Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 16, Problem 36P

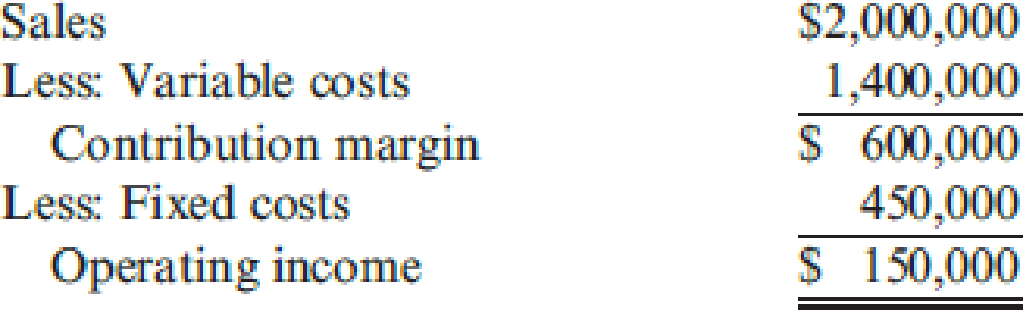

Faldo Company produces a single product. The

Required:

- 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit?

- 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are $200,000 greater than expected. What would the total profit be?

- 3. Compute the margin of safety in sales revenue.

- 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected.

- 5. How many units must be sold to earn a profit equal to 10 percent of sales?

- 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of $180,000?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The following were selected from among the transactions completed by Babcock Company during November of the current year:

Nov.

3

Purchased merchandise on account from Moonlight Co., list price $85,000, trade discount 25%, terms FOB destination, 2/10, n/30.

4

Sold merchandise for cash, $37,680. The cost of the goods sold was $22,600.

5

Purchased merchandise on account from Papoose Creek Co., $47,500, terms FOB shipping point, 2/10, n/30, with prepaid freight of $810 added to the invoice.

6

Returned merchandise with an invoice amount of $13,500 ($18,000 list price less trade discount of 25%) purchased on November 3 from Moonlight Co.

8

Sold merchandise on account to Quinn Co., $15,600 with terms n/15. The cost of the goods sold was $9,400.

13

Paid Moonlight Co. on account for purchase of November 3, less return of November 6.

14

Sold merchandise with a list price of $236,000 to customers who used VISA and who redeemed $8,000 of pointof- sale coupons. The cost…

Hello teacher please solve this questions

Help me to solve this questions

Chapter 16 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 16 - Prob. 1DQCh. 16 - Describe the difference between the units-sold...Ch. 16 - Define the term break-even point.Ch. 16 - Explain why contribution margin per unit becomes...Ch. 16 - A restaurant owner who had yet to earn a monthly...Ch. 16 - What is the variable cost ratio? The contribution...Ch. 16 - Prob. 7DQCh. 16 - Suppose a firm with a contribution margin ratio of...Ch. 16 - Prob. 9DQCh. 16 - Explain how CVP analysis developed for single...

Ch. 16 - Prob. 11DQCh. 16 - How do income taxes affect the break-even point...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Prob. 15DQCh. 16 - Prob. 1CECh. 16 - Prob. 2CECh. 16 - Health-Temp Company is a placement agency for...Ch. 16 - Olivian Company wants to earn 420,000 in net...Ch. 16 - Vandenberg, Inc., produces and sells two products:...Ch. 16 - Prob. 6CECh. 16 - Prob. 7CECh. 16 - Prob. 8ECh. 16 - Gelbart Company manufactures gas grills. Fixed...Ch. 16 - Schylar Pharmaceuticals, Inc., plans to sell...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Big Red Motors, Inc., employs 15 sales personnel...Ch. 16 - Sports-Reps, Inc., represents professional...Ch. 16 - Campbell Company manufactures and sells adjustable...Ch. 16 - Prob. 16ECh. 16 - Sara Pacheco is a sophomore in college and earns a...Ch. 16 - Carmichael Corporation is in the process of...Ch. 16 - Choose the best answer for each of the following...Ch. 16 - Prob. 20ECh. 16 - Income statements for two different companies in...Ch. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Busy-Bee Baking Company produces a variety of...Ch. 16 - Prob. 25ECh. 16 - Jester Company had unit contribution margin on...Ch. 16 - Loessing Company produced and sold 12,000 units...Ch. 16 - Junior Company has a breakeven point of 34,600...Ch. 16 - Prob. 29ECh. 16 - If a companys variable cost per unit increases,...Ch. 16 - Prob. 31PCh. 16 - More-Power Company has projected sales of 75,000...Ch. 16 - Consider the following information on four...Ch. 16 - Hammond Company runs a driving range and golf...Ch. 16 - Prob. 35PCh. 16 - Faldo Company produces a single product. The...Ch. 16 - Katayama Company produces a variety of products....Ch. 16 - Prob. 38PCh. 16 - Prob. 39PCh. 16 - Prob. 40PCh. 16 - Salem Electronics currently produces two products:...Ch. 16 - Good Scent, Inc., produces two colognes: Rose and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License