Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 49CE

Short-Term

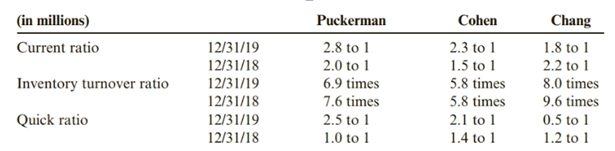

Three ratios calculated for Puckerman, Cohen, and Chang companies for 2018 and 2019 follow.

Required:

Explain which company appears to be the most liquid.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

On January 1, 2017, Christel Madan Corporation had inventory of

$54,500. At December 31, 2017, Christel Madan had the following

account balances.

Freight-in

Purchases

Purchase discounts

Purchase returns and allowances

Sales revenue

$ 4,500

$5,10,000

$7,350

$ 3,700

$ 8,08,000

$ 5,900

$ 11,100

Sales discounts

Sales returns and allowances

At December 31, 2017, Christel Madan determines that its ending

inventory is $64,500.

Compute Christel Madan's 2017 gross profit.

General Accounting

Financial Accounting

Chapter 12 Solutions

Cornerstones of Financial Accounting

Ch. 12 - Describe how some of the primary groups of users...Ch. 12 - Prob. 2DQCh. 12 - Prob. 3DQCh. 12 - Prob. 4DQCh. 12 - Prob. 5DQCh. 12 - Prob. 6DQCh. 12 - Prob. 7DQCh. 12 - Prob. 8DQCh. 12 - Prob. 9DQCh. 12 - Prob. 10DQ

Ch. 12 - Prob. 11DQCh. 12 - 12. Why are higher asset turnover ratios...Ch. 12 - Prob. 13DQCh. 12 - Prob. 14DQCh. 12 - Prob. 15DQCh. 12 - Prob. 16DQCh. 12 - Which of the following use financial statement...Ch. 12 - Prob. 2MCQCh. 12 - Prob. 3MCQCh. 12 - Prob. 4MCQCh. 12 - Prob. 5MCQCh. 12 - Prob. 6MCQCh. 12 - Prob. 7MCQCh. 12 - Which type of analysis compares a single...Ch. 12 - Which of the following types of analysis compares...Ch. 12 - Which of the following types of analysis is...Ch. 12 - Prob. 11MCQCh. 12 - Prob. 12MCQCh. 12 - Prob. 13MCQCh. 12 - Partial information from Fabray Companys balance...Ch. 12 - Hummel Inc. has $30,000 in current assets and...Ch. 12 - Prob. 16MCQCh. 12 - A firms quick ratio is typically computed as: a....Ch. 12 - Prob. 18MCQCh. 12 - Prob. 19MCQCh. 12 - Prob. 20MCQCh. 12 - Prob. 21MCQCh. 12 - Prob. 22MCQCh. 12 - Prob. 23MCQCh. 12 - When analyzing a companys debt to equity ratio,...Ch. 12 - Prob. 25MCQCh. 12 - Prob. 26MCQCh. 12 - Prob. 27MCQCh. 12 - Prob. 28MCQCh. 12 - Prob. 29MCQCh. 12 - Prob. 30MCQCh. 12 - Which of the following ratios is used to measure...Ch. 12 - Prob. 32MCQCh. 12 - Selected information for Berry Company is as...Ch. 12 - Which of the following ratios is used to measure a...Ch. 12 - Prob. 35MCQCh. 12 - Prob. 36MCQCh. 12 - Prob. 37MCQCh. 12 - Prob. 38MCQCh. 12 - Which of the following are not part of common...Ch. 12 - Prob. 40MCQCh. 12 - Prob. 41MCQCh. 12 - Prob. 42MCQCh. 12 - Which of the following is not included in the...Ch. 12 - When a Dupont analysis reveals that a company has...Ch. 12 - Prob. 45MCQCh. 12 - Cross Sectional Analysis Cross sectional analysis...Ch. 12 - Prob. 47CECh. 12 - Prob. 48CECh. 12 - Short-Term Liquidity Ratios Three ratios...Ch. 12 - Debt Management Ratios Selected data from the...Ch. 12 - Debt Management and Short-Term Liquidity Ratios...Ch. 12 - Asset Efficiency Ratios Selected financial...Ch. 12 - Profitability Ratios The following data came from...Ch. 12 - Prob. 54CECh. 12 - Prob. 55CECh. 12 - Prob. 56CECh. 12 - Prob. 57BECh. 12 - Prob. 58BECh. 12 - Prob. 59BECh. 12 - Short-Term Liquidity Ratios Larry, Curly, and Moe...Ch. 12 - Debt Management Ratios Glow Corporation provides...Ch. 12 - Debt Management and Short-Term Liquidity Ratios...Ch. 12 - Asset Efficiency Ratios Rumsford Inc.s financial...Ch. 12 - Prob. 64BECh. 12 - Profitability Ratios Tinker Corporation operates...Ch. 12 - Profitability Ratios Katrina Corp. is a publicly...Ch. 12 - Prob. 67BECh. 12 - Prob. 68ECh. 12 - Prob. 69ECh. 12 - Prob. 70ECh. 12 - Prob. 71ECh. 12 - Horizontal Analysis of Income Statements...Ch. 12 - Prob. 73ECh. 12 - Prob. 74ECh. 12 - Prob. 75ECh. 12 - Prob. 76ECh. 12 - Prob. 77ECh. 12 - Prob. 78ECh. 12 - Prob. 79ECh. 12 - Asset Efficiency Ratios Refer to financial...Ch. 12 - Prob. 81ECh. 12 - Prob. 82ECh. 12 - Prob. 83ECh. 12 - Prob. 84PSACh. 12 - Prob. 85PSACh. 12 - Prob. 86PSACh. 12 - A Using Common Size Statements The following...Ch. 12 - Prob. 88PSACh. 12 - Prob. 89PSACh. 12 - Prob. 90PSACh. 12 - A Comparing Financial Ratios Presented below are...Ch. 12 - A Preparation of Ratios Refer to the financial...Ch. 12 - Accounting Alternatives and Financial Analysis...Ch. 12 - Prob. 84PSBCh. 12 - Prob. 85PSBCh. 12 - Prob. 86PSBCh. 12 - Prob. 87PSBCh. 12 - Prob. 88PSBCh. 12 - Prob. 89PSBCh. 12 - Prob. 90PSBCh. 12 - Comparing Financial Ratios Presented below are...Ch. 12 - Prob. 92PSBCh. 12 - Problem 1 2-93B Accounting Alternatives and...Ch. 12 - Prob. 94CCh. 12 - Prob. 95.1CCh. 12 - Prob. 95.2CCh. 12 - Prob. 96.1CCh. 12 - Prob. 96.2CCh. 12 - Prob. 97.1CCh. 12 - Prob. 97.2CCh. 12 - Prob. 97.3CCh. 12 - Prob. 97.4CCh. 12 - Analyzing Growth Consolidated financial statements...Ch. 12 - Analyzing Growth Consolidated financial statements...Ch. 12 - Prob. 98.1CCh. 12 - Prob. 98.2CCh. 12 - Prob. 98.3CCh. 12 - CONTINUING PROBLEM: FRONT ROW ENTERTAINMENT The...Ch. 12 - Prob. 99.2CCh. 12 - Prob. 99.3CCh. 12 - Prob. 99.4CCh. 12 - Prob. 99.5C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Corporation's standards call for 3,000 direct labor-hours to produce 1,200 units of product. During May 1,000 units were produced and the company worked 1,100 direct labor-hours. The standard hours allowed for May production would be: A. 3,000 hours. B. 1,100 hours. C. 2,500 hours. D. 2,000 hours.arrow_forwardGross profit?? General Accountarrow_forwardA standard costing system will produce the same income as an actual costing system when standard cost variances are closed to: a. Work-in-process b. Work-in-process and finished goods c. Cost of goods sold d. Cost of goods sold and inventoriesarrow_forward

- Blossom Incorporated has acquired additional assets totaling $356,000 during the 2025 fiscal year. Total revenues for Blossom were $827,000 and expenses were $522,000. Blossom's board of directors decided to pay out $23,900 in dividends for the 2025 fiscal year. If no other equity transactions were made, what was the change in Blossom's liabilities during 2025? A. Increase of $281,100 B. Increase of $305,000 C. Decrease of $356,000 D. Increase of $74,900arrow_forwardMicah Levi works in the payroll department at Radiance Windows. The employer has determined that the payroll functions should be moved to a Cloud-based platform that can support its 500 employees, be used remotely, and has requested recommendations. What options could Micah propose? check all that apply SSL, VPN, and CAPTCHA tools Administration of payroll Employee security and confidentiality Online options with mobile accessarrow_forwardGrass Reed Bayou is a bottling company in The Netherlands. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for the year was $680,000, and management budgeted $320,000 of direct labor costs. During the year, the company incurred the following actual costs. Direct materials used $ 382,000 Direct labor 313,000 Factory overhead 650,700 The January 1 balances of inventory accounts are shown below. Materials-all direct $ 64,000 Work-in-process 41,400 Finished goods 25,600 The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year. The cost of goods manufactured during the year is:arrow_forward

- Magna Carta Interiors is a job-order manufacturer. The company uses a predetermined overhead rate based on direct labor hours to apply overhead to individual jobs. For the current year, estimated direct labor hours are 150,000 and estimated factory overhead is $1,140,000. The following information is for September. Job X was completed during September, while Job Y was started but not finished. September 1, inventories: Materials $ 25,700 Work-in-process (All Job X) 55,100 Finished goods 107,300 Materials purchases $ 174,000 Direct materials requisitioned: Job X $ 75,700 Job Y 69,700 Direct labor hours: Job X 8,700 Job Y 7,200 Labor costs incurred: Direct labor ($7.70 per hour) $ 122,430 Indirect labor 50,100 Factory supervisory salaries 12,800 Rental costs: Factory $ 11,000 Administrative offices 4,900 Total equipment depreciation costs: Factory $ 12,100 Administrative offices 4,500 Indirect materials used $ 30,400 The total…arrow_forwardGrass Reed Bayou is a bottling company in The Netherlands. The company uses a normal costing system in which factory overhead is applied on the basis of direct labor costs. Budgeted factory overhead for the year was $680,000, and management budgeted $320,000 of direct labor costs. During the year, the company incurred the following actual costs. Direct materials used $ 382,000Direct labor 313,000Factory overhead 650,700The January 1 balances of inventory accounts are shown below. Materials-all direct $ 64,000Work-in-process 41,400Finished goods 25,600The December 31 balances of these inventory accounts were ten percent lower than the balances at the beginning of the year. The cost of goods manufactured during the year is:arrow_forwardGeneral Accounting Question Solutionarrow_forward

- please give me correct answer of this General accounting questionarrow_forward5/1/25 Lease Receivable 5/1/25 12/31/25 Cost of Goods Sold Sales Revenue Inventory (To record the lease) Cash Lease Receivable (To record lease payment) Lease Receivable Interest Revenue 5/1/26 Cash Lease Receivable Interest Revenue 12/31/26 Lease Receivable Interest Revenue 98000.20 65000 20456.70 20456.70 98arrow_forwardi wont to this question answer General accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License