Concept explainers

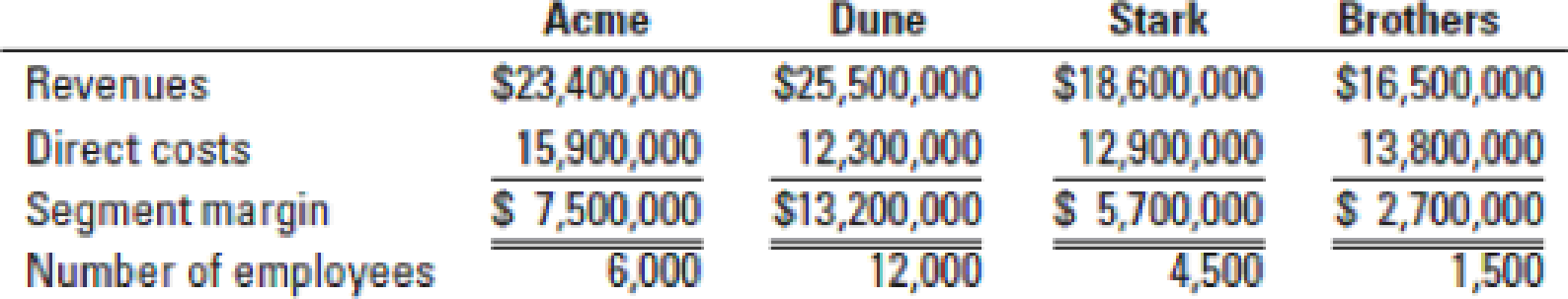

Cost allocation and decision making. Reidland Manufacturing has four divisions: Acme, Dune, Stark, and Brothers. Corporate headquarters is in Minnesota. Reidland corporate headquarters incurs costs of $16,800,000 per period, which is an indirect cost of the divisions. Corporate headquarters currently allocates this cost to the divisions based on the revenues of each division. The CEO has asked each division manager to suggest an allocation base for the indirect headquarters costs from among revenues, segment margin, direct costs, and number of employees. The following is relevant information about each division:

- 1. Allocate the indirect headquarters costs of Reidland Manufacturing to each of the four divisions using revenues, direct costs, segment margin, and number of employees as the allocation bases. Calculate operating margins for each division after allocating headquarters costs.

- 2. Flair ranks the individual customers in the Ma and Pa single-store distribution market on the basis of monthly operating income. The cumulative operating income of the top 20% of customers is $58,120. Best Drugs reports operating losses of $23,670 for the bottom 40% of its customers. Make four recommendations that you think Best Drugs should consider in light of this new customer-profitability information.

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Economics (MindTap Course List)

Foundations Of Finance

Intermediate Accounting (2nd Edition)

- Financial accountingarrow_forwardIf you give me wrong answer this financial accounting question I will give you unhelpful ratearrow_forwardJune, July, and August sales are $100,000, $120,000, and $125,000, respectively. 20% of sales are collected in the month of sale; 50% are collected in the month following sale, and the remaining 30% are collected in the second month following sale. What is the amount of cash collections in August? Show steps used in solving the problem.arrow_forward

- Accounting answer mearrow_forwardEstimate the cost of the merchandise destroyedarrow_forwardFairview Clinic buys $500,000 in medical supplies each year (at gross prices) from its major supplier, Consolidated Supplies, which offers the clinic terms of 5/10, net 30. What is Fairview Clinic's costly trade credit? A. $13,194 B. $39,583 C. $32,986 D. $26,389 E. $22,431arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,