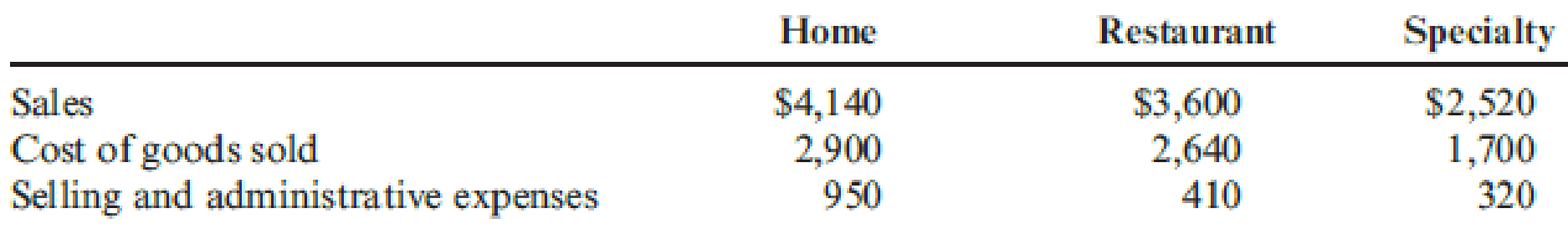

Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands):

The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenold’s total capital employed is $5.04 million ($2,600,000 for the Home Division, $1,700,000 for the Restaurant Division, and the remainder for the Specialty Division).

Required:

- 1. Prepare a segmented income statement for Xenold, Inc., for last year.

- 2. Calculate Xenold’s weighted average cost of capital. (Round to four significant digits.)

- 3. Calculate EVA for each division and for Xenold, Inc.

- 4. Comment on the performance of each of the divisions.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Need correct answer general accounting questionarrow_forwardNonearrow_forwardA supplier offers credit terms of 2/10, net 30, meaning a 2% discount is available if payment is made within 10 days. If a company purchases $12,000 worth of goods and pays within 7 days, calculate the amount paid after applying the discount.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub