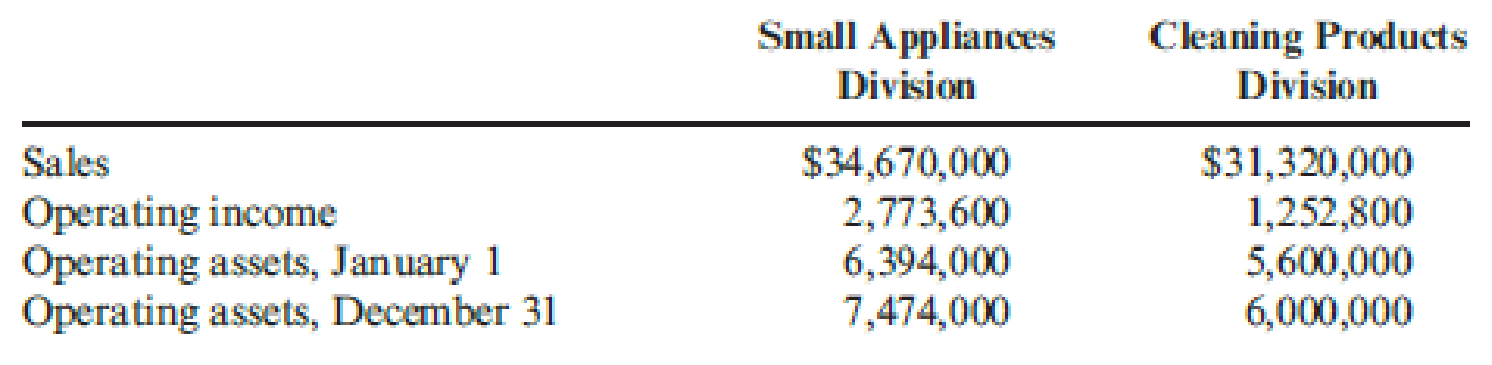

Forchen, Inc., provided the following information for two of its divisions for last year:

Required:

- 1. For the Small Appliances Division, calculate:

- a. Average operating assets

- b. Margin

- c. Turnover

- d.

Return on investment (ROI)

- 2. For the Cleaning Products Division, calculate:

- a. Average operating assets

- b. Margin

- c. Turnover

- d. Return on investment (ROI)

- 3. What if operating income for the Small Appliances Division was $2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).

1 (a)

Calculate the average operating assets for Division A.

Explanation of Solution

Operating assets: Operating assets are the assets which includes all the assets used to generate the operating income. Average operating assets are the average of beginning and ending operating assets.

Calculate the average operating assets for Division A:

Therefore, the average operating assets for Division A are $6,934,000.

1 (b)

Compute the Margin for the Division A.

Explanation of Solution

Margin: It is an amount income generated by a dollar of sales. It is calculated as follows:

Compute the margin for Division A:

Therefore, margin of Division A is 8%.

1 (c)

Compute the turnover of Division A.

Explanation of Solution

Turnover: It is an amount of sales generate by average operating assets. It is calculated by dividing the sales by the average operating assets in the assets, required to generate those sales.

Compute the turnover of Division A:

Therefore, turnover of Division A is 5.0 times of average operating assets.

1 (d)

Compute the ROI of Division A.

Explanation of Solution

Return on investment (ROI): This financial ratio evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions or a companies.

Compute the ROI of Division A:

Therefore, ROI of Division A is 40%.

2 (a)

Calculate the average operating assets for Division P.

Explanation of Solution

Calculate the average operating assets for Division P:

Therefore, the average operating assets for Division P are $5,800,000.

2 (b)

Compute the Margin for the Division P.

Explanation of Solution

Compute the margin for Division P:

Therefore, margin of Division P is 4%.

2 (c)

Compute the turnover of Division P.

Explanation of Solution

Compute the turnover of Division P:

Therefore, turnover of Division P is 5.4 times of average operating assets.

2 (d)

Compute the ROI of Division P.

Explanation of Solution

Compute the ROI of Division A:

Therefore, ROI of Division P is 21.6%.

3.

Explain the effect of change in operating income on average operating assets, margin, turnover, and ROI of Division A. Compute the new ratios if any.

Explanation of Solution

In the given situation, the new operating income is lower. Thus, both margin and ROI would be lower.

Average operating assets and turnover not affected by change in the operating income, since operating income is not a part of the equations for them.

Calculate the new margin and ROI for Division A:

Therefore, new margin is 5.77%.

Therefore, new ROI is 28.85%.

Want to see more full solutions like this?

Chapter 10 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Please provide answer this financial accounting questionarrow_forwardBrentwood Manufacturing forecasts that total overhead for the current year will be $12,000,000 and that total machine hours will be 240,000 hours. Year to date, the actual overhead is $13,200,000, and the actual machine hours are 260,000 hours. Suppose Brentwood Manufacturing uses a predetermined overhead rate based on machine hours for applying overhead as of this point in time (year to date). In that case, the overhead is? Helparrow_forwardSolve this Accounting problemarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College