Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 16, Problem 24E

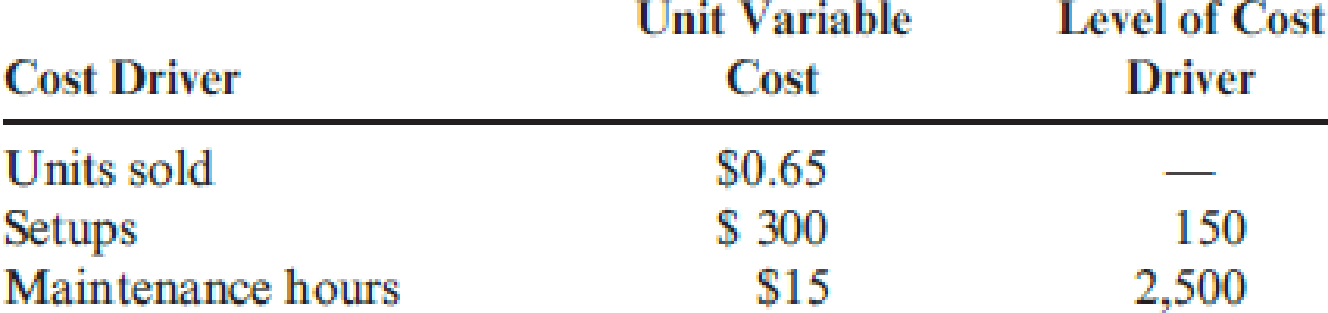

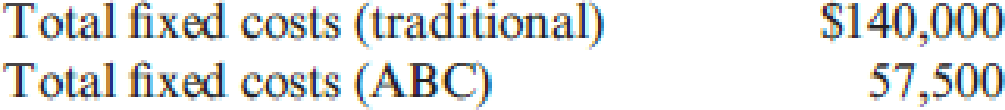

Busy-Bee Baking Company produces a variety of breads. The average price of a loaf of bread is $1. Costs are as follows:

Other data:

Required:

- 1. Compute the break-even point in units using conventional analysis.

- 2. Compute the break-even point in units using activity-based analysis.

- 3. Suppose that Busy-Bee could reduce the setup cost by $100 per setup and could reduce the number of maintenance hours needed to 1,000. How many units must be sold to break even in this case? (Round answer up to whole units.)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the expected dividend next year on these financial accounting question?

Please give me true answer this financial accounting question

Need help with this financial accounting question

Chapter 16 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 16 - Prob. 1DQCh. 16 - Describe the difference between the units-sold...Ch. 16 - Define the term break-even point.Ch. 16 - Explain why contribution margin per unit becomes...Ch. 16 - A restaurant owner who had yet to earn a monthly...Ch. 16 - What is the variable cost ratio? The contribution...Ch. 16 - Prob. 7DQCh. 16 - Suppose a firm with a contribution margin ratio of...Ch. 16 - Prob. 9DQCh. 16 - Explain how CVP analysis developed for single...

Ch. 16 - Prob. 11DQCh. 16 - How do income taxes affect the break-even point...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Prob. 15DQCh. 16 - Prob. 1CECh. 16 - Prob. 2CECh. 16 - Health-Temp Company is a placement agency for...Ch. 16 - Olivian Company wants to earn 420,000 in net...Ch. 16 - Vandenberg, Inc., produces and sells two products:...Ch. 16 - Prob. 6CECh. 16 - Prob. 7CECh. 16 - Prob. 8ECh. 16 - Gelbart Company manufactures gas grills. Fixed...Ch. 16 - Schylar Pharmaceuticals, Inc., plans to sell...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Big Red Motors, Inc., employs 15 sales personnel...Ch. 16 - Sports-Reps, Inc., represents professional...Ch. 16 - Campbell Company manufactures and sells adjustable...Ch. 16 - Prob. 16ECh. 16 - Sara Pacheco is a sophomore in college and earns a...Ch. 16 - Carmichael Corporation is in the process of...Ch. 16 - Choose the best answer for each of the following...Ch. 16 - Prob. 20ECh. 16 - Income statements for two different companies in...Ch. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Busy-Bee Baking Company produces a variety of...Ch. 16 - Prob. 25ECh. 16 - Jester Company had unit contribution margin on...Ch. 16 - Loessing Company produced and sold 12,000 units...Ch. 16 - Junior Company has a breakeven point of 34,600...Ch. 16 - Prob. 29ECh. 16 - If a companys variable cost per unit increases,...Ch. 16 - Prob. 31PCh. 16 - More-Power Company has projected sales of 75,000...Ch. 16 - Consider the following information on four...Ch. 16 - Hammond Company runs a driving range and golf...Ch. 16 - Prob. 35PCh. 16 - Faldo Company produces a single product. The...Ch. 16 - Katayama Company produces a variety of products....Ch. 16 - Prob. 38PCh. 16 - Prob. 39PCh. 16 - Prob. 40PCh. 16 - Salem Electronics currently produces two products:...Ch. 16 - Good Scent, Inc., produces two colognes: Rose and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For the purposes of the 20x0 annual financial statements, how would the additional shares of Series A preferred stock issued from Company Y to Company Y's original investor on November 1 20X0 affect the measurment of the company Y's series A preferred stock purchased on may 1, 20x0?arrow_forwardGeneral Accountingarrow_forwardFinancial Accounting Questionarrow_forward

- What is the investment turnover for this financial accounting question?arrow_forwardSuppose you take out a five-year car loan for $14000, paying an annual interest rate of 4%. You make monthly payments of $258 for this loan. Complete the table below as you pay off the loan. Months Amount still owed 4% Interest on amount still owed (Remember to divide by 12 for monthly interest) Amount of monthly payment that goes toward paying off the loan (after paying interest) 0 14000 1 2 3 + LO 5 6 7 8 9 10 10 11 12 What is the total amount paid in interest over this first year of the loan?arrow_forwardSuppose you take out a five-year car loan for $12000, paying an annual interest rate of 3%. You make monthly payments of $216 for this loan. mocars Getting started (month 0): Here is how the process works. When you buy the car, right at month 0, you owe the full $12000. Applying the 3% interest to this (3% is "3 per $100" or "0.03 per $1"), you would owe 0.03*$12000 = $360 for the year. Since this is a monthly loan, we divide this by 12 to find the interest payment of $30 for the month. You pay $216 for the month, so $30 of your payment goes toward interest (and is never seen again...), and (216-30) = $186 pays down your loan. (Month 1): You just paid down $186 off your loan, so you now owe $11814 for the car. Using a similar process, you would owe 0.03* $11814 = $354.42 for the year, so (dividing by 12), you owe $29.54 in interest for the month. This means that of your $216 monthly payment, $29.54 goes toward interest and $186.46 pays down your loan. The values from above are included…arrow_forward

- Suppose you have an investment account that earns an annual 9% interest rate, compounded monthly. It took $500 to open the account, so your opening balance is $500. You choose to make fixed monthly payments of $230 to the account each month. Complete the table below to track your savings growth. Months Amount in account (Principal) 9% Interest gained (Remember to divide by 12 for monthly interest) Monthly Payment 1 2 3 $500 $230 $230 $230 $230 + $230 $230 10 6 $230 $230 8 9 $230 $230 10 $230 11 $230 12 What is the total amount gained in interest over this first year of this investment plan?arrow_forwardGiven correct answer general Accounting questionarrow_forwardFinancial accounting questionarrow_forward

- General accountingarrow_forwardHii expert please given correct answer general Accounting questionarrow_forwardOn 1st May, 2024 you are engaged to audit the financial statement of Giant Pharmacy for the period ending 30th December 2023. The Pharmacy is located at Mgeni Nani at the outskirts of Mtoni Kijichi in Dar es Salaam City. Materiality is judged to be TZS. 200,000/=. During the audit you found that all tests produced clean results. As a matter of procedures you drafted an audit report with an unmodified opinion to be signed by the engagement partner. The audit partner reviewed your file in October, 2024 and concluded that your audit complied with all requirements of the international standards on auditing and that; sufficient appropriate audit evidence was in the file to support a clean audit opinion. Subsequently, an audit report with an unmodified opinion was issued on 1st November, 2024. On 18th January 2025, you receive a letter from Dr. Fatma Shemweta, the Executive Director of the pharmacy informing you that their cashier who has just absconded has been arrested in Kigoma with TZS.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License