Customer profitability in a manufacturing firm. Mississippi Manufacturing makes a component called B2040. This component is manufactured only when ordered by a customer, so Mississippi keeps no inventory of B2040. The list price is $112 per unit, but customers who place “large” orders receive a 10% discount on price. The customers are manufacturing firms. Currently, the salespeople decide whether an order is large enough to qualify for the discount. When the product is finished, it is packed in cases of 10. If the component needs to be exchanged or repaired, customers can come back within 14 days for free exchange or repair.

The full cost of manufacturing a unit of B2040 is $95. In addition, Mississippi incurs customer-level costs. Customer-level cost-driver rates are:

| Order taking | $360 per order |

| Product handling | $15 per case |

| Rush-order processing | $560 per rush order |

| Exchange and repair costs | $50 per unit |

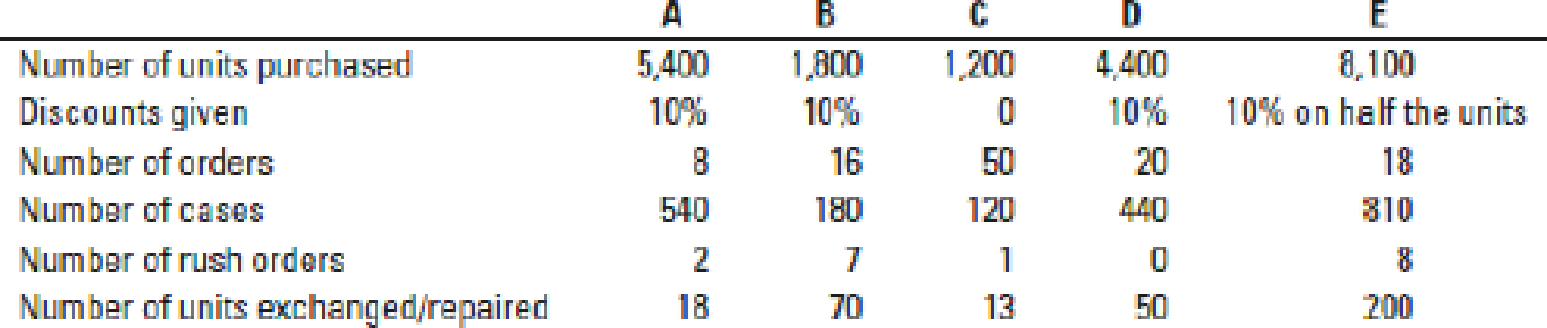

Information about Mississippi’s five biggest customers follows:

All customers except E ordered units in the same order size. Customer E’s order quantity varied, so E got a discount part of the time but not all the time.

- 1. Calculate the customer-level operating income for these five customers. Use the format in Figure 14-3. Prepare a customer-profitability analysis by ranking the customers from most to least profitable, as in Figure 14-4.

Required

Required

- 2. Discuss the results of your customer-profitability analysis. Does Mississippi have unprofitable customers? Is there anything Mississippi should do differently with its five customers?

Want to see the full answer?

Check out a sample textbook solution

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Stevenson Corporation reported a pretax book income of $500,000 in 2022. Included in the computation were favorable temporary differences of $60,000, unfavorable temporary differences of $25,000, and favorable permanent differences of $50,000. What is the book equivalent of taxable income for Stevenson Corporation?arrow_forwardWhat is the direct labor cost variance for October on these financial accounting question?arrow_forwardDetermine the predetermined overhead rate for 2022arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning