Concept explainers

Customer profitability and ethics. KC Corporation manufactures an air-freshening device called GoodAir, which it sells to six merchandising firms. The list price of a GoodAir is $30, and the full

KC Corporation makes products based on anticipated demand. KC carries an inventory of GoodAir, so rush orders do not result in any extra manufacturing costs over and above the $18 per unit. KC ships finished product to the customer at no additional charge for either regular or expedited delivery. KC incurs significantly higher costs for expedited deliveries than for regular deliveries. Customers occasionally return shipments to KC, and the company subtracts these returns from gross revenue. The customers are not charged a restocking fee for returns.

Budgeted (expected) customer-level cost driver rates are:

| Order taking (excluding sales commission) | $15 per order |

| Product handling | $1 per unit |

| Delivery | $1.20 per mile driven |

| Expedited (rush) delivery | $175 per shipment |

| Restocking | $50 per returned shipment |

| Visits to customers | $125 per customer |

Because salespeople are paid $10 per order, they often break up large orders into multiple smaller orders. This practice reduces the actual order-taking cost by $7 per smaller order (from $15 per order to $8 per order) because the smaller orders are all written at the same time. This lower cost rate is not included in budgeted rates because salespeople create smaller orders without telling management or the accounting department. All other actual costs are the same as budgeted costs.

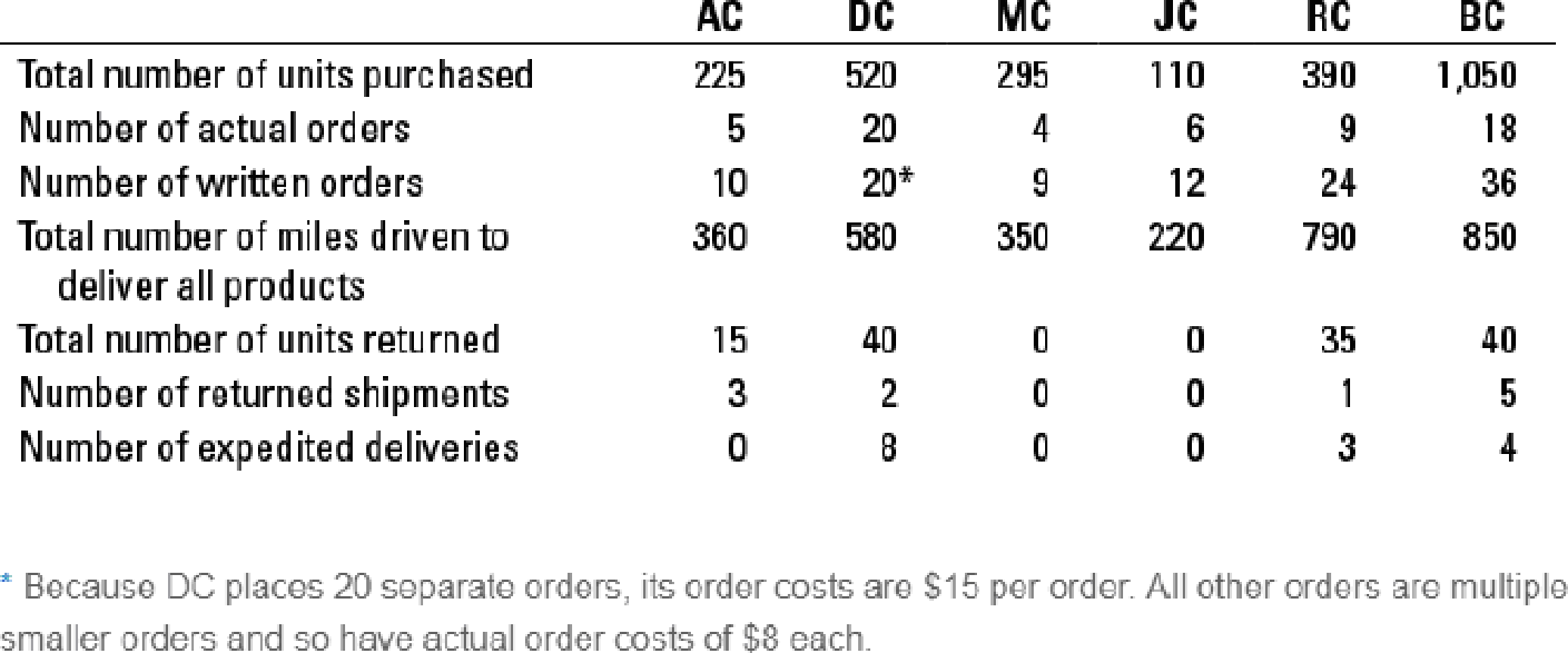

Information about KC’s clients follows:

- 1. Classify each of the customer-level operating costs as a customer output unit–level, customer batch-level, or customer-sustaining cost.

Required

- 2. Using the preceding information, calculate the expected customer-level operating income for the six customers of KC Corporation. Use the number of written orders at $15 each to calculate expected order costs.

- 3. Recalculate the customer-level operating income using the number of written orders but at their actual $8 cost per order instead of $15 (except for DC, whose actual cost is $15 per order). How will KC Corporation evaluate customer-level operating cost performance this period?

- 4. Recalculate the customer-level operating income if salespeople had not broken up actual orders into multiple smaller orders. Don’t forget to also adjust sales commissions.

- 5. How is the behavior of the salespeople affecting the profit of KC Corporation? Is their behavior ethical? What could KC Corporation do to change the behavior of the salespeople?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Your boss at LK Enterprises asks you to compute the company's cash conversion cycle. Looking at the financial statements, you see that the average inventory for the year was $135,500, accounts receivable were $102,400, and accounts payable were at $121,700. You also see that the company had sales of $356,000 and that cost of goods sold was $298,500. What is your firm's cash conversion cycle? Round to the nearest day. What is the answer ?arrow_forwardPlease correct answer this financial accounting questionarrow_forwardBy-year-end, the firm's overhead wasarrow_forward

- Helparrow_forwardYour boss at LK Enterprises asks you to compute the company's cash conversion cycle. Looking at the financial statements, you see that the average inventory for the year was $135,500, accounts receivable were $102,400, and accounts payable were at $121,700. You also see that the company had sales of $356,000 and that cost of goods sold was $298,500. What is your firm's cash conversion cycle? Round to the nearest day. Correct answerarrow_forwardPlease provide problem with accounting answerarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College