Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 32E

Saskatewan Can Company manufactures recyclable soft-drink cans. A unit of production is a case of 12 dozen cans. The following standards have been set by the production-engineering staff and the controller.

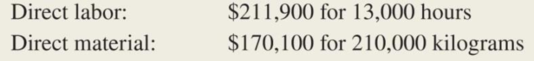

Actual material purchases amounted to 240,000 kilograms at $.81 per kilogram. Actual costs incurred in the production of 50,000 units were as follows:

Set up T-accounts, and

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ingabire Company manufactures recyclable soft-drink cans. A unit of production is a case of 12 dozen cans. The following standards have been set by the production-engineering staff and the controller.

Direct Labor:

Direct Material:

Quantity, 0.29 hour

Quantity, 8 kilograms

Rate, $14.50 per hour

Price, $0.68 per kilogram

Actual material purchases amounted to 412,800 kilograms at $0.700 per kilogram. Actual costs incurred in the production of 48,000 units were as follows:

Direct labor:

$228,096 for 15,360 hours

Direct material:

$273,840 for 391,200 kilograms

Required:

Post the journal entries prepared above to the appropriate T-accounts below.

(a) Raw Material inventory (b) Work-in-process Inventory (Accounts Payable (d) Wages Payable (e)direct labour rate variance (f)direct material quantity variance (g) direct labour efficiency variance

Mirembe PLC manufactures recyclable soft-drink cans. A unit of production is a case of 12 dozen cans. The following standards have been set by the production-engineering staff and the controller.

Direct Labor:

Direct Material:

Quantity, 0.29 hour

Quantity, 8 kilograms

Rate, $14.50 per hour

Price, $0.68 per kilogram

Actual material purchases amounted to 412,800 kilograms at $0.700 per kilogram. Actual costs incurred in the production of 48,000 units were as follows:

Direct labor:

$228,096 for 15,360 hours

Direct material:

$273,840 for 391,200 kilograms

Required: post the above journal entries to the relevant t-accounts listed below:

Raw Material inventory

Work in process inventory

Accounts payable

Wages payable

Cost of goods sold

Direct material purchase variance

Direct material quantity variance

Direct labour rate variance

Direct labour efficiency variance

Indege PLC manufactures recyclable soft-drink cans. A unit of production is a case of 12 dozen cans. The following standards have been set by the production-engineering staff and the controller.

Direct Labor:

Direct Material:

Quantity, 0.29 hour

Quantity, 8 kilograms

Rate, $14.50 per hour

Price, $0.68 per kilogram

Actual material purchases amounted to 412,800 kilograms at $0.700 per kilogram. Actual costs incurred in the production of 48,000 units were as follows:

Direct labor:

$228,096 for 15,360 hours

Direct material:

$273,840 for 391,200 kilograms

Required:

Post the journal entries prepared above to the appropriate T-accounts.

(1)Raw Material inventory (2) Work-in-process Inventory (3) accounts payable (4)Wages payable (5) Cost of goods sold (6) Direct Material Purchase Price variance (7) Direct Material Quantity variance (8) Direct Labour Rate Varianxce (9) Direct labour efficiency varianxe

Chapter 10 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 10 - Prob. 1RQCh. 10 - What is meant by the phrase management by...Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What is the interpretation of the direct-material...Ch. 10 - What manager is usually in the best position to...Ch. 10 - What is the interpretation of the direct-material...Ch. 10 - Prob. 10RQ

Ch. 10 - Prob. 11RQCh. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - Prob. 16RQCh. 10 - Describe five factors that managers often consider...Ch. 10 - Discuss several ways in which standard-costing...Ch. 10 - Describe how standard costs are used for product...Ch. 10 - Prob. 20RQCh. 10 - Prob. 21RQCh. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - Refer to the data in the preceding exercise. Use...Ch. 10 - Cayuga Hardwoods produces handcrafted jewelry...Ch. 10 - During June, Danby Companys material purchases...Ch. 10 - Refer to the data in the preceding exercise. Draw...Ch. 10 - The director of cost management for Odessa Company...Ch. 10 - Due to evaporation during production, Plano...Ch. 10 - Prob. 30ECh. 10 - Refer to the data in Exercise 1022, regarding...Ch. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - New Jersey Valve Company manufactured 7,800 units...Ch. 10 - Prob. 34PCh. 10 - During May, Joliet Fabrics Corporation...Ch. 10 - Sal Amato operates a residential landscaping...Ch. 10 - Santa Rosa Industries uses a standard-costing...Ch. 10 - The following data pertain to Colgate-Palmolives...Ch. 10 - Orion Corporation has established the following...Ch. 10 - Associated Media Graphics (AMG) is a rapidly...Ch. 10 - The director of cost management for Portland...Ch. 10 - Ogwood Companys Johnstown Division is a small...Ch. 10 - Quincy Farms produces items made from local farm...Ch. 10 - Schiffer Corporation manufactures agricultural...Ch. 10 - Aqua float Corporation manufactures rafts for use...Ch. 10 - Rocky Mountain Camping Equipment, Inc. has...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - European Styles, Inc. manufactures womens blouses...Ch. 10 - MacGyver Corporation manufactures a product called...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hansabenarrow_forwardSaskatewan Can Company manufactures recyclable soft-drink cans. A unit of production is a case of 12 dozen cans. The following standards have been set by the production-engineering staff and the controller. Direct labor: Direct material:Quantity, .25 hour Quantity, 4 kilogramsRate, $16 per hour Price, $.80 per kilogram Actual material purchases amounted to 240,000 kilograms at $.81 per kilogram. Actual costs incurred in the production of 50,000 units were as follows:Direct labor: $211,900 for 13,000 hoursDirect material: $170,100 for 210,000 kilograms Refer to the data given above. Use diagrams similar to those in Exhibits 10-2, 10–3, and 10–4 to determine the direct-material and direct-labor variances. Indicate whether each variance is favorable or unfavorable.arrow_forwardSaskatewan Can Company manufactures recyclable soft-drink cans. A unit of production is a case of 12 dozen cans. The following standards have been set by the production-engineering staff and the controller. Direct labor: Direct material:Quantity, .25 hour Quantity, 4 kilogramsRate, $16 per hour Price,$.80 per kilogram Actual material purchases amounted to 240,000 kilograms at $.81 per kilogram. Actual costs incurred in the production of 50,000 units were as follows:Direct labor: $211,900 for 13,000 hoursDirect material: $170,100 for 210,000 kilograms Prepare journal entries to:1. Record the purchase of direct material on account.2. Add direct-material and direct-labor cost to Work-in-Process Inventory.3. Record the direct-material and direct-labor variances.4. Close these variances into Cost of Goods Sold.arrow_forward

- Saskatewan Can Company manufactures recyclable soft-drink cans. A unit of production is a case of 12 dozen cans. The following standards have been set by the production-engineering staff and the controller. Direct labor: Direct material:Quantity, .25 hour Quantity, 4 kilogramsRate, $16 per hour Price, $.80 per kilogram Actual material purchases amounted to 240,000 kilograms at $.81 per kilogram. Actual costs incurred in the production of 50,000 units were as follows:Direct labor: $211,900 for 13,000 hoursDirect material: $170,100 for 210,000 kilograms Required:1. Use the variance formulas to compute the direct-material price and quantity variances, the directmaterial purchase price variance, and the direct-labor rate and efficiency variances. Indicate whether each variance is favorable or unfavorable.2. Build a spreadsheet: Construct an Excel spreadsheet to solve the preceding requirement. Show how the solution will…arrow_forwardAthena Can Company manufactures recyclable soft-drink cans. A unit ofproduction is a case of 12 dozen cans. The following standards have beenset by the production-engineering staff and the controller. Direct Labour: Direct Material:Quantity .25 hour Quantity, 4 kilogramsRate, $16 per hour Price, $0.80 per kilogram Actual material purchases amounted to 240,000 kilograms at $.81 per kilogram.Actual costs incurred in the production of 50,000 units were as follows: Direct Labour: $211,900 for 13,000 hoursDirect Material: $170,100 for 210,000 kilograms REQUIRED:(a) Use the variance formulas to compute the direct-material price and quantityvariances and the direct-labour rate and efficiency variances. Indicate whethereach variance is favourable or unfavourable.(Hilton, p. 480, 9-30)(b) Refer to the data in the preceding exercise. Use diagrams similar to those in Figures6.1 and 6.2 to…arrow_forwardJohnson manufactures Xingo through two processes: mixing and packing. In June, raw materials used were mixing $ 40,000 and packing $ 20,000. Factory labour costs were mixing $ 60,000 and packing $ 40,000. Manufacturing overhead costs were mixing $ 80,000 and packing $ 75,000. The company transfers units completed at a cost of $ 70,000 in the mixing department to the packing department. The packing department transfers units completed at a cost of $ 130,000 to Finished Goods. Required: Journalize the assignment of these costs to the two processes and the transfer of units as appropriate.arrow_forward

- Gunthrum Company has a production process that involves three processes. Units move through the process in this order: cutting, stamping, and then polishing. The company had the following transactions: 1. Cost of units completed in the Cutting Department, $19,200. 2. Cost of units completed in the Stamping Dept., $24,600. 3. Cost of units completed in the Polishing Dept., $40,000. 4. Sales on account, $18,200. 5. Cost of goods sold is 20% of sales. Prepare the journal entries for Gunthrum Company. Date 1 2 3 4 5 Description O O O O O O O O ✪ Debit Creditarrow_forwardCardioTrainer Equipment Company manufactures stationary bicycles and treadmills. The products are produced in the Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $22 per machine hour (mh) Assembly $12 per direct labor hour (dlh) Setup $40 per setup Inspecting $18 per inspection Production scheduling $8 per production order Purchasing $5 per purchase order The activity-base usage quantities and units produced for each product were as follows: Stationary Bicycle Treadmill Machine hours 1,680 1,070 Direct labor hours 243 131 Setups 45 20 Inspections 158 94 Production orders 60 32 Purchase orders 240 98 Units produced 500 350 Use the activity rate and usage information to compute the total activity…arrow_forwardAqua Company Ltd manufactures recyclable soft drink cans. A unit of production is a case oftwelve (12) dozen cans. The following standards have been set by the production engineeringstaff and the management accountant:Direct Material $3.12Quantity 4 kgPrice $0.78 per kgDirect Labour $4.025Quantity 0.25 hourRate $16.10 per hourActual costs incurred in the production of 50,000 units were as follows:Direct Material $170,100 for 210,000 kgDirect Labour $210,600 for 13,000 hoursAll materials were purchased during this time period.Required:a) Use the variance formulas to calculate the direct material price and quantity variances andthe direct labour rate and efficiency variances. Indicate whether each variance is favourableor unfavourablearrow_forward

- Domino Foods, Inc., manufactures a sugar product by a continuous process, involving three production departments—Refining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first department, Refining, were $450,000, $200,000, and $150,000, respectively. Also, work in process in the Refining Department at the beginning of the period totaled $40,000, and work in process at the end of the period totaled $35,000. Journalize the entries to record The flow of costs into the Refining Department during the period for Direct materials Direct labor Factory overhead, and The transfer of production costs to the second department, Siftingarrow_forwardDomino Foods, Inc., manufactures a sugar product by a continuous process involving three production departments—Refining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first department, Refining, were $400,000, $150,000, and $100,000, respectively. Also, work in process in the Refining Department at the beginning of the period totaled $40,000, and work in process at the end of the period totaled $35,000.Journalize the entries to record (a) the flow of costs into the Refining Department during the period for (1) direct materials, (2) direct labor, and (3) factory overhead and to record (b) the transfer of production costs to the second department, Sifting.arrow_forwardRadford Inc. manufactures a sugar product by a continuous process, involving three production departments—Refining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first department, Refining, were $1,250,000, $660,000, and $975,000, respectively. Also, work in process in the Refining Department at the beginning of the period totaled $328,000, and work in process at the end of the period totaled $295,000. a. Journalize the entries to record the flow of costs into the Refining Department during the period for (1) direct materials, (2) direct labor, and (3) factory overhead. If an amount box does not require an entry, leave it blank. 1. Work in Process-Refining Department Materials 2. Work in Process-Refining Department Wages Payable 3. Work in Process-Refining Department Factory Overhead-Refining Department Feedback Remember that in this…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY