Concept explainers

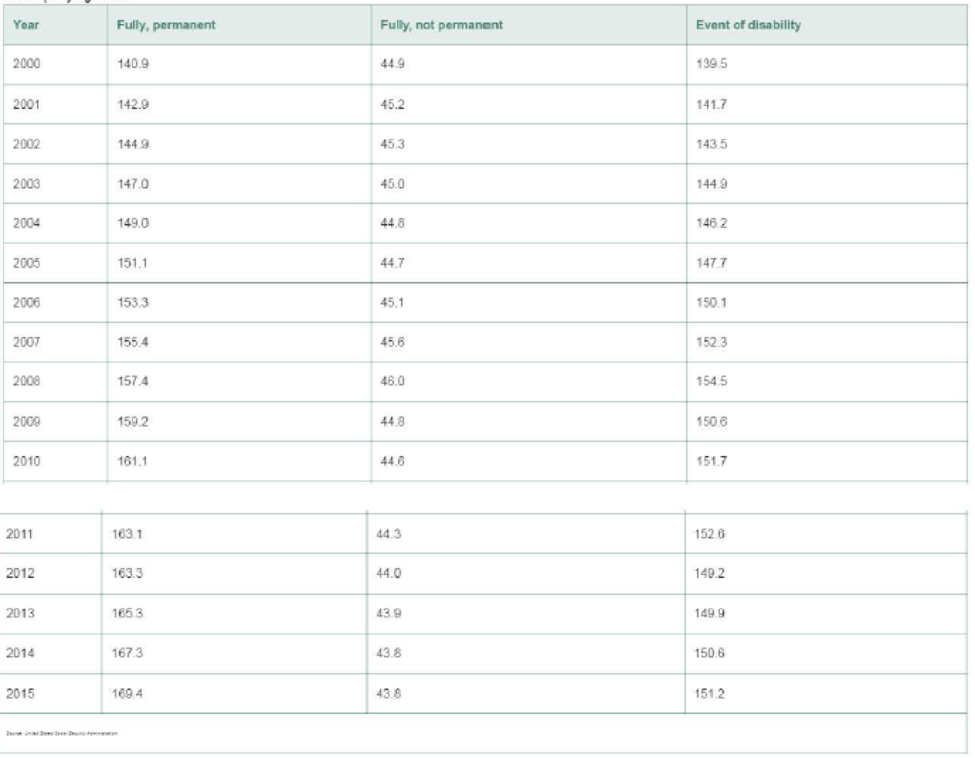

Insured Social Security workers. Workers insured under the Social Security program are categorized as fully and permanently insured, fully but not permanently insured, or insured in the

a. Compute a simple composite index for the number of workers in the three insured categories using 2000 as the base period.

b. Is the index, part a, a price index or a quantity index?

c. Refer to part a. Interpret the index value for 2015.

a.

To compute: The simple composite index for the number of workers in the three insured categories using 2000 as the base period.

Answer to Problem 14.58ACB

The simple composite index for the number of workers in the three insured categories using 2000 as the base period is,

| Year | Fully Permanent | Fully Not Permanent | Event Disability | Index |

| 2000 | 140.9 | 44.9 | 139.5 | 100.0 |

| 2001 | 142.9 | 45.2 | 141.7 | 101.4 |

| 2002 | 144.9 | 45.3 | 143.5 | 102.6 |

| 2003 | 147 | 45 | 144.9 | 103.6 |

| 2004 | 149 | 44.8 | 146.2 | 104.5 |

| 2005 | 151.1 | 44.7 | 147.7 | 105.6 |

| 2006 | 153.3 | 45.1 | 150.1 | 107.1 |

| 2007 | 155.4 | 45.6 | 152.3 | 108.6 |

| 2008 | 157.4 | 46 | 154.5 | 110.0 |

| 2009 | 159.2 | 44.8 | 150.6 | 109.0 |

| 2010 | 161.1 | 44.6 | 151.7 | 109.9 |

| 2011 | 163.1 | 44.3 | 152.6 | 110.7 |

| 2012 | 163.3 | 44 | 149.2 | 109.6 |

| 2013 | 165.3 | 43.9 | 149.9 | 110.4 |

| 2014 | 167.3 | 43.8 | 150.6 | 111.2 |

| 2015 | 169.4 | 43.8 | 151.2 | 112.0 |

Explanation of Solution

Given info:

The table shows that the number of workers in different categories from 2000 to 2015.

Calculation:

The total number of workers in fully and permanently insured, fully but not permanently insured or insured in the event of disability of the years 2000-2015 is obtained as follows:

The total number of workers in fully and permanently insured, fully but not permanently insured or insured in the event of disability of the 2000 is obtained by adding the number of workers in fully and permanently insured, fully but not permanently insured or insured in the event of disability of the year 2000.

Similarly the totals of the remaining years 2001-2015 is as follows:

| Year | Fully Permanent | Fully Not Permanent | Event Disability | Sum |

| 2000 | 140.9 | 44.9 | 139.5 | 325.3 |

| 2001 | 142.9 | 45.2 | 141.7 | 329.8 |

| 2002 | 144.9 | 45.3 | 143.5 | 333.7 |

| 2003 | 147 | 45 | 144.9 | 336.9 |

| 2004 | 149 | 44.8 | 146.2 | 340.0 |

| 2005 | 151.1 | 44.7 | 147.7 | 343.5 |

| 2006 | 153.3 | 45.1 | 150.1 | 348.5 |

| 2007 | 155.4 | 45.6 | 152.3 | 353.3 |

| 2008 | 157.4 | 46 | 154.5 | 357.9 |

| 2009 | 159.2 | 44.8 | 150.6 | 354.6 |

| 2010 | 161.1 | 44.6 | 151.7 | 357.4 |

| 2011 | 163.1 | 44.3 | 152.6 | 360.0 |

| 2012 | 163.3 | 44 | 149.2 | 356.5 |

| 2013 | 165.3 | 43.9 | 149.9 | 359.1 |

| 2014 | 167.3 | 43.8 | 150.6 | 361.7 |

| 2015 | 169.4 | 43.8 | 151.2 | 364.4 |

The formula to find the simple composite index is,

For year 2000:

The simple composite index for the number of workers in the three insured categories for year 2000 using 2000 as the base period is as follows:

Substitute 325.3 for “Sum value at time t” and 325.3 for “Time series value at base period”

Similarly, the simple composite index for the remaining years using 2000 as the base year is as follows:

| Year | Fully Permanent | Fully Not Permanent | Event Disability | Sum | Simple Composite Index-2000 |

| 2000 | 140.9 | 44.9 | 139.5 | 325.3 | 100.0 |

| 2001 | 142.9 | 45.2 | 141.7 | 329.8 | 101.4 |

| 2002 | 144.9 | 45.3 | 143.5 | 333.7 | 102.6 |

| 2003 | 147 | 45 | 144.9 | 336.9 | 103.6 |

| 2004 | 149 | 44.8 | 146.2 | 340.0 | 104.5 |

| 2005 | 151.1 | 44.7 | 147.7 | 343.5 | 105.6 |

| 2006 | 153.3 | 45.1 | 150.1 | 348.5 | 107.1 |

| 2007 | 155.4 | 45.6 | 152.3 | 353.3 | 108.6 |

| 2008 | 157.4 | 46 | 154.5 | 357.9 | 110.0 |

| 2009 | 159.2 | 44.8 | 150.6 | 354.6 | 109.0 |

| 2010 | 161.1 | 44.6 | 151.7 | 357.4 | 109.9 |

| 2011 | 163.1 | 44.3 | 152.6 | 360.0 | 110.7 |

| 2012 | 163.3 | 44 | 149.2 | 356.5 | 109.6 |

| 2013 | 165.3 | 43.9 | 149.9 | 359.1 | 110.4 |

| 2014 | 167.3 | 43.8 | 150.6 | 361.7 | 111.2 |

| 2015 | 169.4 | 43.8 | 151.2 | 364.4 | 112.0 |

b.

To identify: Whether the index in part (a) is price index or quantity index.

Answer to Problem 14.58ACB

The index in part (a) is quantity index.

Explanation of Solution

Justification:

From the given information it can be observed that the index in part (a) represents the quantities. Thus, the index in part (a) is quantity index.

c.

To interpret: The index value for 2015.

Answer to Problem 14.58ACB

The index value for 2015 interprets that the total number of insured workers in 2015 is increased by 12.0% when the base year is 2000.

Explanation of Solution

Justification:

Here, it is observed that the total number of insured workers in 2015 is increased by 12.0%

Want to see more full solutions like this?

Chapter 14 Solutions

Statistics for Business and Economics (13th Edition)

- For a binary asymmetric channel with Py|X(0|1) = 0.1 and Py|X(1|0) = 0.2; PX(0) = 0.4 isthe probability of a bit of “0” being transmitted. X is the transmitted digit, and Y is the received digit.a. Find the values of Py(0) and Py(1).b. What is the probability that only 0s will be received for a sequence of 10 digits transmitted?c. What is the probability that 8 1s and 2 0s will be received for the same sequence of 10 digits?d. What is the probability that at least 5 0s will be received for the same sequence of 10 digits?arrow_forwardV2 360 Step down + I₁ = I2 10KVA 120V 10KVA 1₂ = 360-120 or 2nd Ratio's V₂ m 120 Ratio= 360 √2 H I2 I, + I2 120arrow_forwardQ2. [20 points] An amplitude X of a Gaussian signal x(t) has a mean value of 2 and an RMS value of √(10), i.e. square root of 10. Determine the PDF of x(t).arrow_forward

- In a network with 12 links, one of the links has failed. The failed link is randomlylocated. An electrical engineer tests the links one by one until the failed link is found.a. What is the probability that the engineer will find the failed link in the first test?b. What is the probability that the engineer will find the failed link in five tests?Note: You should assume that for Part b, the five tests are done consecutively.arrow_forwardProblem 3. Pricing a multi-stock option the Margrabe formula The purpose of this problem is to price a swap option in a 2-stock model, similarly as what we did in the example in the lectures. We consider a two-dimensional Brownian motion given by W₁ = (W(¹), W(2)) on a probability space (Q, F,P). Two stock prices are modeled by the following equations: dX = dY₁ = X₁ (rdt+ rdt+0₁dW!) (²)), Y₁ (rdt+dW+0zdW!"), with Xo xo and Yo =yo. This corresponds to the multi-stock model studied in class, but with notation (X+, Y₁) instead of (S(1), S(2)). Given the model above, the measure P is already the risk-neutral measure (Both stocks have rate of return r). We write σ = 0₁+0%. We consider a swap option, which gives you the right, at time T, to exchange one share of X for one share of Y. That is, the option has payoff F=(Yr-XT). (a) We first assume that r = 0 (for questions (a)-(f)). Write an explicit expression for the process Xt. Reminder before proceeding to question (b): Girsanov's theorem…arrow_forwardProblem 1. Multi-stock model We consider a 2-stock model similar to the one studied in class. Namely, we consider = S(1) S(2) = S(¹) exp (σ1B(1) + (M1 - 0/1 ) S(²) exp (02B(2) + (H₂- M2 where (B(¹) ) +20 and (B(2) ) +≥o are two Brownian motions, with t≥0 Cov (B(¹), B(2)) = p min{t, s}. " The purpose of this problem is to prove that there indeed exists a 2-dimensional Brownian motion (W+)+20 (W(1), W(2))+20 such that = S(1) S(2) = = S(¹) exp (011W(¹) + (μ₁ - 01/1) t) 롱) S(²) exp (021W (1) + 022W(2) + (112 - 03/01/12) t). where σ11, 21, 22 are constants to be determined (as functions of σ1, σ2, p). Hint: The constants will follow the formulas developed in the lectures. (a) To show existence of (Ŵ+), first write the expression for both W. (¹) and W (2) functions of (B(1), B(²)). as (b) Using the formulas obtained in (a), show that the process (WA) is actually a 2- dimensional standard Brownian motion (i.e. show that each component is normal, with mean 0, variance t, and that their…arrow_forward

- The scores of 8 students on the midterm exam and final exam were as follows. Student Midterm Final Anderson 98 89 Bailey 88 74 Cruz 87 97 DeSana 85 79 Erickson 85 94 Francis 83 71 Gray 74 98 Harris 70 91 Find the value of the (Spearman's) rank correlation coefficient test statistic that would be used to test the claim of no correlation between midterm score and final exam score. Round your answer to 3 places after the decimal point, if necessary. Test statistic: rs =arrow_forwardBusiness discussarrow_forwardBusiness discussarrow_forward

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning

College Algebra (MindTap Course List)AlgebraISBN:9781305652231Author:R. David Gustafson, Jeff HughesPublisher:Cengage Learning Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill