Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259569562

Author: Ronald W Hilton Proffesor Prof, David Platt

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 10, Problem 38P

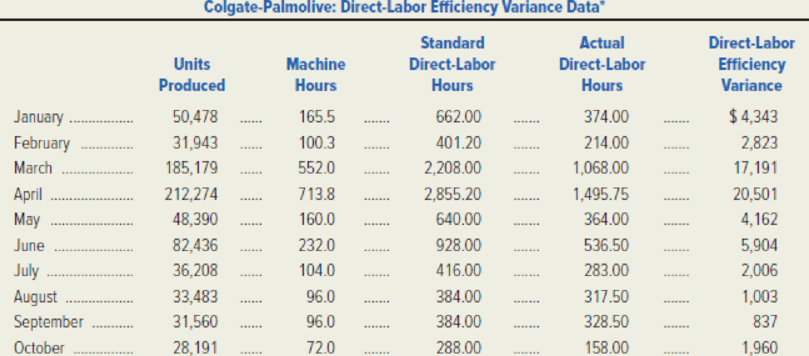

The following data pertain to Colgate-Palmolive’s liquid filling line during the first 10 months of a particular year. The standard ratio of direct-labor hours to machine hours is 4:1. The standard direct-labor rate is $15.08.

*Source of data: Alan S. Levitan and Sidney J. Baxendale, “Analyzing the Labor Efficiency Variance to Signal Process Engineering Problems,” Journal of Cost Management 6, no. 2, p. 70.

Required:

- 1. Show how the following amounts were calculated for the month of January:

- a. Standard direct-labor hours.

- b. Direct-labor efficiency variance.

- 2. Calculate the following amounts.

- a. The standard direct-labor cost for each of the 10 months.

- b. For each month, 20 percent of the standard direct-labor cost.

- 3. Suppose management investigates all variances in excess of 20 percent of

standard cost. Which variances will be investigated? - 4. Suppose the standard deviation for the direct-labor efficiency variance is $5,000. Draw a statistical control chart, and plot the variance data.

- 5. Using the chart developed in requirement (4), which variances will be investigated?

- 6. The variances for March, April, and June are much larger than the others. Suggest at least one reason for this.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

a) Refer to the information in Question 1 for data. Now, assume that Juju has decided to use a plantwide overhead rate based on the direct labor hours.Required:i) Calculate the predetermined plantwide overhead rate. (Note: Round to the nearest cent.)ii) Calculate the overhead applied to production for the month of Jun.iii) Calculate the overhead variance for the month of Jun.

Refer to the information in Question 1 for data. Now, assume that Juju has decided to use

a plantwide overhead rate based on the direct labor hours.

Required:

i) Calculate the predetermined plantwide overhead rate. (Note: Round to the nearest cent.)

ii) Calculate the overhead applied to production for the month of Jun.

iii) Calculate the overhead variance for the month of Jun.

During the most recent month at Schwab Corporation, queue time was 10.6 days, inspection time was 1.7 day, process time was 2.7

days, wait time was 12.5 days, and move time was 3.5 day.

Required:

a. Compute the throughput time.

b. Compute the manufacturing cycle efficiency (MCE).

c. What percentage of the production time is spent in non-value-added activities?

d. Compute the delivery cycle time.

a. Throughput time

b. MCE

c. Percentage of non-value-added activities

d. Delivery cycle time

days

%

%

days

Chapter 10 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 10 - Prob. 1RQCh. 10 - What is meant by the phrase management by...Ch. 10 - Prob. 3RQCh. 10 - Prob. 4RQCh. 10 - Prob. 5RQCh. 10 - Prob. 6RQCh. 10 - What is the interpretation of the direct-material...Ch. 10 - What manager is usually in the best position to...Ch. 10 - What is the interpretation of the direct-material...Ch. 10 - Prob. 10RQ

Ch. 10 - Prob. 11RQCh. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - What is the interpretation of the direct-labor...Ch. 10 - What manager is generally in the best position to...Ch. 10 - Prob. 16RQCh. 10 - Describe five factors that managers often consider...Ch. 10 - Discuss several ways in which standard-costing...Ch. 10 - Describe how standard costs are used for product...Ch. 10 - Prob. 20RQCh. 10 - Prob. 21RQCh. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - Refer to the data in the preceding exercise. Use...Ch. 10 - Cayuga Hardwoods produces handcrafted jewelry...Ch. 10 - During June, Danby Companys material purchases...Ch. 10 - Refer to the data in the preceding exercise. Draw...Ch. 10 - The director of cost management for Odessa Company...Ch. 10 - Due to evaporation during production, Plano...Ch. 10 - Prob. 30ECh. 10 - Refer to the data in Exercise 1022, regarding...Ch. 10 - Saskatewan Can Company manufactures recyclable...Ch. 10 - New Jersey Valve Company manufactured 7,800 units...Ch. 10 - Prob. 34PCh. 10 - During May, Joliet Fabrics Corporation...Ch. 10 - Sal Amato operates a residential landscaping...Ch. 10 - Santa Rosa Industries uses a standard-costing...Ch. 10 - The following data pertain to Colgate-Palmolives...Ch. 10 - Orion Corporation has established the following...Ch. 10 - Associated Media Graphics (AMG) is a rapidly...Ch. 10 - The director of cost management for Portland...Ch. 10 - Ogwood Companys Johnstown Division is a small...Ch. 10 - Quincy Farms produces items made from local farm...Ch. 10 - Schiffer Corporation manufactures agricultural...Ch. 10 - Aqua float Corporation manufactures rafts for use...Ch. 10 - Rocky Mountain Camping Equipment, Inc. has...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - Springsteen Company manufactures guitars. The...Ch. 10 - European Styles, Inc. manufactures womens blouses...Ch. 10 - MacGyver Corporation manufactures a product called...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- ThingOne Company has the following information available for the past year. They use machine hours to allocate overhead. What is the variable overhead efficiency variance?arrow_forwardUpon your review of Shalom Company's standard cost card. You found the following information: Standards: Material Labor Actual: Production Material Labor 5.0 feet per unit @ P4.00 per foot 3.0 hours per unit @ 35.00 per hour 2,800 units produced during the month 14,500 feet used; 15,100 feet purchased @ P3.70 per foot 8,150 direct labor hours @ P36.00 per hour Determine the variances based on the information above. Indicate as favorable or unfavorable. Format should be: 8,000 F or 8,000 UF No need to indicate if the amount is positive or negative. Amounts must be in whole numbers. Example: 88,000 or (88,000) Unit costs be in whole numbers. Example: 88 Format of percentages: 88% Words must be in capital letters. What is the labor rate variance?arrow_forwardUpon your review of Shalom Company's standard cost card. You found the following information: Standards: Material Labor Actual: Production Material Labor 5.0 feet per unit @ P4.00 per foot 3.0 hours per unit @ 35.00 per hour 2,800 units produced during the month 14,500 feet used; 15,100 feet purchased @ P3.70 per foot 8,150 direct labor hours @ P36.00 per hour Determine the variances based on the information above. Indicate as favorable or unfavorable. Format should be: 8,000 F or 8,000 UF No need to indicate if the amount is positive or negative. Amounts must be in whole numbers. Example: 88,000 or (88,000) Unit costs be in whole numbers. Example: 88 Format of percentages: 88% Words must be in capital letters. What is the labor efficiency variance?arrow_forward

- Upon your review of Shalom Company's standard cost card. You found the following information: Standards: Material Labor Actual: Production Material Labor 5.0 feet per unit @ P4.00 per foot 3.0 hours per unit @ 35.00 per hour 2,800 units produced during the month 14,500 feet used; 15,100 feet purchased @ P3.70 per foot 8,150 direct labor hours @ P36.00 per hour Determine the variances based on the information above. Indicate as favorable or unfavorable. Format should be: 8,000 F or 8,000 UF No need to indicate if the amount is positive or negative. Amounts must be in whole numbers. Example: 88,000 or (88,000) Unit costs be in whole numbers. Example: 88 Format of percentages: 88% Words must be in capital letters. What is the material price variance?arrow_forwardUpon your review of Shalom Company's standard cost card. You found the following information: Standards: Material Labor Actual: Production Material Labor 5.0 feet per unit @ P4.00 per foot 3.0 hours per unit @ 35.00 per hour 2,800 units produced during the month 14,500 feet used; 15,100 feet purchased @ P3.70 per foot 8,150 direct labor hours @ P36.00 per hour Determine the variances based on the information above. Indicate as favorable or unfavorable. Format should be: 8,000 F or 8,000 UF No need to indicate if the amount is positive or negative. Amounts must be in whole numbers. Example: 88,000 or (88,000) Unit costs be in whole numbers. Example: 88 Format of percentages: 88% Words must be in capital letters. What is the material quantity variance?arrow_forwardHh1.arrow_forward

- Sharp Company manufactures a product for which the following standards have been set: Standard Quantity Standard Price Standard or Hours or Rate Cost $5 per foot ? per hour Direct materials 3 feet $ 15 Direct labor ? hours ? During March, the company purchased direct materials at a cost of $45,375, all of which were used in the production of 2,350 units of product. In addition, 4,800 direct labor-hours were worked on the product during the month. The cost of this labor time was $50,400. The following variances have been computed for the month: Materials quantity variance Labor spending variance Labor efficiency variance $ 2,250 U $ 3,400 U $ 1,000 U Required: 1. For direct materials: a. Compute the actual cost per foot of materials for March. b. Compute the price variance and the spending variance. 2. For direct labor: a. Compute the standard direct labor rate per hour. b. Compute the standard hours allowed for the month's production. c. Compute the standard hours allowed per unit of…arrow_forwardPlease help i will definitely likearrow_forwardThe following information describes a company’s direct labor usage in a recent period. Compute the direct labor rate and efficiency variances for the period and classify each as favorable or unfavorable. Actual direct labor hours used. 65,000 Standard direct labor rate per hour. $14 Actual direct labor rate per hour. $15 Standard direct labor hours for units produced. 67,000arrow_forward

- Krueger Corporation in Washington, D.C., U.S., recently implemented a standard cost system. The company's cost accountant has gathered the following information needed to perform a variance analysis at the end of the month: Standard Cost Information Direct materials.... Quantity allowed per unit . Direct labor rate .... Hours allowed per unit.. Fixed overhead budgeted Normal level of production Variable overhead application rate Fixed overhead application rate ($12,000 _ 1,200 units) . .. 10.00 per unit Total overhead application rate.. $5 per pound .100 pounds per unit $20.00 per hour 2 hours per unit $12,000 per month . 1,200 units $ 2.00 per unit $12.00 per unit Actual Cost Information Cost of materials purchased and used .... Pounds of materials purchased and used. Cost of direct labor.... $468,000 .104,000 pounds $46,480 2,240 hours Hours of direct labor . anr$2,352 .$12,850 .1,000 units Cost of variable overhead . Cost of fixed overhead . Volume of production . Instructions 1.…arrow_forwardYogesharrow_forwardA company reports the following information for its direct labor. Actual hours of direct labor used (AH) Actual rate of direct labor per hour (AR) Standard rate of direct labor per hour (SR) Standard hours of direct labor for units produced (SH) 72,000 $ 16 $ 15 73,300 AH = Actual Hours SH = Standard Hours AR = Actual Rate SR = Standard Rate Compute the direct labor rate and efficiency variances and identify each as favorable or unfavorable. Actual Cost Standard Costarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY