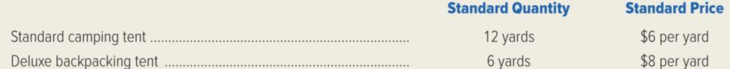

Rocky Mountain Camping Equipment, Inc. has established the following direct-material standards for its two products.

During March, the company purchased 2,100 yards of tent fabric for its standard model at a cost of $13,440. The actual March production of the standard tent was 100 tents, and 1,250 yards of fabric were used. Also during March, the company purchased 800 yards of the same tent fabric for its deluxe backpacking tent at a cost of $6,320. The firm used 720 yards of the fabric during March in the production of 120 deluxe tents.

Required:

- 1. Compute the direct-material purchase price variance and quantity variance for March.

- 2. Prepare

journal entries to record the purchase of material, use of material, and incurrence of variances in March.

1.

Calculate the direct material purchase price variance and direct material quantity variance of Company R for the month of March.

Explanation of Solution

Variance: Variance refers to the difference level in the actual cost incurred and standard cost. The total cost variance is subdivided into separate cost variances; this cost variance indicates that the amount of variance that is attributable to specific casual factors.

Standard cost: In the accounting records, the term standard cost refers to the practice of replacement of an expected cost for an actual cost. Then the difference between the expected costs and actual costs showing the variance are also recorded periodically. A standard costs is also known as target cost or predetermined cost.

Calculate the direct material purchase price variance and direct material quantity variance of Company R for the month of March as follows:

Direct material purchase price variance:

Working note (1):

Calculate the actual price for standard tent:

Working note (2):

Calculate the actual price for deluxe tent:

Working note (3):

Calculate the direct material purchased price variance of standard tent:

Working note (4):

Calculate the direct material purchased price variance of deluxe tent:

Direct material quantity variance:

Working note (5):

Calculate the standard quantity of standard tent:

Working note (6):

Calculate the standard quantity of deluxe tent:

Working note (7):

Calculate the direct material quantity variance of standard tent:

Working note (8):

Calculate the direct material quantity variance of deluxe tent:

2.

Prepare journal entries for the given transactions of Company R for the month of March.

Explanation of Solution

Prepare journal entry to record the purchase of direct material and variance:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Raw materials inventory (9) | 19,000 | ||

| Direct materials cost variance | 760 | ||

| Accounts payable | 19,760 | ||

| (To record the direct materials purchased on account) |

Table (1)

- Raw materials inventory is an asset account, and it increases the value of asset. Hence, debit the raw materials inventory account with $19,000.

- Direct materials cost variance is expense account and it decreases the value of stockholder’s equity. Hence, debit the direct material cost variance account with $760.

- Accounts payable is a liability account, and it increases the value of liabilities. Hence, credit the accounts payable account with $19,760.

Working note (9):

Calculate the raw materials inventory:

Prepare journal entry to record the use of direct material and variance:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Work-in-Process Inventory (10) | 12,960 | ||

| Direct Materials quantity Variance | 300 | ||

|

Raw Materials Inventory | 13,260 | ||

| (To record the direct materials used in the production process) |

Table (2)

- Work-in-process inventory is an asset account, and it increases the value of asset. Hence, debit the work-in-process inventory account with $12,960.

- Direct materials quantity variance is an expense account and it decreases the value of stockholder’s equity. Hence, debit t the direct material quantity variance account with $300.

- Raw materials inventory is an asset account, and it decreases the value of asset. Hence, credit the raw materials inventory account with $13,260.

Working note (10):

Calculate the work in process inventory:

Want to see more full solutions like this?

Chapter 10 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Please solve this problem is accountingarrow_forwardThe material quantity variance for April isarrow_forwardMenka Company has annual fixed costs totaling $135,000 and variable costs of $4 per unit. Each unit of product is sold for $18. Menka expects to sell 14,500 units this year. How many units must be sold to earn an annual profit of $60,000? Helparrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education