Problem 1 2-93B Accounting Alternatives and Financial Analysis

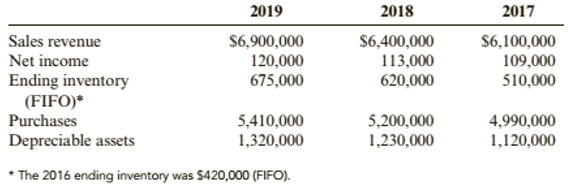

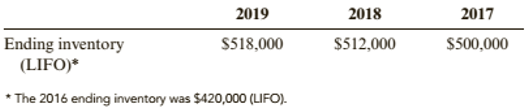

Affordable Autos Inc. has asked your bank for a SlOO.000 loan to expand its sales facility. Affordable Autos provides you with the following data:

Your inspection of the financial statements of other automobiles sales firms indicates that most of these firms adopted the LIFO method in the late 1970s. You further note that Afford able Autos has used 10% of

Required:

1. Compute cost of goods sold for 2017-2019. using both the FIFO and the LIFO methods.

2. Compute depreciation expense for Affordable Autos for 2017-2019. using both 10% and 20% of the cost of depreciable assets.

3. Recompute Affordable Autos's net income for 2017-2019. using LIFO and 20% depreciation. (Do&t forget the tax impact of the increases in cost of goods sold and depreciation expense.)

4. CONCEPTUAL CONNECTiON Does Affordable Autos appear to have materially changed its financial statements by the selection of FIFO (rather than LIFO) and l0% (rather than 20%) depreciation?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Cornerstones of Financial Accounting

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning