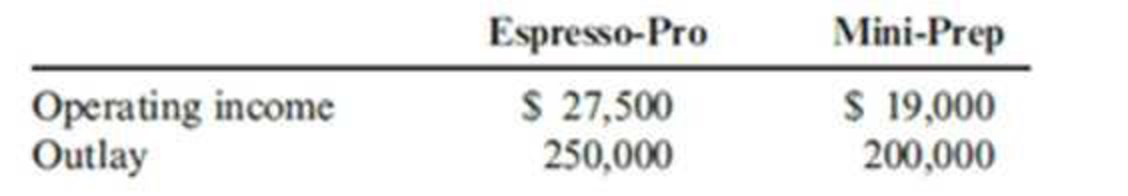

Refer to Exercise 10.7 for data. At the end of Year 2, the manager of the Houseware Division is concerned about the division’s performance. As a result, he is considering the opportunity to invest in two independent projects. The first is called the Espresso-Pro; it is an in-home espresso maker that can brew regular coffee as well as make espresso and latte drinks. While the market for espresso drinkers is small initially, he believes this market can grow, especially around gift-giving occasions. The second is the Mini-Prep appliance that can be used to do small chopping and dicing chores that do not require a full-sized food processor. Without the investments, the division expects that Year 2 data will remain unchanged. The expected operating incomes and the outlay required for each investment are as follows:

Jarriot’s corporate headquarters has made available up to $500,000 of capital for this division. Any funds not invested by the division will be retained by headquarters and invested to earn the company’s minimum required

Required:

- 1. Compute the

ROI for each investment. - 2. Compute the divisional ROI (rounded to four significant digits) for each of the following four alternatives:

- a. The Espresso-Pro is added.

- b. The Mini-Prep is added.

- c. Both investments are added.

- d. Neither investment is made; the status quo is maintained.

Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which alternative do you think the divisional manager will choose?

Trending nowThis is a popular solution!

Chapter 10 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Quick answer of this accounting questionsarrow_forwardMead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $20,500. February 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $21,500; Sony, $52,500; and Mattel, $46,350. Year 2 April 15 Sold all of the Johnson & Johnson bonds for $23,500. July 5 Sold all of the Mattel bonds for $35,850. July 22 Purchased Sara Lee notes for $13,500. August 19 Purchased Kodak bonds for $15,300. December 31 Fair values for debt in the portfolio are Kodak, $17,325; Sara Lee, $12,000; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black & Decker bonds for $50,400. August 3 Sold all of the Sara…arrow_forwardWhat is the ending inventory?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning