Accounting Alternatives and Financial Analysis

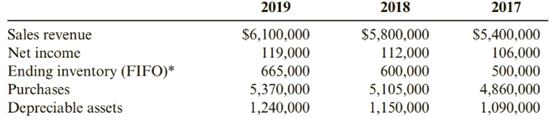

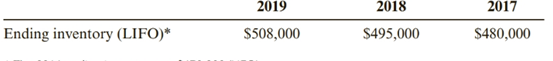

Lemon Automobiles has asked your bank for a $100,000 loan to expand its sales facility. Lemon provides you with the following data:

Your inspection of the financial statements of other automobiles sales firms indicates that most of these firms adopted the LIFO method in the late 1970s. You further note that Lemon has used 5% of

Required:

1. Compute cost of goods sold for 2017-2019. using both the FIFO and the LIFO methods.

2. Compute depreciation expense for Lemon for 20l72019. using both 5% and 10% of the cost of depreciable assets.

3. Recompute Lemon’s net income for 2017--2019. using LIFO and JOY0 depreciation. (Don’t forget the tax impact of the increases in cost of goods sold and depreciation expense.,)

4. CONCEPTUAL CONNECTION Explain whether Lemon appears to have materially changed its financial statements by the selection of FIFO (rather than LIFO) and 5% (rather than 10%) depreciation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Cornerstones of Financial Accounting

- 9 A B C D E 4 Ramsey Miller Style, Inc. manufactures a product which requires 15 pounds of direct materials at a cost of $8 5 per pound and 5.0 direct labor hours at a rate of $17 per hour. Variable overhead is budgeted at a rate of $3 per direct labor hour. Budgeted fixed overhead is $433,000 per month. The company's policy is to end each month with direct materials inventory equal to 45% of the next month's direct materials requirement, and finished 7 goods inventory equal to 60% of next month's sales. August sales were 13,400 units, and marketing expects 8 sales to increase by 500 units in each of the upcoming three months. At the end of August, the company had 9 95,850 pounds of direct materials in inventory, and 8,340 units in finished goods inventory. 10 11 August sales 12 Expected increase in monthly sales 13 Desired ending finished goods (units) 14 Selling price per unit 15 Direct materials per unit 16 Direct materials cost 17 Direct labor hours (DLHS) per unit 18 Direct labor…arrow_forwardSherrod, Incorporated, reported pretax accounting income of $84 million for 2024. The following information relates to differences between pretax accounting income and taxable income: a. Income from installment sales of properties included in pretax accounting income in 2024 exceeded that reported for tax purposes by $3 million. The installment receivable account at year-end 2024 had a balance of $4 million (representing portions of 2023 and 2024 installment sales), expected to be collected equally in 2025 and 2026. b. Sherrod was assessed a penalty of $4 million by the Environmental Protection Agency for violation of a federal law in 2024. The fine is to be paid in equal amounts in 2024 and 2025. c. Sherrod rents its operating facilities but owns one asset acquired in 2023 at a cost of $88 million. Depreciation is reported by the straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight- line depreciation the…arrow_forwardProvide answerarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning