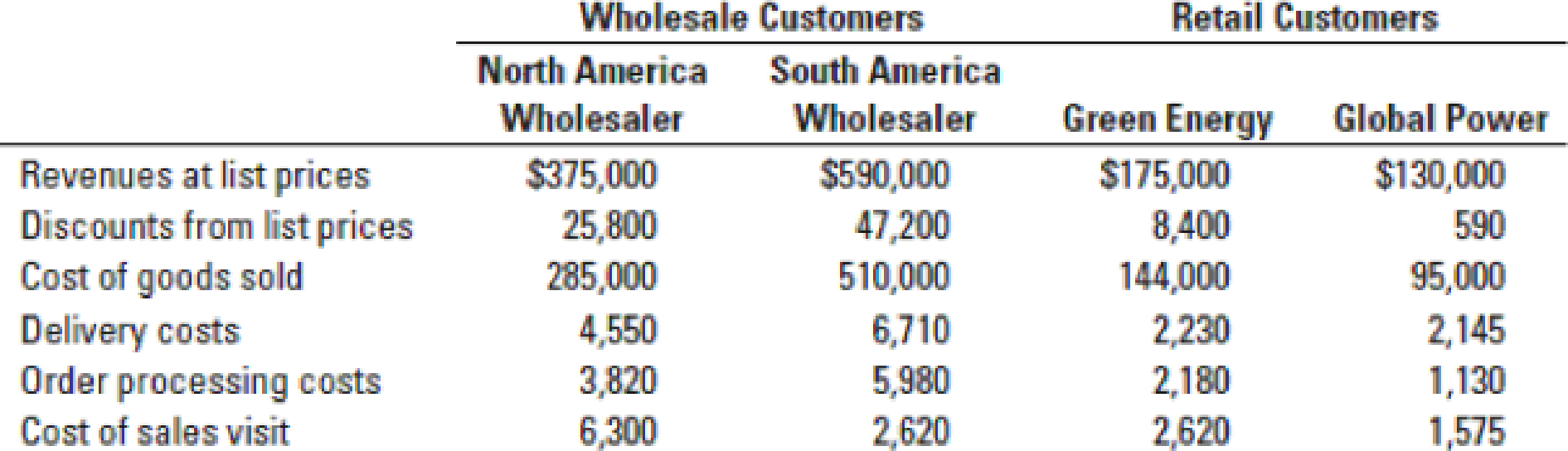

Customer profitability, customer-cost hierarchy. Enviro-Tech has only two retail and two wholesale customers. Information relating to each customer for 2017 follows (in thousands):

Enviro-Tech’s annual distribution-channel costs are $33 million for wholesale customers and $12 million for retail customers. The company’s annual corporate-sustaining costs, such as salary for top management and general-administration costs are $48 million. There is no cause-and-effect or benefits-received relationship between any cost-allocation base and corporate-sustaining costs. That is, Enviro-Tech could save corporate-sustaining costs only if the company completely shuts down.

- 1. Calculate customer-level operating income using the format in Figure 14-3.

Required

- 2. Prepare a customer-cost hierarchy report, using the format in Figure 14-6.

- 3. Enviro-Tech’s management decides to allocate all corporate-sustaining costs to distribution channels: $38 million to the wholesale channel and $10 million to the retail channel. As a result, distribution channel costs are now $71 million ($33 million + $38 million) for the wholesale channel and $22 million ($12 million + $10 million) for the retail channel. Calculate the distribution-channel-level operating income. On the basis of these calculations, what actions, if any, should Enviro-Tech’s managers take? Explain.

- 4. How might Enviro-Tech use the new cost information from its activity-based costing system to better manage its business?

Learn your wayIncludes step-by-step video

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Financial Accounting, Student Value Edition (5th Edition)

Intermediate Accounting (2nd Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Operations Management

Horngren's Accounting (12th Edition)

- During a specific period, Nexus Technologies reported a decrease in total assets of $14,500 and an increase in stockholders' equity of $9,800. By what amount and direction must total liabilities have changed during that same period?arrow_forwardneed help this questionsarrow_forwardDo fast answer of this accounting questionsarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub