Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 26E

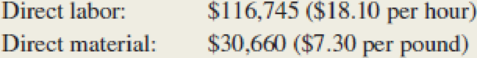

During June, Danby Company’s material purchases amounted to 6,000 pounds at a price of $7.30 per pound. Actual costs incurred in the production of 2,000 units were as follows:

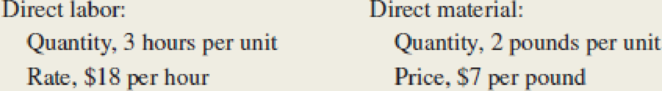

The standards for one unit of Danby Company’s product are as follows:

Required: Compute the direct-material price and quantity variances, the direct-material purchase price variance, and the direct-labor rate and efficiency variances. Indicate whether each variance is favorable or unfavorable.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

During the month of June, a company’s direct materials costs for the production of Product X were as follows:

Standard unit price P12.50

Standard quantity allowed for actual production 6,300 units

Actual unit purchase price P13.00

Quantity purchased and used for actual production 6,900 units

Compute the materials’ efficiency or usage variance.

Compute the materials spending variance or price variance.

(3)

or

https://ezto.mheducation.com/ext/map/index.html?_con%3Dcon&external browser%-0&la...

Saved

ework

Exercise 16-36 (Algo) Variable Cost Variances (LO 16-5)

Paynesville Corporation manufactures and sells a preservative used in food and drug manufacturing. The company carries no

inventories. The master budget calls for the company to manufacture and sell 132,000 liters at a budgeted price of $315 per liter this

year. The standard direct cost sheet for one liter of the preservative follows.

(2 pounds @ $20)

(0.5 hours @ $56)

Direct materials

Direct labor

28

Variable overhead is applied based on direct labor hours. The variable overhead rate is $180 per direct-labor hour. The fixed overhead

rate (at the master budget level of activity) is $90 per unit. All non-manufacturing costs are fixed and are budgeted at $2.8 million for

the coming year.

At the end of the year, the costs analyst reported that the sales activity variance for the year was $942,000 unfavorable.

The following is the…

Upon your review of Shalom Company's standard cost card. You found the following information:

Standards:

Material

Labor

Actual:

Production

Material

Labor

5.0 feet per unit @ P4.00 per foot

3.0 hours per unit @ 35.00 per hour

2,800 units produced during the month

14,500 feet used; 15,100 feet purchased @ P3.70 per foot

8,150 direct labor hours @ P36.00 per hour

Determine the variances based on the information above. Indicate as favorable or unfavorable.

Format should be: 8,000 F or 8,000 UF

No need to indicate if the amount is positive or negative.

Amounts must be in whole numbers. Example: 88,000 or (88,000)

Unit costs be in whole numbers. Example: 88

Format of percentages: 88%

Words must be in capital letters.

What is the labor rate variance?

Chapter 10 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 10 - Prob. 1RQCh. 10 - What is meant by the phrase management by...Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What is the interpretation of the direct-material...Ch. 10 - What manager is usually in the best position to...Ch. 10 - What is the interpretation of the direct-material...Ch. 10 - Prob. 10RQ

Ch. 10 - Prob. 11RQCh. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - Prob. 16RQCh. 10 - Describe five factors that managers often consider...Ch. 10 - Discuss several ways in which standard-costing...Ch. 10 - Describe how standard costs are used for product...Ch. 10 - Prob. 20RQCh. 10 - Prob. 21RQCh. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - Refer to the data in the preceding exercise. Use...Ch. 10 - Cayuga Hardwoods produces handcrafted jewelry...Ch. 10 - During June, Danby Companys material purchases...Ch. 10 - Refer to the data in the preceding exercise. Draw...Ch. 10 - The director of cost management for Odessa Company...Ch. 10 - Due to evaporation during production, Plano...Ch. 10 - Prob. 30ECh. 10 - Refer to the data in Exercise 1022, regarding...Ch. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - New Jersey Valve Company manufactured 7,800 units...Ch. 10 - Prob. 34PCh. 10 - During May, Joliet Fabrics Corporation...Ch. 10 - Sal Amato operates a residential landscaping...Ch. 10 - Santa Rosa Industries uses a standard-costing...Ch. 10 - The following data pertain to Colgate-Palmolives...Ch. 10 - Orion Corporation has established the following...Ch. 10 - Associated Media Graphics (AMG) is a rapidly...Ch. 10 - The director of cost management for Portland...Ch. 10 - Ogwood Companys Johnstown Division is a small...Ch. 10 - Quincy Farms produces items made from local farm...Ch. 10 - Schiffer Corporation manufactures agricultural...Ch. 10 - Aqua float Corporation manufactures rafts for use...Ch. 10 - Rocky Mountain Camping Equipment, Inc. has...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - European Styles, Inc. manufactures womens blouses...Ch. 10 - MacGyver Corporation manufactures a product called...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardSmith Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for the cost of one basket (unit): Smith Industries made 3,000 baskets in July and used 15,500 pounds of material to make these units. Smith Industries paid $39,370 for the 15,500 pounds of material. A. What was the direct materials price variance for July? B. What was the direct materials quantity variance for July? C. What is the total direct materials cost variance? D. If Smith Industries used 15,750 pounds to make the baskets, what would be the direct materials quantity variance?arrow_forwardYohan Company has the following balances in its direct materials and direct labor variance accounts at year-end: Unadjusted Cost of Goods Sold equals 1,500,000, unadjusted Work in Process equals 236,000, and unadjusted Finished Goods equals 180,000. Required: 1. Assume that the ending balances in the variance accounts are immaterial and prepare the journal entries to close them to Cost of Goods Sold. What is the adjusted balance in Cost of Goods Sold after closing out the variances? 2. What if any ending balance in a variance account that exceeds 10,000 is considered material? Close the immaterial variance accounts to Cost of Goods Sold and prorate the material variances among Cost of Goods Sold, Work in Process, and Finished Goods on the basis of prime costs in these accounts. The prime cost in Cost of Goods Sold is 1,050,000, the prime cost in Work in Process is 165,200, and the prime cost in Finished Goods is 126,000. What are the adjusted balances in Work in Process, Finished Goods, and Cost of Goods Sold after closing out all variances? (Round ratios to four significant digits. Round journal entries to the nearest dollar.)arrow_forward

- The following data relate to the direct materials cost for the production of 50,000 automobile tires: a. Determine the direct materials price variance, direct materials quantity variance, and total direct materials cost variance. b. To whom should the variances be reported for analysis and control?arrow_forwardDelano Company uses two types of direct labor for the manufacturing of its products: fabricating and assembly. Delano has developed the following standard mix for direct labor, where output is measured in number of circuit boards. During the second week in April, Delano produced the following results: Required: 1. Calculate the yield ratio. 2. Calculate the standard cost per unit of the yield. 3. Calculate the direct labor yield variance. 4. Calculate the direct labor mix variance.arrow_forwardEagle Inc. uses a standard cost system. During the most recent period, the company manufactured 115,000 units. The standard cost sheet indicates that the standard direct labor cost per unit is $1.50. The performance report for the period includes an unfavorable direct labor rate variance of $3,700 and a favorable direct labor time variance of $10,275. What was the total actual cost of direct labor incurred during the period?arrow_forward

- Direct materials, direct labor, and factory overhead cost variance analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Each unit requires 0.3 hour of direct labor. Instructions Determine (A) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; (B) the direct labor rate variance, direct labor time variance, and total direct labor cost variance; and (C) the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance.arrow_forwardCarlo Lee Corp. has established the following standard cost per unit: Although 10,000 units were budgeted, only 8,800 units were produced. The purchasing department bought 55,000 lb of materials at a cost of $123,750. Actual pounds of materials used were 54,305. Direct labor cost was $186,550 for 18,200 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forwardBotella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles. The following standards for producing one case of bottles have been established: During December, 78,000 pounds of materials were purchased and used in production. There were 15,000 cases produced, with the following actual prime costs: Required: 1. Compute the materials variances. 2. Compute the labor variances. 3. CONCEPTUAL CONNECTION What are the advantages and disadvantages that can result from the use of a standard costing system?arrow_forward

- USD Inc. has established the following standard cost per unit: Although 10,000 units were budgeted, 12,000 units were produced. The Purchasing department bought 50,000 lb of materials at a cost of $237,500. Actual pounds of materials used were 46,000. Direct labor cost was $287,500 for 25,000 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forwardApril Industries employs a standard costing system in the manufacturing of its sole product, a park bench. They purchased 60,000 feet of raw material for $300,000, and it takes S feet of raw materials to produce one park bench. In August, the company produced 10,000 park benches. The standard cost for material output was $100,000, and there was an unfavorable direct materials quantity variance of $6,000. A. What is April Industries standard price for one unit of material? B. What was the total number of units of material used to produce the August output? C. What was the direct materials price variance for August?arrow_forwardSitka Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for one ladder (unit): Sitka Industries made 3,000 ladders in July and used 8,800 pounds of material to make these units. Smith Industries bought 15,500 pounds of material in the current period. There was a $250 unfavorable direct materials price variance. A. How much in total did Sitka pay for the 15,500 pounds? B. What is the direct materials quantity variance? C. What is the total direct material cost variance? D. What ii 9,500 pounds were used to make these ladders, what would be the direct materials quantity variance? E. It there was a $340 favorable direct materials price variance, how much did Sitka pay for the 15,500 pounds of material?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY