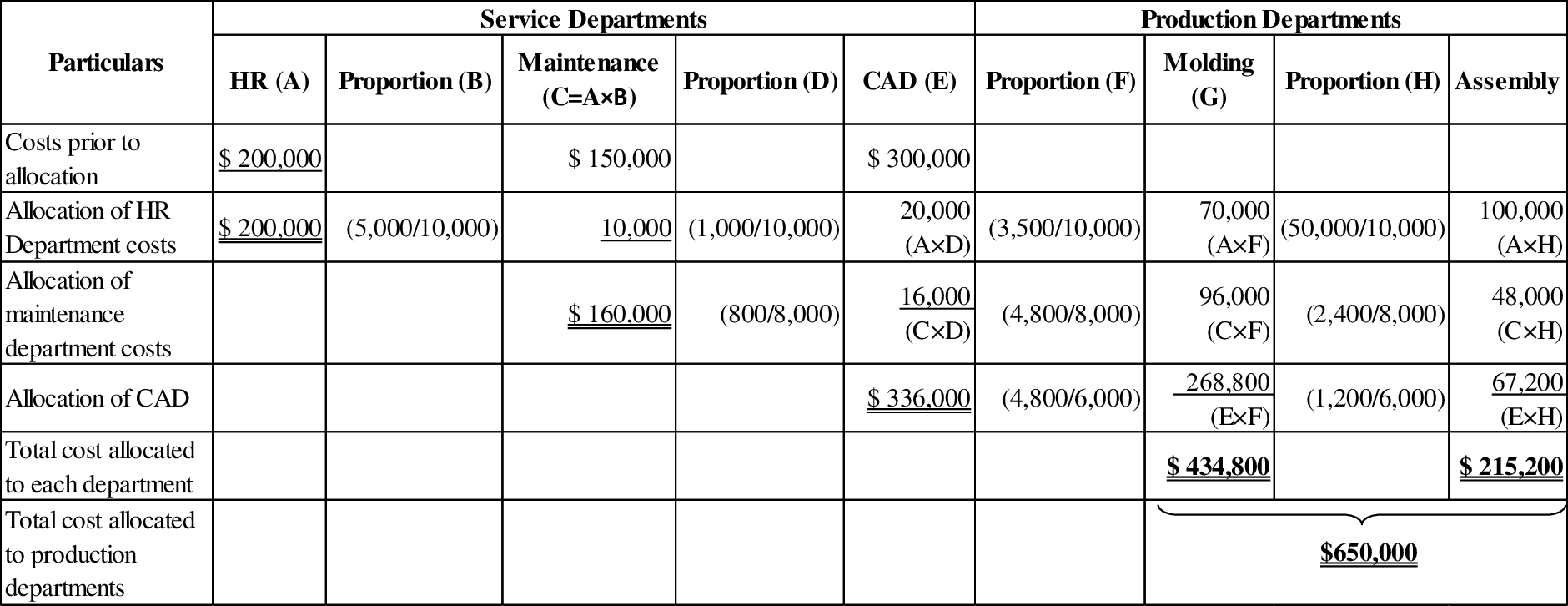

Fixed costs:

Table (5)

Total cost allocated:

| Particulars | Machining | Assembly |

| Variable costs | $ 99,336 | $80,664 |

| Fixed costs | 434,800 | 215,200 |

| Total costs | $534,136 | $295,864 |

| Grand total | 830,000 | |

Table (6)

Want to see more full solutions like this?

Chapter 17 Solutions

Connect 1-Semester Access Card for Managerial Accounting: Creating Value in a Dynamic Business Environment (NEW!!)

- Question: 5.6 - On a particular date, Delta Logistics has a stock price of $92.50 and an EPS of $6.75. Its competitor, Swift Freight, had an EPS of $0.45. What would be the expected price of Swift Freight stock on this date, if estimated using the method of comparables? Solve this Accounting problemarrow_forwardselling shop no use AIarrow_forwardIncorrect questions dont solvearrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning