Concept explainers

Cost allocation to divisions. Forber Bakery makes baked goods for grocery stores and has three divisions: bread, cake, and doughnuts. Each division is run and evaluated separately, but the main headquarters incurs costs that are indirect costs for the divisions. Costs incurred in the main headquarters are as follows:

| Human resources (HR) costs | $1,900,000 |

| Accounting department costs | 1,400,000 |

| Rent and |

1,200,000 |

| Other | 600,000 |

| Total costs | $5,100,000 |

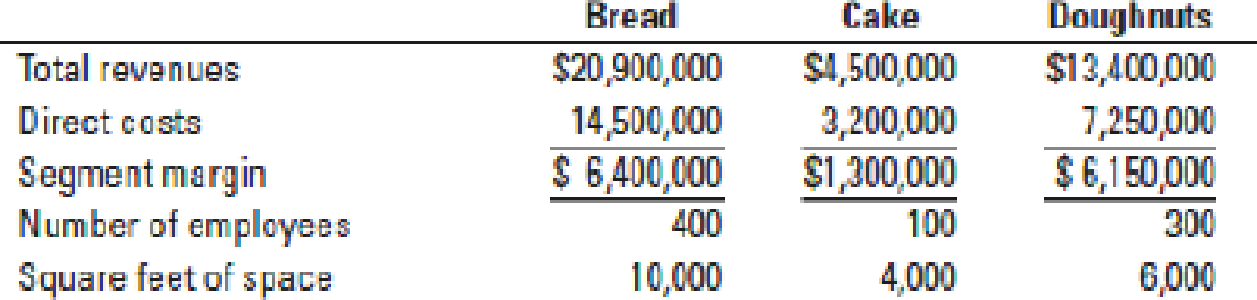

The Forber upper management currently allocates this cost to the divisions equally. One of the division managers has done some research on activity-based costing and proposes the use of different allocation bases for the different indirect costs—number of employees for HR costs, total revenues for accounting department costs, square feet of space for rent and depreciation costs, and equal allocation among the divisions of “other” costs. Information about the three divisions follows:

- 1. Allocate the indirect costs of Forber to each division equally. Calculate division operating income after allocation of headquarter costs.

- 2. Allocate headquarter costs to the individual divisions using the proposed allocation bases. Calculate the division operating income after allocation. Comment on the allocation bases used to allocate headquarter costs.

- 3. Which division manager do you think suggested this new allocation. Explain briefly. Which allocation do you think is “better?”

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Question: What is the formula for computing direct materials price variance? a. actual costs - (actual quantity X standard price) b. actual cost + standard costs c. actual cost - standard costs d. (actual quantity X standard price) - standard costsarrow_forwardGeneral accountingarrow_forwarddo fast of this answer General accounting questionarrow_forward

- Starlord's Music Shop's cash sales for Year 1 were $783,300, and $939,960 for Year 2. These figures included the 11.9% galatic sales tax. The store gives its customers coupons redeemable for a poster plus a Blue Swede CD. One coupon is issued for each dollar of sales. On the surrender of 100 coupons and $6.00 cash, the poster and CD are given to the customer. It is estimated that 80% of the coupons will be presented for redemption. Coupons redeemed in Year 1 totaled 420,000, and coupons redeemed in Year 2 totaled 750,000. Starlord's Music Shop bought 20,000 posters at $2.50/poster and 20,000 CDs at $7.50/CD. 1. Record the journal entry for sales and sales tax for Year 1 (assume all sales are in cash). Points Value: 10 Redemption Schedule Account Use this schedule to complete the journal entries below. Debit Credit Coupons Coupon Redeemed Redemptions Cash Received Inventory Costs Expense Total Y1 Potential Redemptions 560,000 5,600 33,600 56,000 22,400 Total Redeemed in Y1 420,000 4,200…arrow_forwardAccount Question answer wanted.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning