Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.17MCQ

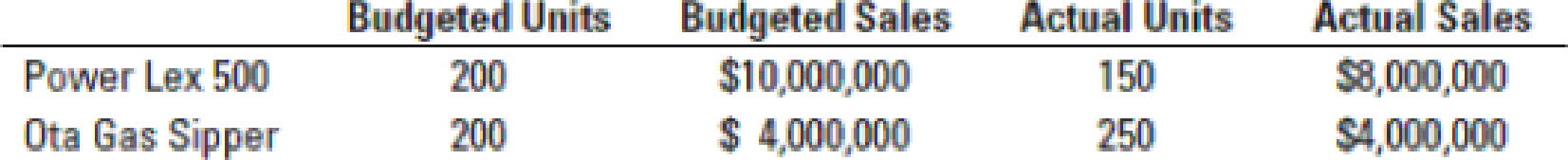

Sales-volume, sales-mix, and sales-quantity variance. Lexota, Inc., an auto manufacturer, reported the following budgeted and actual sales of its vehicles during September, Year 2:

The budgeted contribution margin is 20% for both vehicle types. Which of the following statements is true concerning the sales variances for Lexota, Inc. for September, Year 2?

- a. The sales-volume variance for the company is favorable.

- b. The sales-quantity variance for the company is unfavorable.

- c. The budgeted variable cost for each vehicle type is the same.

- d. The sales-mix variance for the company is unfavorable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What amount should be reported on the balance sheet for inventory of this general accounting question?

Michael is a 40% partner in the Juno Partnership. At the beginning of the tax year, Michael's basis in the partnership interest was $80,000, including his share of partnership liabilities. During the current year, Juno reported an ordinary income of $50,000. In addition, Juno distributed $7,500 to each of the partners ($22,500 total). At the end of the year, Michael's share of partnership liabilities increased by $15,000. What is Michael's basis in the partnership interest at the end of the year?

Financial Accounting Question please solve this one

Chapter 14 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 14 - Prob. 14.1QCh. 14 - Why is customer-profitability analysis an...Ch. 14 - Prob. 14.3QCh. 14 - A customer-profitability profile highlights those...Ch. 14 - Give examples of three different levels of costs...Ch. 14 - What information does the whale curve provide?Ch. 14 - A company should not allocate all of its corporate...Ch. 14 - What criteria might managers use to guide...Ch. 14 - Once a company allocates corporate costs to...Ch. 14 - A company should not allocate costs that are fixed...

Ch. 14 - How should a company decide on the number of cost...Ch. 14 - Show how managers can gain insight into the causes...Ch. 14 - How can the concept of a composite unit be used to...Ch. 14 - Explain why a favorable sales-quantity variance...Ch. 14 - How can the sales-quantity variance be decomposed...Ch. 14 - Flexible-budget variance, sales-quantity,...Ch. 14 - Sales-volume, sales-mix, and sales-quantity...Ch. 14 - Cost allocation in hospitals, alternative...Ch. 14 - Customer profitability, customer-cost hierarchy....Ch. 14 - Customer profitability, service company. Instant...Ch. 14 - Customer profitability, distribution. Best Drugs...Ch. 14 - Cost allocation and decision making. Reidland...Ch. 14 - Cost allocation to divisions. Rembrandt Hotel ...Ch. 14 - Cost allocation to divisions. Bergen Corporation...Ch. 14 - Prob. 14.25ECh. 14 - Variance analysis, working backward. The Hiro...Ch. 14 - Variance analysis, multiple products. Emcee Inc....Ch. 14 - Market-share and market-size variances...Ch. 14 - Click here to open your MyFinanceLab Study Plan...Ch. 14 - Customer profitability. Bracelet Delights is a new...Ch. 14 - Customer profitability, distribution. Green Paper...Ch. 14 - Customer profitability in a manufacturing firm....Ch. 14 - Customer-cost hierarchy, customer profitability....Ch. 14 - Allocation of corporate costs to divisions. Cathy...Ch. 14 - Cost allocation to divisions. Forber Bakery makes...Ch. 14 - Prob. 14.36PCh. 14 - Cost-hierarchy income statement and allocation of...Ch. 14 - Variance analysis, sales-mix and sales-quantity...Ch. 14 - Market-share and market-size variances...Ch. 14 - Variance analysis, multiple products. The Robins...Ch. 14 - Customer profitability and ethics. KC Corporation...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tech Solutions, Inc. is looking to achieve a net income of 18 percent of sales. Here’s the firm’s profile: Unit sales price is $12; variable cost per unit is $7; total fixed costs are $50,000. What is the level of sales in units required to achieve a net income of 18 percent of sales?arrow_forwardAccurate answerarrow_forward??arrow_forward

- Helparrow_forwardThe Suit Factory sells suits. Currently, it sells 20,000 suits annually at an average price of $150 each. It is considering adding a lower-priced line of suits that sell for $120 each. The firm estimates it can sell 8,000 of the lower-priced suits but will sell 3,000 fewer of the higher-priced suits by doing so. What is the amount of the sales that should be used when evaluating the addition of the lower-priced suits? A. $510,000 B. $420,000 C. $605,000 D. $530,000arrow_forwardWhat is level of accounts receivable?arrow_forward

- Accounting 02.08.24arrow_forwardTech Solutions, Inc. is looking to achieve a net income of 18 percent of sales. Here’s the firm’s profile: Unit sales price is $12; variable cost per unit is $7; total fixed costs are $50,000. What is the level of sales in units required to achieve a net income of 18 percent of sales? Helparrow_forwardSolve this Accounting problemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY