Debt Management and Short-Term

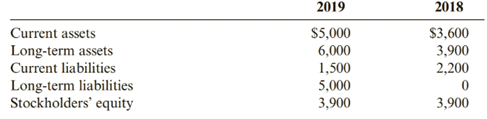

Magellan Company is an international travel agency providing travel planning services to customers in over 20 Countries. Recently, the travel industry has been experiencing volatility as a result of increases in oil prices. Magellan’s investors have been following its financial information closely to determine its ability to continue as a going concern, Its investors have used the following information to determine financial ratios:

Required:

Between 20l8 and 20l9, indicate whether Magellan’s debt to equity ratio increased or decreased. Also, indicate whether Magellan’s

Trending nowThis is a popular solution!

Chapter 12 Solutions

Cornerstones of Financial Accounting

- please given answer of this General accounting questionarrow_forwardHilary owns a fruit smoothie shop at the local mall. Each smoothie requires 1/3 pound of mixed berries, which are expected to cost $7 per pound during the summer months. Shop employees are paid $8 per hour. Variable overhead consists of utilities and supplies. The variable overhead rate is $0.12 per minute of DL time. Each smoothie should require 4 minutes of DL time. 1. What is the standard cost of direct materials for each smoothie? 2. What is the standard cost of direct labor for each smoothie? 3. What is the standard cost of variable overhead for each smoothie?arrow_forwardAt the beginning of the recent period, there were 1,100 units of product in a department, 40% completed. These units were finished, and an additional 6,200 units were started and completed during the period. 900 units were still in process at the end of the period, 30% completed. Using the weighted-average method, the equivalent units produced by the department were: a. 6,200 units. b. 7,100 units. c. 7,370 units. d. 6,800 units. e. 7,570 units.arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning