Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 16, Problem 21E

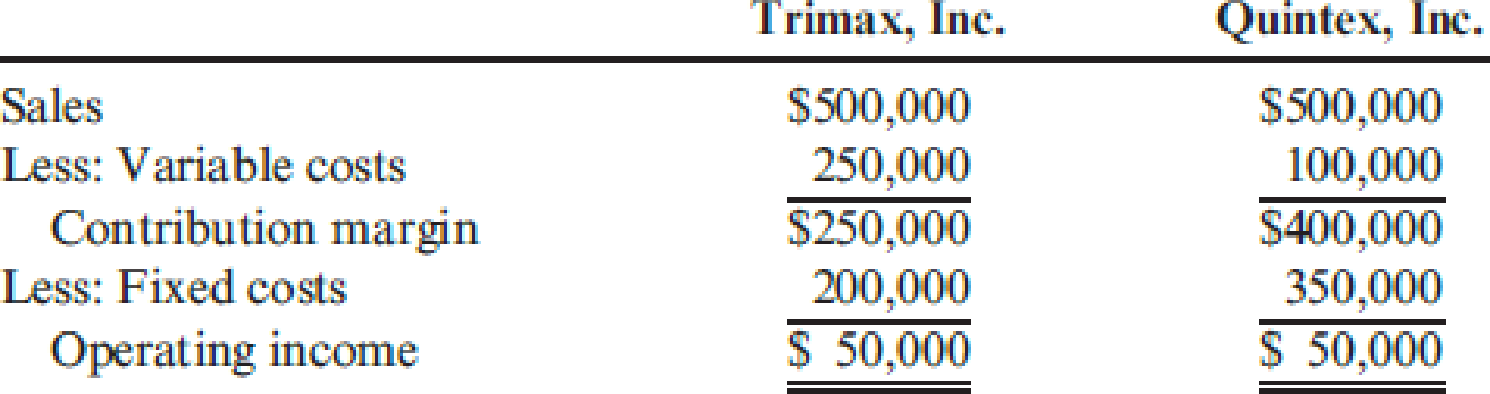

Income statements for two different companies in the same industry are as follows:

Required:

- 1. Compute the degree of operating leverage for each company.

- 2. Compute the break-even point for each company. Explain why the break-even point for Quintex, Inc., is higher.

- 3. Suppose that both companies experience a 50 percent increase in revenues. Compute the percentage change in profits for each company. Explain why the percentage increase in Quintex’s profits is so much greater than that of Trimax.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

hello teacher please solve questions

hi expert please help me financial accounting

need help this questions

Chapter 16 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 16 - Prob. 1DQCh. 16 - Describe the difference between the units-sold...Ch. 16 - Define the term break-even point.Ch. 16 - Explain why contribution margin per unit becomes...Ch. 16 - A restaurant owner who had yet to earn a monthly...Ch. 16 - What is the variable cost ratio? The contribution...Ch. 16 - Prob. 7DQCh. 16 - Suppose a firm with a contribution margin ratio of...Ch. 16 - Prob. 9DQCh. 16 - Explain how CVP analysis developed for single...

Ch. 16 - Prob. 11DQCh. 16 - How do income taxes affect the break-even point...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Explain how a change in sales mix can change a...Ch. 16 - Prob. 15DQCh. 16 - Prob. 1CECh. 16 - Prob. 2CECh. 16 - Health-Temp Company is a placement agency for...Ch. 16 - Olivian Company wants to earn 420,000 in net...Ch. 16 - Vandenberg, Inc., produces and sells two products:...Ch. 16 - Prob. 6CECh. 16 - Prob. 7CECh. 16 - Prob. 8ECh. 16 - Gelbart Company manufactures gas grills. Fixed...Ch. 16 - Schylar Pharmaceuticals, Inc., plans to sell...Ch. 16 - Prob. 11ECh. 16 - Prob. 12ECh. 16 - Big Red Motors, Inc., employs 15 sales personnel...Ch. 16 - Sports-Reps, Inc., represents professional...Ch. 16 - Campbell Company manufactures and sells adjustable...Ch. 16 - Prob. 16ECh. 16 - Sara Pacheco is a sophomore in college and earns a...Ch. 16 - Carmichael Corporation is in the process of...Ch. 16 - Choose the best answer for each of the following...Ch. 16 - Prob. 20ECh. 16 - Income statements for two different companies in...Ch. 16 - Prob. 22ECh. 16 - Prob. 23ECh. 16 - Busy-Bee Baking Company produces a variety of...Ch. 16 - Prob. 25ECh. 16 - Jester Company had unit contribution margin on...Ch. 16 - Loessing Company produced and sold 12,000 units...Ch. 16 - Junior Company has a breakeven point of 34,600...Ch. 16 - Prob. 29ECh. 16 - If a companys variable cost per unit increases,...Ch. 16 - Prob. 31PCh. 16 - More-Power Company has projected sales of 75,000...Ch. 16 - Consider the following information on four...Ch. 16 - Hammond Company runs a driving range and golf...Ch. 16 - Prob. 35PCh. 16 - Faldo Company produces a single product. The...Ch. 16 - Katayama Company produces a variety of products....Ch. 16 - Prob. 38PCh. 16 - Prob. 39PCh. 16 - Prob. 40PCh. 16 - Salem Electronics currently produces two products:...Ch. 16 - Good Scent, Inc., produces two colognes: Rose and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected comparative financial statements of Korbin Company follow. Sales KORBIN COMPANY Comparative Income Statements For Years Ended December 31 2021 2020 $ 512,008 $ 392,240 2019 $ 272,200 Cost of goods sold 308,229 245,542 174,208 Gross profit 203,779 146,698 97,992 Selling expenses 72,705 54,129 35,930 Administrative expenses 46,081 34,517 22,593 Total expenses 118,786 88,646 58,523 Income before taxes .84,993 58,052 39,469 Income tax expense 15,809 11,901 8,012 Net income $ 69,184 $ 46,151 $ 31,457 KORBIN COMPANY Comparative Balance Sheets Assets Current assets Long-term investments Plant assets, net Total assets Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings December 31 2021 2020 2019 $ 54,370 0 $ 36,390 600 $ 48,645 3,870 99,436 90,776 53,339 Total liabilities and equity $ 153,806 $ 127,766 $ 105,854 $ 22,456 $ 19,037 $ 18,524 68,000 68,000 50,000 8,500 8,500 5,556 54,850 32,229 31,774 $ 153,806 $ 127,766 $ 105,854arrow_forwardprovide correct answer mearrow_forwardgeneral accountingarrow_forward

- E3-17 (Algo) Calculating Equivalent Units, Unit Costs, and Cost Assigned (Weighted-Average Method) [LO 3-2] Vista Vacuum Company has the following production Information for the month of March. All materials are added at the beginning of the manufacturing process. Units . • Beginning Inventory of 3,500 units that are 100 percent complete for materials and 28 percent complete for conversion. 14,600 units started during the period. Ending Inventory of 4,200 units that are 14 percent complete for conversion. Manufacturing Costs Beginning Inventory was $20,500 ($10,100 materials and $10,400 conversion costs). Costs added during the month were $28,400 for materials and $51,500 for conversion ($26.700 labor and $24,800 applied overhead). Assume the company uses Weighted-Average Method. Required: 1. Calculate the number of equivalent units of production for materials and conversion for March. 2. Calculate the cost per equivalent unit for materials and conversion for March. 3. Determine the…arrow_forwardNonearrow_forwardAccounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License